and the distribution of digital products.

State of BNB Chain Q1 2025

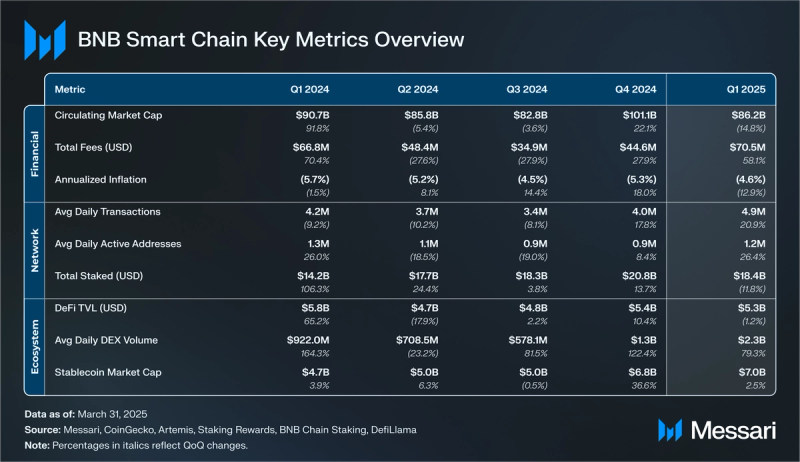

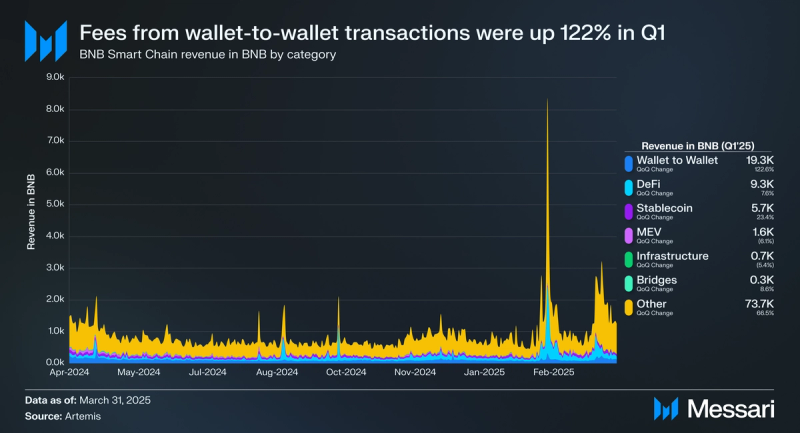

- BNB Chain network revenue rose 58.1% QoQ to $70.8 million, driven by a 122.6% surge in wallet-to-wallet transaction fees. BNB’s market cap fell 14.8% in Q1 2025, ending the quarter at $86.2 billion, yet maintained the fourth position excluding stablecoins.

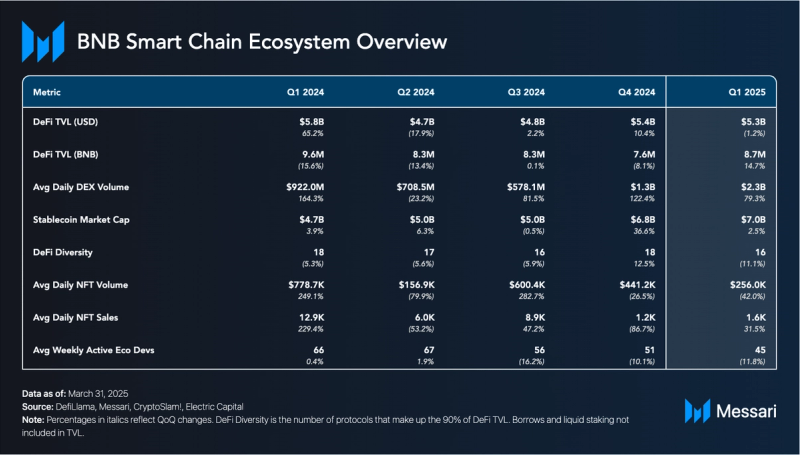

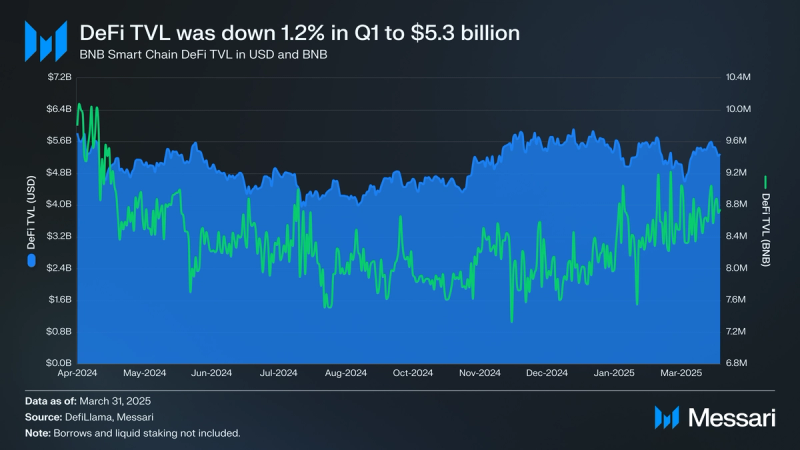

- DeFi activity remained resilient this quarter, with TVL on BNB Smart Chain growing by 14.7% when denominated in BNB, reflecting strong ecosystem engagement despite a modest 1.2% QoQ dip to $5.3 billion in USD terms.

