and the distribution of digital products.

DM Television

Basics of Indian Taxation: What is Your Income Tax Slab?

The term tax introduces many puzzles in our minds. This article covers the basics of Indian taxation laws to understand taxes on income and gains. Furthermore, we’ll also look at the various takes you are exempted from.

Summary (TL;DR)- Any person is liable to pay tax who earns income and makes profits.

- The income is classified under five heads: Salaries, Profits and gains of business or profession, Income from house property, Capital gains, and Income from other sources.

- A full-time employee who receives all the benefits from his employer is taxed under salaries.

- Rental income earned from a property, including land, buildings, flats etc., is taxed under Income from house property.

- Profits and gains of business or profession allow for computation of business profits/ net income.

- Capital gains arrive on sale or transfer of capital assets held from an investment and not trading perspective are taxed.

- Income from other sources includes interest, dividend, income from mining cryptocurrencies, gifts are taxable under this head.

- You can use various crypto tax software such as CoinTracking, Accointing, TokenTax, etc.

- Income earned by a minor (below 18 years of age) is also taxable and included with their parent’s income.

The history of taxation dates back to the ancient practices of kings in their kingdoms. However, it is learned that Kautilya, in his Arthasastra, was the first one to deal with the taxation system in an elaborate and planned manner when the Mauryan Empire was at its glorious peak, running the State most efficiently and fruitfully. The king’s ministry collected taxes in gold coins, cattle, grains, raw materials from agriculturists, traders, artists like dancers, singers, actors, etc.

This evolved into the modern form of taxation, where the government collects taxes and spends for the nation’s welfare and protection. Furthermore, the revenue collected from taxes is utilized towards subsidies on essentials, public transportation, parks, libraries, defence, security, etc. Moreover, the term “Tax” in layman’s language is a charge on income or profits made by a person and collected by the government.

Basics of Indian Taxation

Types of Income Taxes

Basics of Indian Taxation

Types of Income Taxes

In the Indian context, there are two types of taxes collected:

Direct Income TaxThis type of tax is charged and collected directly from the person who earns income or profits. Eg. The Income Tax Act, 1961. While direct taxes are levied on taxable income earned by individuals and corporate entities, the burden to deposit taxes is also on themselves.

Indirect Income TaxThis type of tax is charged to one person (end customer) and collected from another person (manufacturer/ dealer/ service provider). E.g., The Goods & Services Tax Act, 2017, Customs and Excise duty. On the other hand, indirect taxes are levied on the sale and provision of goods and services respectively and the burden to collect and deposit taxes is on the sellers instead of the customer directly.

Introduction to Income TaxThis article specifically covers the nuances of The Income Tax Act, 1961 (the Act), to deal with taxes on income and gains of a person. The Government of India levies it on the income of every person. Furthermore, the Act is divided into 23 Chapters and 298 Sections. Each chapter places guidelines on the computation of income, deduction from income, exemption, maintaining and sharing records with the authorities, and punishing non-compliance with the law.

Who is liable to pay Income Tax?Any person with income or gains is liable to pay tax as per the Act. The definition of person includes natural as well as artificial persons:

- Firstly, individual

- Secondly, Hindu Undivided Families [HUFs]

- Thirdly, Association of Persons [AOPs]

- Body of individuals [BOIs]

- Firms

- LLPs

- Companies

- Finally, local authority and any artificial juridical person not covered under any of the above.

Thus, it construes that any form of an entity, whether natural or artificial, earns income/ gains is liable to pay taxes.

Terms specific to Income TaxWe need to familiarise ourselves with specific terminologies to understand the Act:

- Assessee: Assessee is the person who is liable to pay taxes or any other amount under the Act.

- Deduction: The amount allowed to be deducted from the Gross Total Income reduces the total taxable income which results in reduction in total tax liability. Thus, it is a kind of tax benefit which helps you save tax. In addition, tax deductions aim to promote the culture of savings and investments among the general public. For e.g., Chapter VIA of the Act allows deductions for specific investments and expenditures.

- Exempt Income: Exempt income means excluded income that does not form part of the total income.