- DEX volume on BNB Smart Chain grew 79.3% QoQ to $2.3 billion in average daily trading volume. PancakeSwap extended its dominance, accounting for 91.8% of total DEX activity, supported by a 95.2% QoQ increase in volume.

- The BNB Good Will Alliance launched in Q1 to coordinate ethical MEV practices across infrastructure providers. Its initial effort, deploying sandwich attack filters via builders like BlockRazor and 48 Club, contributed to a greater than 90% reduction in sandwich attacks on BNB Smart Chain.

- Q1 saw major protocol enhancements with the Pascal hard fork. The upgrade introduced EIP-7702 smart contract wallets, BLS12-381 cryptography, gas abstraction, and batch transaction support, positioning BNB Chain for improved EVM compatibility and scalability.

BNB Chain (BNB) is an ecosystem of blockchains where each chain serves a particular function. The three core components of BNB Chain are as follows:

- BNB Smart Chain (BSC): Smart contract layer and DeFi hub. Since its merge with BNB Beacon Chain, BSC also serves as the staking and governance layer.

- BNB Greenfield: Decentralized storage network. As a vital component of the One BNB paradigm, Greenfield focuses on live, valuable data and lets users create their own personal data marketplace.

- opBNB: High-performance optimistic rollup. opBNB is ideal for Dapps that require high transaction frequency, like fully onchain games. It offers the lowest gas fees among L2s, with transactions costing <$0.0001. It also delivers very high performance, processing between 5,000 and 10,000 TPS.

The metrics in this report will mostly focus on BNB Smart Chain (BSC). BSC is an EVM-compatible, Layer-1 blockchain secured by a form of Proof-of-Staked-Authority (PoSA) that combines aspects of Proof-of-Authority (PoA) and Delegated Proof-of-Stake (DPoS). In PoSA on BSC, the validator set is of fixed size and is elected by stake weight (staked plus bonded). In addition, validators must continue staking assets to secure the network, and validators chosen to produce blocks are rotated (not based on stake weight).

Website / X (Twitter) / Telegram

Key Metrics Financial Overview

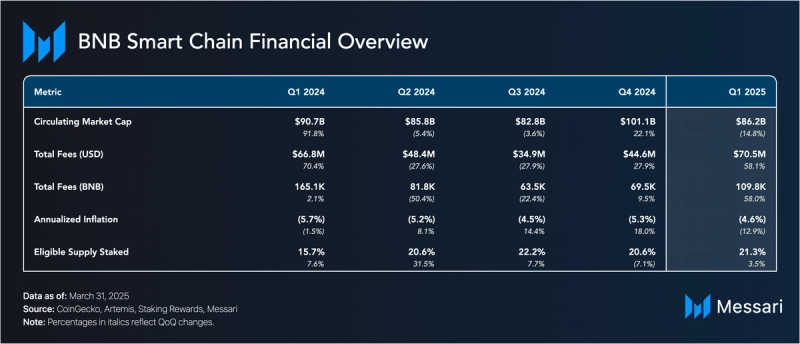

Financial Overview Market Cap and Revenue

Market Cap and Revenue

BNB Chain’s network revenue experienced substantial growth in Q1. Total fees collected reached $70.8 million, a 58.1% increase QoQ from $44.6 million in Q4. Measured in BNB terms, revenue rose by a similar 58.0%, from 69,500 BNB to 109,800 BNB.

A notable spike in revenue occurred in early February, driven by increased adoption of BNB Chain and the popularity of the TST memecoin, which pushed the number of unique onchain users to an all time high of 517 million on February 11, 2025. This peak was followed by a swift normalization in activity levels, which brought revenue back to its underlying trend.

At the end of Q1 2025, BNB retained its position as the fourth-largest non-stablecoin crypto asset by market cap behind Bitcoin, Ethereum, and XRP. While it’s market cap stood at $86.2 billion, a 14.8% decline QoQ, this pullback aligned with broader market conditions. Relative to Bitcoin, BNB slightly underperformed (BTC’s market cap declined 11.8% QoQ from $1.8 trillion to $1.6 trillion, compared to BNB’s 14.8% drop) but outperformed Ethereum and Solana, which fell 45.2% QoQ and 29.6% QoQ respectively.

Gas fees from wallet-to-wallet transactions increased 122.6% QoQ and generated 19,266 BNB in Q1, accounting for 17.4% of total market share and overtaking DeFi as the largest individual contributor to revenue. Fees generated by the DeFi category increased 7.6% QoQ to 9,274.9 BNB. However, DeFi’s share of revenue fell 33.0% QoQ to 8.4%, placing it second behind wallet-to-wallet transactions. Stablecoins were the third largest revenue generator in Q1, increasing 23.4% QoQ to 5,745.1 BNB. Its share of revenue fell by 23.1% QoQ to 5.2%. The MEV (down 6.1% QoQ to 1,613.6 BNB) and Infrastructure (down 5.4% to 659.4 BNB) categories both saw decreases in revenue for Q1. Fees generated by bridges rose 8.6% QoQ to 275.1 BNB in Q1.

Supply DynamicsThe initial total token supply for BNB was 202 million tokens (launched in July 2017). BNB is deflationary through a series of burning mechanisms:

- Auto-Burn: A mechanism that automatically burns varying amounts of BNB every quarter, depending on the token’s price and the number of blocks generated on BNB Chain during said quarter.

- Pioneer Burn: A program that counts all BNB accidentally lost by new or careless BNB Chain users as part of the quarterly burns. The project team reimburses users for accepted cases.

- Gas Fees Burn: In accordance with BEP-95, 10% of all gas fees incurred on BNB Smart Chain are burned automatically. The remaining 90% is rewarded to validators and stakers.

By quarter end, the circulating supply of BNB was 142.5 million, giving BNB an annualized deflation rate of 4.6% (down 12.9% QoQ). Lastly, the 30th quarterly BNB burn occurred on January 23. 1.6 million BNB was burned, equivalent to $1.2 billion at the time of the burn transaction. The Pioneer Burn made up 6.7% of the burn, with the remainder coming from the Auto Burn and BTokens.

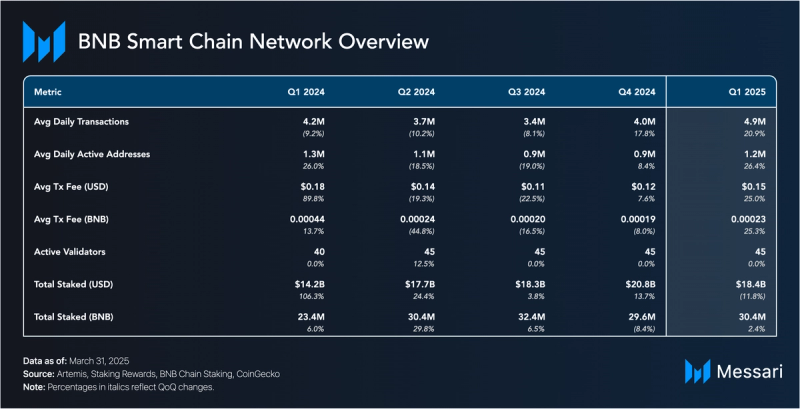

Network Overview Onchain Activity

Onchain Activity

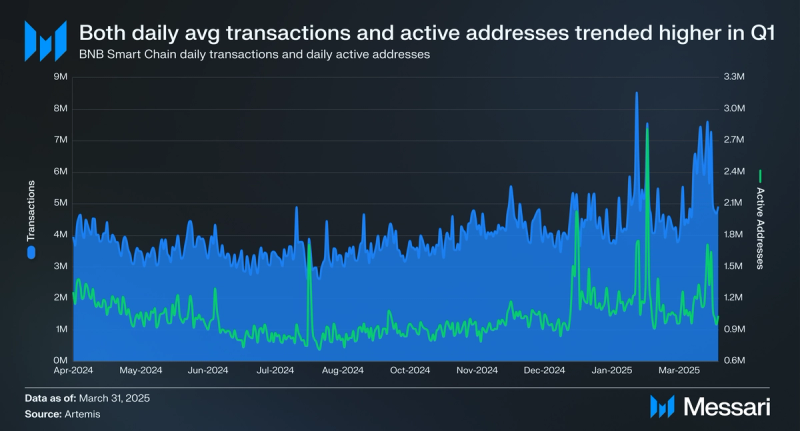

Following the trend from Q4, onchain activity climbed even higher on BNB Smart Chain in Q1. Average daily transactions trended higher in Q1, up 20.9% QoQ from 4.0 million to 4.9 million. Average daily active addresses also experienced an upward trend in Q1, increasing 26.4% QoQ from 941,600 to 1.2 million.