The income with no tax charge is free from tax liability. For E.g., agricultural income is exempt income, i.e., no tax is applicable on agricultural income. Section 10 of the Act covers the exempt incomes which are not taxable.

Income Tax Department

Income Tax Department

- Total/ Taxable/ Net Income: The gross total income reduced by deductions is known as Total Income or Taxable Income or Net Income. Tax liability (tax amount to be paid) is calculated on this income.

- Gross Total Income (GTI): The Income of a person before any deductions is GTI.

- Year: Income tax is levied on the annual income of a person. The year under the Act starts from 1st April and ends on 31st March of the following calendar year. The Income-tax Law classifies the year as:

- Previous year: The year in which Income is earned.

- Assessment year: The year in which Income is charged and assessed for taxes.

For e.g., Income earned between 1st April 2020 to 31st March 2021 is treated as income of the Previous Year 2020-21 (PY 2020-21). This income will be charged and assesses for tax in the next year, i.e., in the Assessment Year 2021-22 (AY 2021-22).

What does the term “Income” include?- Salary or anything received in-kind/cash/facility from the employer;

- Business profits or net income;

- Gains from the sale of assets like property, jewelry, securities, etc.;

- Income through dividend;

- Interest from deposits, securities;

- Commission;

- Rental Income from property, plant, and machinery;

- Winnings from lotteries, horse races, etc.

Is income earned anywhere in the world taxable in India? The answer depends on your residential status, detailed in section 6 of the Act. Each person (the above seven types) classifies as a Resident or Non-Resident person. However, an Individual and HUF are classified into the below types:

Resident- Ordinary Resident (ROR)

- Non-Ordinary Resident (RNOR)

- Non- Resident (NR)

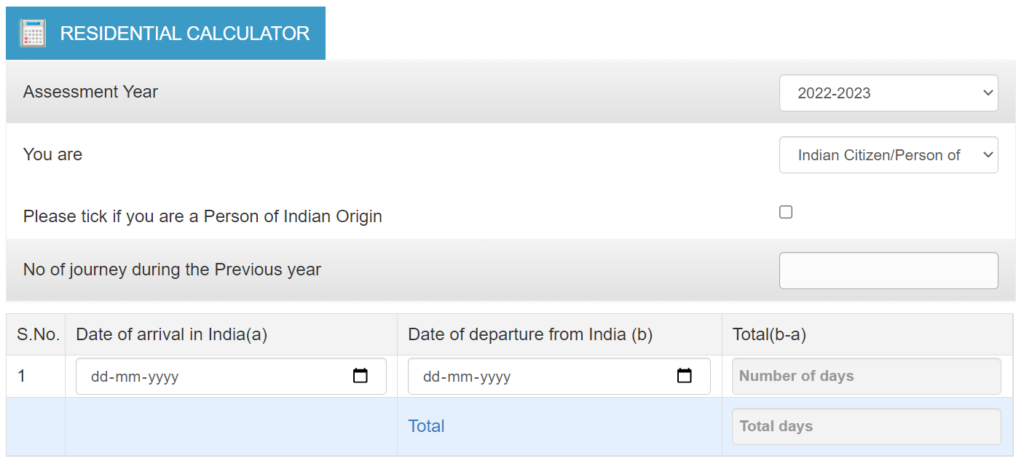

A person can have different residential status as compared to his previous year. Thus, a person needs to assess his residential status every year (especially those who frequently travel). One can check their residential status through online tools. Click here to verify your residential status.

Check Your Residential Status

Check Your Residential Status

The status is dependent on the number of days you have stayed in India and whether you are:

- Citizen of India (frequent overseas traveler)

- Person of Indian Origin visiting India

- Crew member of a ship

- Leaving India for employment purposes that year

- Any other (not falling in any of the above categories)

Once you verify your residential status, the below table will help you understand which income will be taxable.

Types of IncomeThe income is classified under five heads:

- Salaries

- Income from house property

- Profits and gains of business or profession

- Capital gains

- Income from other sources

Computation of Gross Total Income:

Income Tax: SalariesIncome will be considered as a salary income when an employee receives it from the employer. Therefore, a full-time salaried employee income will be taxed under this head. However, interns, freelancers, contractual and part-time employees will not be taxed under this head. This is because they do not hold an employee-employer relationship, nor are they eligible for all the monetary/ non-monetary benefits available to full-time employees. Sections 15-17 of the Act cover salary income in detail.