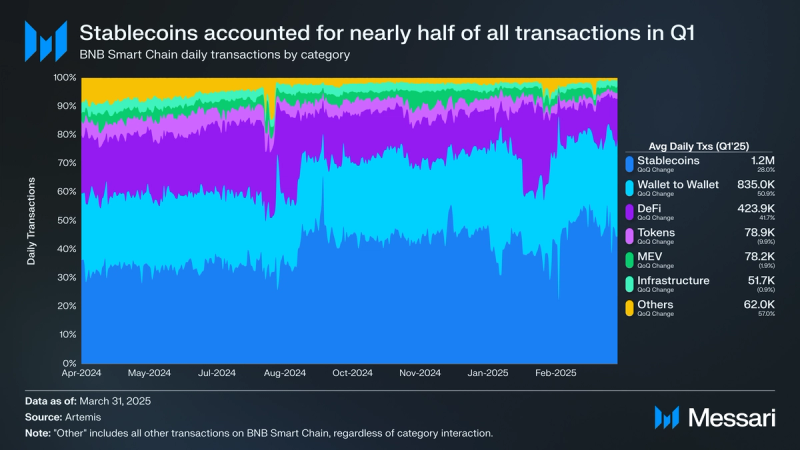

Broken down by category, stablecoins represented nearly half (45%) of all transactions on BNB Smart Chain for Q1, averaging 1.2 million daily transactions, up 28% QoQ from 925,200. The second-highest category by daily transaction count was wallet-to-wallet transfers, which averaged 835,000 daily transactions (up 50.9% QoQ from 553,400). Combined, stablecoin and wallet-to-wallet transactions represented 74.4% of all transactions in Q1. Other categories that saw notable QoQ increases in daily transaction counts were DeFi (up 41.6% QoQ to 423,900) and others (up 57.1% to 62,000). The Tokens (down 9.8% QoQ to 78,900), Mev (down 1.9% QoQ to 78,200), and Infrastructure (down 0.9% QoQ to 51,700) categories all saw declines in Q1.

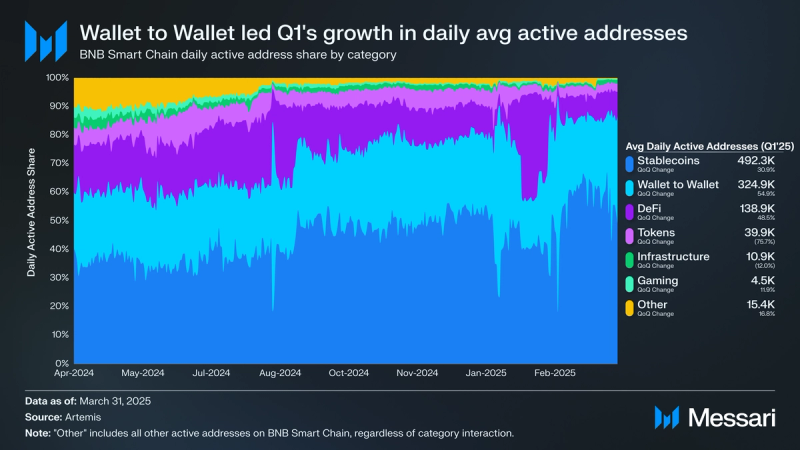

Similar to transactions, stablecoins accounted for the most active addresses of any singular category on BNB Smart Chain in Q1. Stablecoins ended the quarter with an average of 492,300 daily active addresses (up 31% QoQ from 376,000). Nearly half of all daily active addresses in Q1 interacted with stablecoins. The second largest category by active addresses, wallet-to-wallet transfers, accounted for the largest increase in active addresses in Q1. Average daily active addresses for wallet-to-wallet transfers were 324,900 (up 54.9% QoQ from 209,800). The only other categories with a QoQ increase were DeFi (up 48.5% QoQ to 138,900) and gaming (up 11.9% to 4,460).

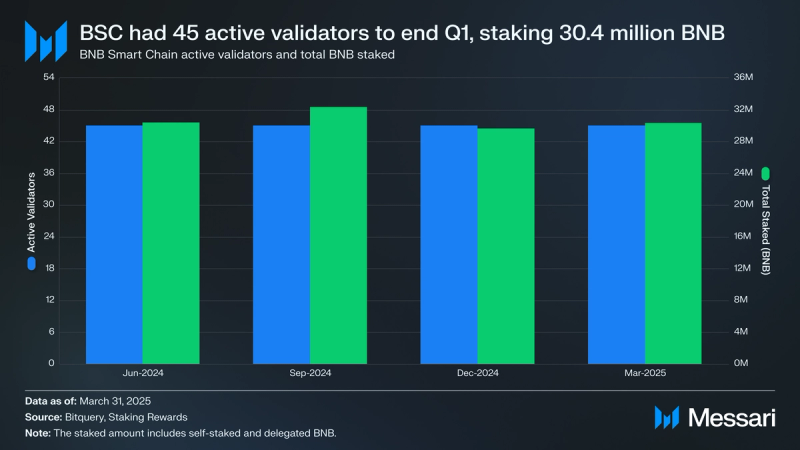

Security and DecentralizationBNB Smart Chain utilizes a Proof-of-Staked Authority (PoSA) consensus mechanism in which 45 validator nodes are elected every 24 hours to participate in consensus. Their election is based on the total number of BNB tokens staked to each node. Of these 45 validators, the top 21 with the highest staked amounts are “Cabinets,” while the remaining 24 are “Candidates.” Then, 18 of the 21 “Cabinets” and 3 of the 18 “Candidates” are randomly selected to produce blocks for the given epoch. The selected validator nodes then take turns producing blocks based on Ethereum’s Clique consensus design.