An exception to the rule: Any salary, bonus, commission, or remuneration due or received by a partner of a partnership firm from the firm shall not be regarded as “salary” and be excluded from here.

Tax Payer Portal

What does the term “salary” include?

Tax Payer Portal

What does the term “salary” include?

- wages;

- annuity/ pension;

- gratuity;

- fees, commissions, perquisites, profits in lieu of salary or in addition to any salary or wages;

- contribution to a recognized provident fund;

- any advance of salary;

- leave encashment;

- contribution to Superannuation Fund;

- contribution to National Pension Scheme

- General Deduction of Rs. 50,000 or the total amount of salary, whichever is lower

- Entertainment Allowance of Rs. 5,000 or 1/5th of your salary, whichever is lower. This allowance is only allowed to a government employee.

- Profession tax if paid by the employee directly due to his employment.

As an employee, we receive certain benefits from our employer known as perquisites. E.g., Meal coupons, accommodation, car, stock options, etc. These benefits are also taxable and included under the head salaries to the extent their fair value/ cost to the employer exceeds the reimbursement from the employee. E.g., an employee was allowed to purchase a phone for Rs. 50,000 by reimbursing only Rs. 10,000, and the company bears Rs. 40,000. Therefore, Rs. 40,000 is a taxable perquisite for the employee. In addition, there are limits prescribed for various perks under the Act.

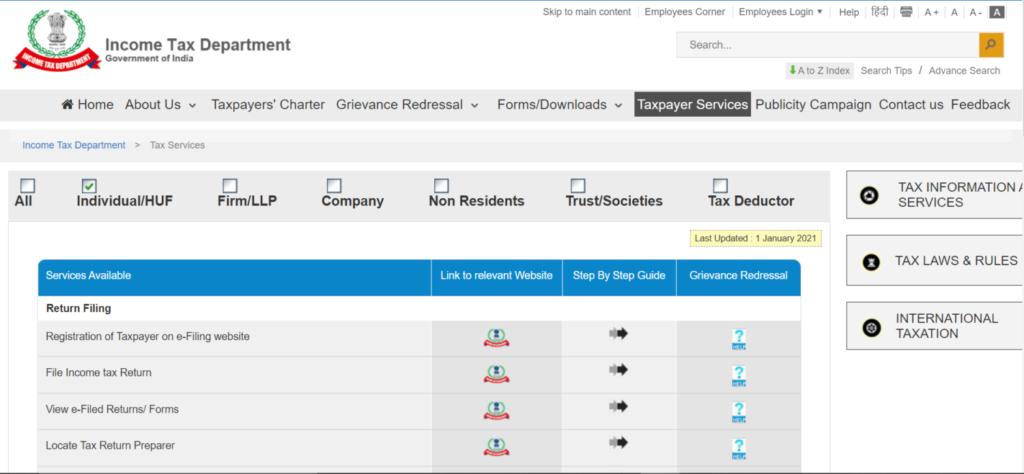

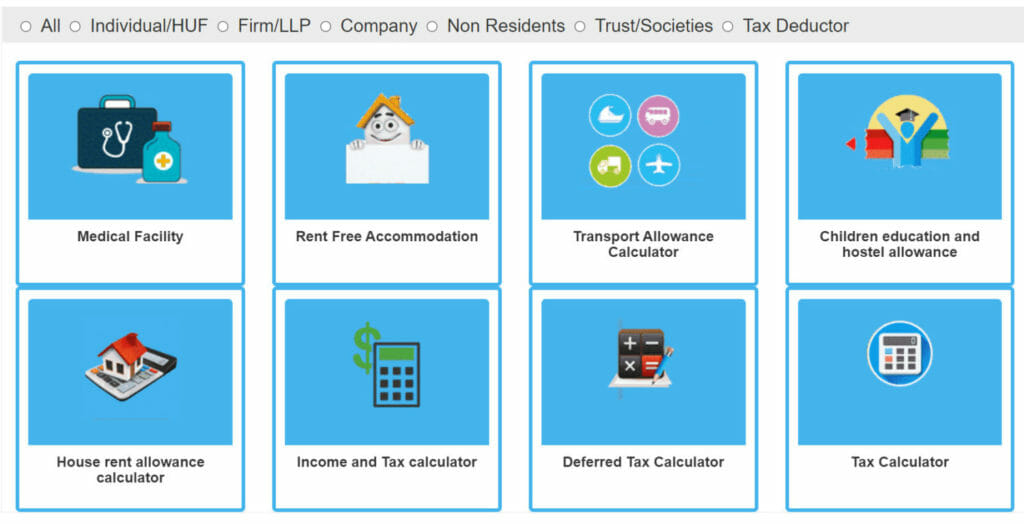

Use this online tax calculator to compute your deductions and perquisite value.

Online tax calculator

Online tax calculator

To calculate your Crypto tax, use Accointing – A Complete Crypto Tax solution.

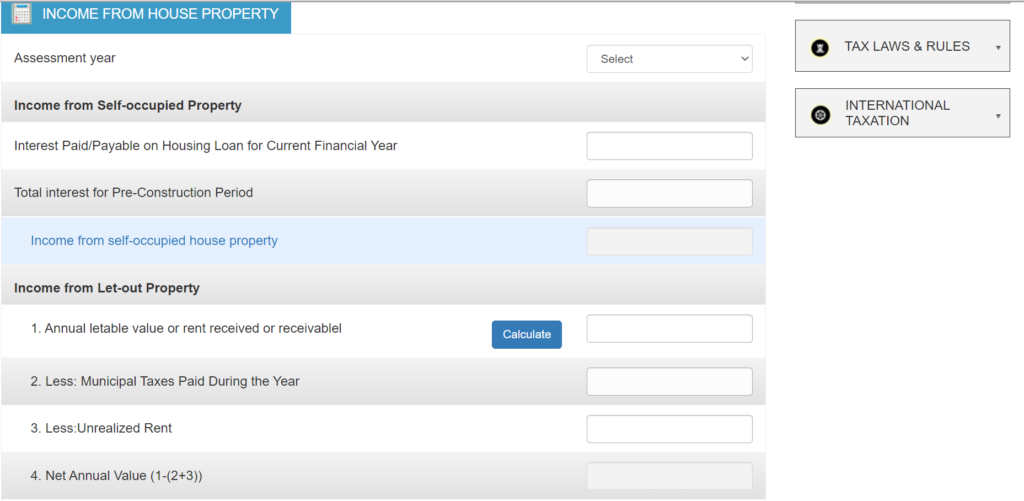

House Income TaxAn assessee who earns rental income from a property/ building/ land/ apartment/ flat owned by him will be added under this head. This is because sections 22-27 of the Act covers computation related to housing property income.

An exception to the rule:- An assessee will not include the space/area used for carrying out business/ profession here.

- The rental income earned by anyone other than the owner is not included here. Thus a person must be the owner of the property to be taxed here. For E.g., Rent earned by the subtenant is not included here.

If you own more than two properties, it is assumed that all other properties are rented. The rental income that ought to be earned is known as Gross Annual Value (GAV). For a self-occupied property, no such revenue is generated; thus, the GAV becomes Nil.

Deductions allowed under this head- Interest on borrowed capital: If the property occupied by self/ family is purchased/ constructed by taking a loan, then deduction of Rs. 2,00,000 or actual interest repaid, whichever is lower, is allowed. However, this deduction is capped to Rs. 30,000 if:

- The property is purchased/ constructed after five years from the date of taking loan or

- The loan was for renovation, reconstruction, repair purpose

- The person giving the loan does not certify that the loan was for the purchase/ construction of the property.

- The loan started before 1st April 1999.

- Standard deduction of 30% on Net Annual Value: It is claimed as a deduction irrespective of the actual higher or lower expenditure. We need to understand that this deduction is only available for properties with a rental income that ought to be earned and will have a GAV, unlike properties used for self/ family occupancy.