With BNB Chain’s Feynman Upgrade on April 18, 2024, the maximum amount of active validators on BNB Smart Chain increased from 40 to 45. Since the upgrade, there have been 45 active validators on BNB Smart Chain, signaling strong network security and a healthy appetite for operating validators on BNB Smart Chain.

Total staked BNB increased by 2.4% QoQ from 29.6 million to 30.4. However, since the price of BNB fell in Q1, the dollar amount of BNB staked decreased by 11.8% QoQ from $20.8 billion to $18.4 billion. Compared to other PoS networks, BNB Smart Chain had the third-highest dollar value of funds staked by the end of Q1, rising one spot above Sui.

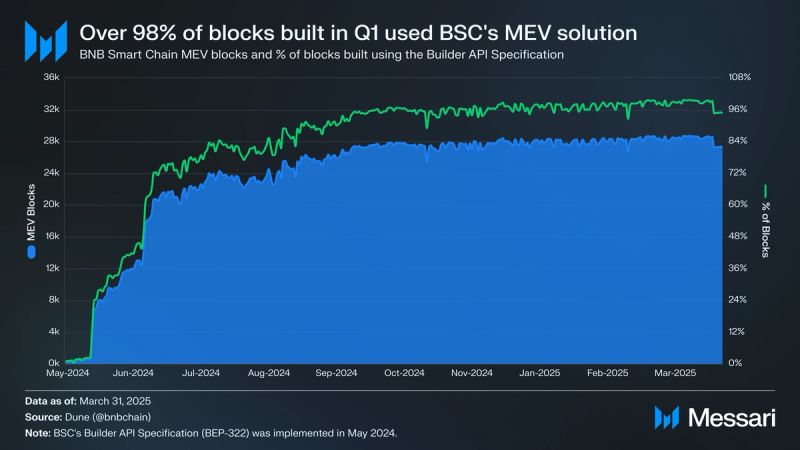

MEVBEP-322, a proposal for Proposer-Builder Separation (PBS) on BNB Smart Chain validators, went live Q2 2024. BEP-322 was implemented as a builder API specification to address the fragmentation of MEV (maximal extractable value) solutions on BSC. This specification creates a unified and open MEV market where block proposers (i.e., validators) do not play a role in selecting which transactions are included in the proposed block. Instead, block builders create possible blocks and submit them to the validator proposing a block. The validator then selects the proposed blocks that net them the most fees. This new mechanism brings stability and transparency to BNB Chain’s MEV market while also promoting healthy market competition for block builders.

BNB Smart Chain’s Builder API Specification went live in May 2024. In Q1 2025, 98% of all blocks were built using the Builder API Specification, up 2.1% QoQ from 96% in Q1. Furthermore, as of writing, there are 36 different block builders on BNB Smart Chain.

On February 10, 2025, BNB Chain announced a collaboration with wallet providers and RPC service operators to deploy a multi-tiered MEV protection architecture. The initiative introduced three distinct solutions tailored to different user needs:

- Built-in MEV Protection: Wallets such as Trust Wallet, Binance Wallet, OKX Wallet, TokenPocket, and SafePal now offer automatic MEV protection integrated into their native swap interfaces. These features are enabled by default or easily accessible via in-app settings, providing seamless protection for retail users.

- Private RPC Integration: For wallets lacking native MEV safeguards, such as MetaMask, users can now route transactions through designated private RPC endpoints. Providers such as PancakeSwap, 48 Club, and Merkle offer public RPC services that obscure transaction data from mempool scanners, thereby neutralizing sandwiching bots.

- Advanced Solutions for Professionals: Institutional traders, developers, and power users can access specialized MEV protection through providers such as BloxRoute, Blocksmith, Nodereal, and Puissant. These services offer premium features such as atomic bundling, low-latency execution, and validator communication layers.

Building on these efforts, BNB Chain launched the Good Will Alliance in March 2025 to further strengthen MEV protection at the block builder and validator level. The alliance, composed of prominent infrastructure providers such as BlockRazor and 48 Club, aims to establish off-chain best practices and ethical standards that promote a fairer onchain environment. The alliance’s first initiative focused on filtering sandwich attacks during block construction. Participating builders implemented sandwich attack filters into their infrastructure, and validators were encouraged to prioritize block bids from alliance-approved builders. Early results indicated that sandwich attacks on BNB Smart Chain were reduced by over 90% following the initiative's deployment, reflecting significant progress in enhancing transaction fairness and user protection.

Pascal Hard ForkIn Q1 2025, BNB Chain executed the Pascal hard fork, a milestone upgrade focused on enhancing Ethereum compatibility, improving performance, and increasing developer flexibility. Announced on February 21, the Pascal fork introduced a suite of new features aligned with Ethereum’s Pectra roadmap, notably EIP-7702 and BEP-439.