- Properties purchased for other than self/ family occupancy on loan can claim entire interest repaid during the year as deduction without the limits of Rs. 2,00,000 or Rs. 30,000.

- Under section 80C, a deduction of Rs. 1,50,000 can be availed on a house loan principal repayment.

- Co-ownership of property: If the property is co-owned by two or more persons, then deduction of Rs. 2,00,000/ 30,000 is allowed to both the co-owners individually.

House Income Tax Calculation

Income from Business and Profession: Business Tax

House Income Tax Calculation

Income from Business and Profession: Business Tax

Sections 28-44 of the IT Act covers the computation of business income with guidelines on expenses allowed to be deducted and arrive at net taxable business income. We should remember the transactions done in cryptocurrencies by keeping them as stock-in-trade or speculating they will be included in this head. The same can be assessed from the frequency and volume of cryptocurrency transactions to treat it as business income.

Hence, read our CoinTracking Review to learn about doing your crypto tax.

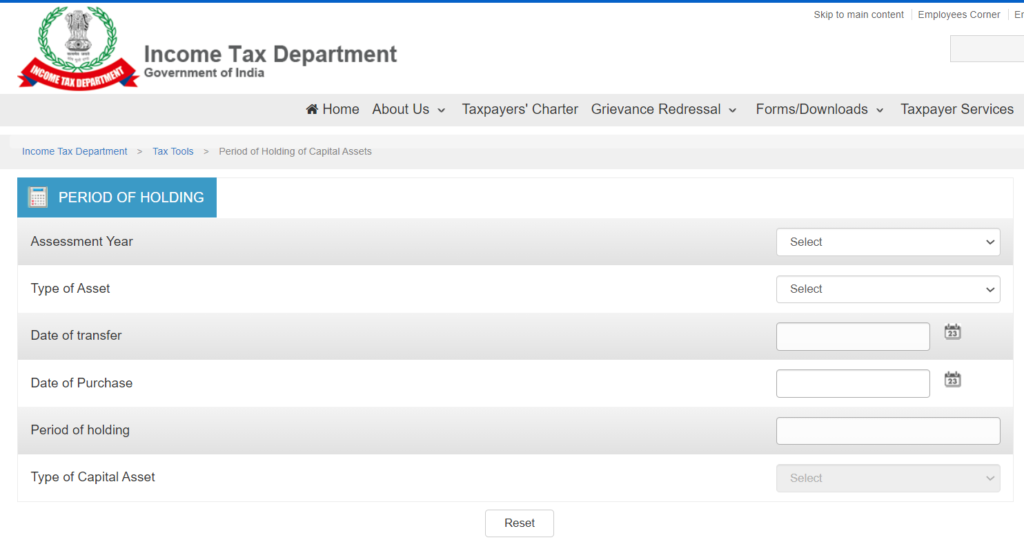

Capital Gains TaxSection 45-55 of the Act covers the computation of gains and losses on the transfer/sale of capital assets.

Capital gains can be classified into Short term gains and Long Term gains depending on the tenure of holding the assets. The below table summarises the eligibility of a short term or long term capital asset. The classification is important as the tax rate on the gains will be dependent on it.

What is Capital Asset?- Any kind of property held by a person may or may not be connected with the business or profession of the person.

- Securities (financial assets) held by FIIs following the regulations under the SEBI Act, 1992.

- A person for business or professional purposes holds stock-in-trade, consumable stores, or raw materials. E.g., a car for a car dealer or jewelry for a gold merchant is their stock-in-trade and not a capital asset.

- The personal movable property, including wearing apparel and furniture held for personal use or use by any family member dependent on him. E.g., a laptop used for personal purposes is not a capital asset. However, a laptop used for office purposes is a capital asset of the business.

- An exception to the rule: The below stated movable personal property is considered as a capital asset:

- Jewelry

- Archeological collections

- Drawings

- Paintings

- Sculptures

- Any work of art

- An exception to the rule: The below stated movable personal property is considered as a capital asset:

Capital Asset

Capital Asset

- Agricultural Land in India, a land not being located within:

- Jurisdiction of a municipality, notified area committee, town area committee, cantonment board with a population of 10,000 or more;

- Within the range of the following distance measured aerially from the local limits of any municipality or cantonment board:

- 6½% Gold Bonds, 1977 or 7% Gold Bonds, 1980 or National Defence Gold Bonds, 1980 issued by the Central Government.

- Special Bearer Bonds, 1991, issued by the Central Government

- Gold Deposit Bonds issued under Gold Deposit Scheme, 1999.

- Deposit certificates issued under the Gold Monetisation Scheme, 2015.

*The securities include financial instruments and will consist of cryptocurrencies if they are held from a long term investment point of view. Thus any crypto assets held from a long term horizon and sold/ transferred gains will be treated as capital gains.

To learn more, read our article on Best crypto tax software for your money.

Income from Other SourcesAny income which cannot be classified in any of the above four heads will be included under this head.

- Dividend Income

- Interest income

- Gifts

- Winning from lotteries, horse racings, etc. (Winnings from these activities are taxed @ flat 30% rate, and no deduction of expenditure incurred to realize the winning is allowed)

- Any other income earned which will include your income generated from mining cryptocurrencies. Even gifts received as cryptocurrencies will be taxed here subject to the conditions being satisfied as stated below.

To learn more, Top 7 profitable mining pools for beginners

Taxation on Gifts Gifts received in 3 forms are covered for taxation under the Act- Monies through cash, cheque, draft, etc.

- Immovable property, e.g., land, building or both

- Property other than immovable property i.e

- shares and securities;

- jewellery;

- archaeological collections;

- drawings;

- paintings;

- sculptures;

- any work of art;

- bullion;

- Gifts received from relatives which as per the Act cover:

- spouse;

- your brother or sister;

- brother or sister of the spouse;

- brother or sister of either of the parents;

- any lineal ascendant or descendant;

- any lineal ascendant or descendant of the spouse;

- spouse of the person referred to in items (b) to (f)

Thus as per the definition, your friend or colleague is not your relative.

- Gifts received on the occasion of marriage. Only gifts received for the event of marriage are exempted, and this does not include those received on engagement, other marriage functions, anniversaries, birthdays, etc.

- Further, received under a will/ by way of inheritance

- Moreover, if you’ve received in contemplation of death of the payer or donor.

- If received from a local authority, any specified fund, foundation, university, other educational institution, hospital or other medical institution, any trust or institution

- Finally, if received through a trust created or established solely for the benefit of the relative of the Individual. (this is only applicable if the money is received on or after 1st day of April 2017)

Gifts received in any other scenario not covered above are taxable subject to certain relaxations

Monies received in cash/ cheque/ draft without consideration (i.e., without giving anything in exchange/ return). If the sum of monies received from person/s exceeds Rs. 50,000 throughout the year, then it is fully taxable under Income from Other Sources. Let us understand this in multiple scenarios:

- Gifts received from 3 friends Tina, Mina, Rina, sum to Rs. 45,000: Not Taxable

- Gifts received from 3 friends Tina, Mina, Rina each giving Rs. 45000 i.e sum of Rs. 1,35,000: Entire Rs. 1,35,000 is taxable

- Gift received from friend Tina of Rs. 50,001: Entire Rs. 50,001 is taxable

If the immovable property is received without consideration and the said property’s stamp duty value exceeds Rs. 50,000, the entire value of the property is taxable. Let us understand this in multiple scenarios:

- Tina transferred the property to Mina, whose stamp duty value is Rs. 50,000: Not taxable.

- Tina transferred two properties to Mina with a stamp duty value of Rs. 65,000 and Rs. 30,000 respectively: Property worth Rs. 65,000 is taxable as it exceeds Rs. 50,000 threshold but the property of Rs. 30,000 is not taxable as it is below Rs. 50,000.

- Tina and Mina both transferred one property each to their friend Rina with each property having a stamp duty value of Rs. 40,000 each: None of the property value will be taxable as both properties are below Rs. 50,000 threshold. Thus it is crucial to note taxability on the transfer of the immovable property is decided on individual property thresholds.