EIP-7702 allows externally owned accounts (EOAs) to temporarily behave like smart contracts during transactions. This paves the way for native smart contract wallets with enhanced functionality, including multi-signature support, account abstraction, spending limits, and batch transactions. These changes enable more flexible and user-friendly wallet interfaces while supporting use cases like sponsored transactions and gas fee abstraction, critical for reducing onboarding friction in dApps.

The upgrade also integrated BEP-439, which implements cryptographic support for the BLS12-381 curve. This enables more efficient and secure signature aggregation, a foundational feature for scaling decentralized applications.

Beyond feature enhancements, Pascal also delivered performance optimizations: the network’s gas limit was increased from 120 million gas units to nearly 140 million gas units, and internal transaction pool logic was refined to better handle edge cases introduced by reorgs and zero-gas transactions.

Pascal marks the first of three major upgrades planned for 2025. The second is the Lorentz hard fork, which is scheduled for April, and aims to reduce block intervals to 1.5 seconds. Lastly, the Maxwell upgrade, scheduled for June, which will further decrease block times to 0.75 seconds. Together, these upgrades form a comprehensive roadmap to enhance BNB Chain’s scalability, usability, and competitiveness within the broader EVM ecosystem.

Ecosystem Overview DeFi

DeFi

BNB Smart Chain DeFi TVL held steady in USD, decreasing slightly from $5.4 billion in Q4 to $5.3 billion, a 1.2% QoQ decrease. By the end of the quarter, BNB Smart Chain ranked as the fourth-highest chain by TVL denominated in USD, rising one spot from last quarter and placing it behind Solana. TVL denominated in BNB was up in Q1, increasing 14.7% QoQ from 7.6 million BNB to 8.7 billion BNB. This dynamic indicates that the lack of TVL growth in USD was driven by the drop in the price of BNB in line with market condition over the quarter rather than a drop in on-chain activity or ecosystem engagement.

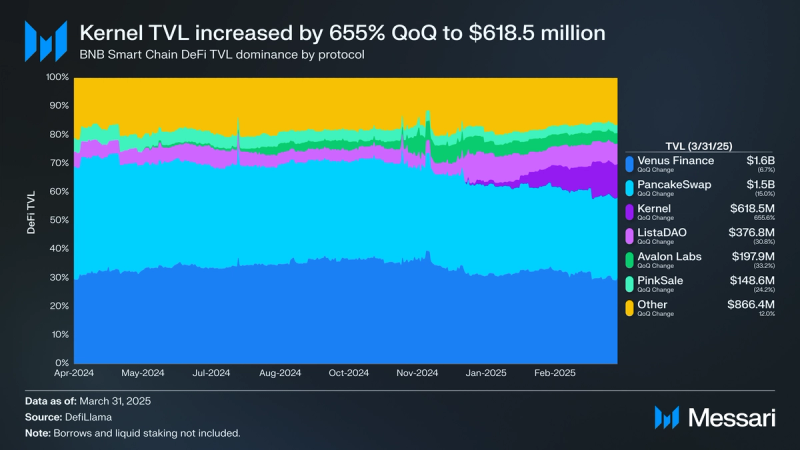

The top two protocols by TVL on BNB Smart Chain are Venus Finance and PancakeSwap. Venus Finance became the largest protocol by TVL, despite a 6.4% QoQ decrease from $1.7 billion to $1.6 billion. Notably, borrows decreased from $857.0 million in Q4 to $675.9 million in Q1, a 21.1% QoQ decrease. By the end of Q1, Venus Finance’s TVL dominance was 30.1% (down 5.7.% QoQ from 31.9%).

PancakeSwap saw a significant decline in TVL in Q1, falling from $1.8 billion to $1.5 billion, a 15% QoQ decrease. PancakeSwap consists of three different AMMs (PancakeSwap AMM, StableSwap, and AMM V3). By the end of Q1, AMM TVL was $1.2 billion (80% of TVL), StableSwap TVL was $29.4 million (2% of TVL), and AMM V3 TVL was $312.1 million (20.8% of TVL). Due to the decline in TVL, PancakeSwap’s TVL dominance decreased to 28% (down 14.8% QoQ from 32.8%).

The biggest gainer QoQ within the top six was Kernel, a BNB restaking protocol from KernelDAO, which launched on Mainnet on December 9, 2024. Its TVL increased 655.6% QoQ from $81.9 million to $618.5 million. New initiatives in Q1, such as KernelDAO’s announcement of a $40M Ecosystem Fund to expand BNB restaking, and BNB’s Executive TVL Incentive Program, helped catapult Kernel into the top three protocols by TVL on BNB Smart Chain.

ListaDAO, Avalon Labs, and PinkSale round out the top six, which all experienced TVL losses in Q1.

- ListaDAO, a CDP stablecoin lending and liquid staking protocol, saw a 30.8% QoQ decrease in TVL from $544.5 million to $376.8 million. A lack of new product launches, increased competition in the BNB Chain ecosystem, and external market activity, contributed to the decrease in TVL.