Immovable Property

With consideration

Immovable Property

With consideration

If the immovable property is received by paying consideration (i.e. paying monies/in kind in exchange) from another person, then the difference between the stamp duty value of the property and the consideration paid shall be taxable subject to:

- Difference exceeds Rs. 50,000 AND

- Exceeds 10% of the consideration amount.

Both the conditions should be satisfied for taxability. Let us understand through some examples:

- Tina transferred Rs. 10 Lakhs property to Mina for Rs. 9.6 Lakhs here, the difference is lesser than Rs. 50,000 (Rs. 10 Lakhs – Rs. 9.60 Lakhs). Thus 1st condition is itself not fulfilled: Nothing is taxable.

- Tina transferred Rs. 100 Lakhs property to Mina for Rs. 95 Lakhs. Here the difference is more than Rs. 50,000 (Rs. 5 Lakhs = Rs. 100 Lakhs – Rs. 95 Lakhs), but the difference should also exceed 10% of the consideration amount, i.e., more than Rs. 9.50 Lakhs (Rs. 95 Lakhs * 10%): Nothing is taxable

- Continuing the above example (b) where Mina only paid Rs. 90 Lakhs as consideration. Here the 1st condition of difference exceeding Rs. 50,000 is fulfilled and 2nd condition of difference exceeding 10% of consideration {Rs. 9 Lakhs (Rs. 90 Lakhs*10%)} is also fulfilled. The difference between the stamp duty value and consideration is Rs. 10Lakhs (Rs. 100 Lakhs- Rs. 90 Lakhs) greater than Rs. 9 Lakhs: Entire Rs. 10 Lakhs is taxable.

This includes shares and securities; jewellery; archaeological collections; drawings; paintings; sculptures; any work of art; bullion;

- Without consideration: If the fair market value of the total properties received throughout the year exceeds Rs. 50,000, then the entire value is taxable. The same concept explained above for monies received is applicable for movable properties received without consideration.

- With consideration: The difference between the fair market value of the total properties and consideration paid throughout the year exceeds Rs. 50,000, then the difference is taxable. Let us understand this through an example.

- First of all, Tina gifted jewellery to Mina worth Rs. 65,000 for a consideration of Rs. 20,000 only: Not taxable as difference between fair market value and considerations is less than Rs. 50,000 (i.e Rs. 45,000= Rs. 65,000- Rs. 20,000)

- Thereafter, Mina received jewelry for a consideration of Rs. 10,000 only. The difference is Rs. 55,000 (Rs. 65,000- Rs. 10,000): Rs. 55,000 is taxable

- Nothing is taxable for movable properties if anything else is received other than the eight specified ones. E.g., Television is accepted as a gift from a friend although valued more than Rs. 50,000 is not taxable. Even if the same is received by paying some consideration irrespective of its difference, it is not taxable as Television is not a specified movable property.

How does the taxation law work if all the above types of income is earned by a minor (below 18 years of age)?

Income earned by a minor is clubbed with his parent’s income (parent having the highest taxable income). In such cases, the parent is allowed to deduce up to Rs.1500 on clubbing the minor child’s income.

However, if a minor earns income due to his skill, talent, manual work, knowledge, and experience, such income will not be added to his parents’ income. Instead, he will be required to file a regular return like other individuals.

E.g. Tina is a minor and earned Rs. 3,00,000 doing stage shows and Rs. 5,000 as interest from the bank. In this scenario, only Rs. 5,000 will be clubbed to her parent’s income and will be allowed a deduction of Rs. 1500. The remaining Rs. 300K will be as regular income of the minor, and he will be required to file an income tax return.

Additionally, the income earned by the minor suffering from a disability, including autism, cerebral palsy, mental retardation, etc., will not be clubbed with his parent’s income.

Indian Taxation: ConclusionThis article should warm you up with the basic terms of taxation. It would have helped you understand different heads of income right from salary income to general income like interest income or income from crypto mining. Moreover a complete clarity on what gifts you can receive from your friends and to what extent you should, to have no tax on your valuable gifts. In the upcoming article, we shall cover the filing of income tax returns.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.