- Avalon Labs, a lending protocol for BTC-based assets on multiple networks, decreased its TVL by 33.2% QoQ from $296.3 million to $197.9 million. Broader DeFi headwinds and the 11.7% QoQ decrease in the price of BTC, which dominates the majority of Avalon Labs’ TVL, pushed TVL lower.

- PinkSale, a token launchpad protocol, had a TVL decrease of 24.2% QoQ from $196 million to $148.6 million.

In Q4 2023, BNB Smart Chain introduced the TVL Incentive Program. The program aims to reward projects deployed within the ecosystem that attract significant amounts of TVL. Phase 5 of the program focused on BNB staking, liquid staking, and restaking on BSC. It ended in Q1 2025, running from January 21 to March 21. The initiative aimed to strengthen the infrastructure for distributed validator networks (DVNs) and restaking use cases supporting emerging sectors like AI, DePIN, and cross-chain bridges.

Unlike prior iterations, rewards in Phase 5 were distributed in the form of Delegation Support (BNB or WBNB delegated to the top protocols for a period of one to three months). The support amount was calculated as a percentage of each protocol’s incremental staked BNB, with a maximum reward cap of 5%.

The top five recipients of Delegation Support in Phase 5 were:

- KernelDAO – 5% Delegation Support (3,956 BNB)

- Astherus – 4% Delegation Support (3,512 BNB)

- YieldNest – 3% Delegation Support (97 BNB)

- Tranchess – 2% Delegation Support (149 BNB)

- ListaDAO – 1% Delegation Support (1,704 BNB)

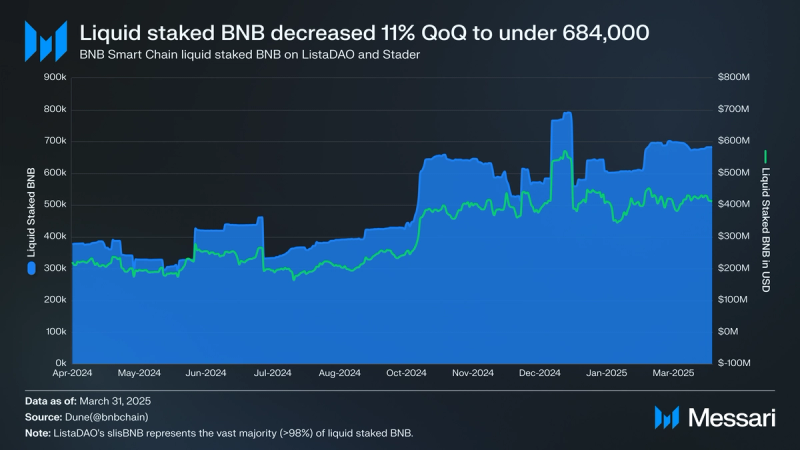

With the migration of validation and staking services to BNB Smart Chain this past year, liquid staking has become a top priority for the BNB Chain ecosystem. Concurrently, ListaDAO’s liquid staking solution, slisBNB, has emerged as the dominant liquid staking solution on BNB Smart Chain. By the end of Q1, 683,108 BNB ($410.9 million) was deposited in liquid staking solutions. Compared to last quarter, the amount of liquid staked BNB was down 10.8% QoQ from 766,000. Furthermore, ListaDAO’s slisBNB represented 97% of all liquid-staked BNB (667,000).

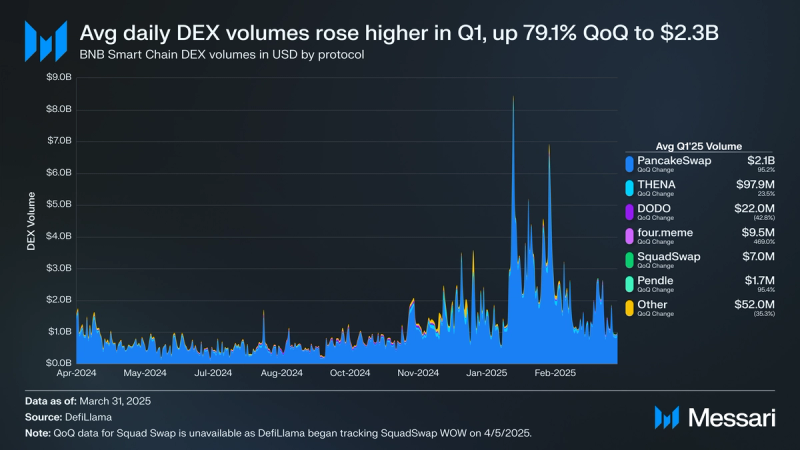

BNB Chain’s DEX ecosystem continued its growth trajectory in Q1 2025, building on the strong rebound observed in the previous quarter. Average daily DEX volume on the network rose 79.3% QoQ, reaching $2.3 billion. This surge helped BNB Chain gather the fourth-highest DEX volumes of any chain in Q1.

The number of active DEXs on BNB Chain increased to 82 by the end of Q1, up 15.4% QoQ from 71. Despite the high level of competition, PancakeSwap has historically been the most dominant DEX on BNB Smart Chain.

PancakeSwap extended its dominance on BNB Chain, posting an average daily trading volume of $2.1 billion, a 95.2% increase QoQ. Its market share rose by 8.7% QoQ to 91.8%, reinforcing its position as the primary liquidity hub on the network. The biggest gainer in average daily volume for Q1 was SquadSwap, which launched SquadSwap WOW on February 6, 2025, increasing its average daily volume from near-zero to $7.0 million by the end of the quarter. Despite this rise, SquadSwap only managed to claim 0.3% of the market. Pendle also posted strong growth, with volumes up 95.4% QoQ and a market share of 0.07%.

For Q1 2025, the top five DEXs by average daily trading volume on BNB Chain were:

- PancakeSwap ($2.12 billion – 91.8% of BNB Smart Chain DEX volume)

- THENA ($97.9 million – 4.2%of BNB Smart Chain DEX volume)

- DODO ($22 million – 1% of BNB Smart Chain DEX volume)

- four.meme ($9.5 million – 0.4% of BNB Smart Chain DEX volume)

- Pendle ($1.7 million – 0.1% of BNB Smart Chain DEX volume)

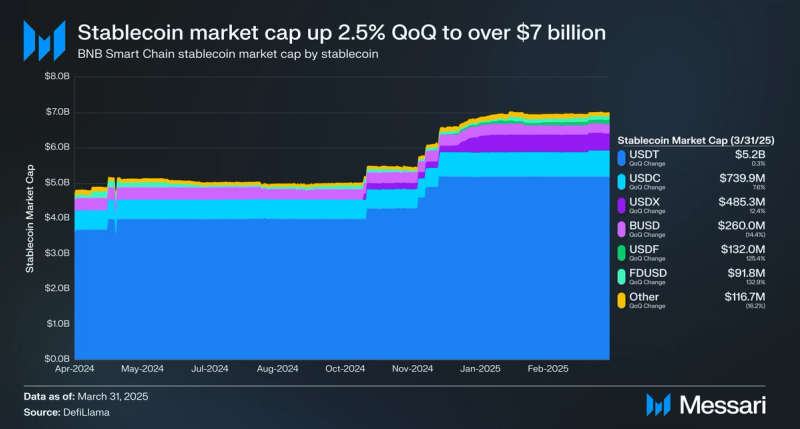

The stablecoin market on BNB Chain continued to grow in Q1 2025, with a total stablecoin market capitalization reached $7.0 billion, a 2.5% increase from the previous quarter. This growth was not enough to maintain BNB Chain’s position in the rankings, as it slipped from third to fourth among all blockchain networks by stablecoin market cap. At the end of Q1, BNB Chain trailed Ethereum ($124.3 billion), TRON ($66.2 billion), and Solana ($12.6 billion) in terms of Stablecoin market cap.

USDT remained the dominant stablecoin on BNB Chain, ending the quarter with a $5.2 billion market cap, up 0.3% QoQ from $5.17 billion, and a 74% market share. However, its relative position weakened slightly as its market share declined by 2.29% QoQ. The dip in overall market share is partly attributed to USDC and USDX, which both gained ground. USDC grew 7.6% QoQ from $688 million to $739.9 million, increasing its share of the market to 10.56% in Q1. USDX, a synthetic stablecoin backed by delta-neutral positions, expanded 12.4% QoQ from $431.7 million to $485.3 million, increasing its share of the market to 6.93% in Q1.

The biggest gainers in Q1 were USDF and FDUSD. USDF increased its market cap by 125.4% from $58.3 million to $132.0 million, while FDUSD surged 132.9% from $39.4 million to $91.8 million. Both stablecoins more than doubled their market share, reflecting growing user interest in alternative dollar-pegged assets.

Despite USDT's continued dominance, the stablecoin landscape on BNB Chain is becoming increasingly diversified. New and emerging stablecoins are capturing a larger share of on-chain liquidity, potentially reshaping the ecosystem's competitive dynamics over the coming quarters.

At the end of Q3 2024, BNB Smart Chain launched the “Gas-Free Carnival,” an initiative to increase stablecoin adoption on the platform. This initiative lasts until June 30, 2025, and partners with 12 different wallets, 8 centralized exchanges, and 2 bridges. The Gas-Free Carnival allows users to transfer stablecoins with no gas fees, offering several options for seamless transactions:

- Gas-Free Stablecoin Transfers: Users can send USDT, USDC, and FDUSD across BNB Smart Chain and opBNB with no gas fees, supported by Binance Wallet Wallet ,SafePal, Trust Wallet, Bitget Wallet, Coin98, Tokenpocket, GateWeb3Wallet, Wello, Mathwallet, UXUY, ImToken,Reveel, Fizen, CodexField, etc .

- 0-Fee Withdrawals: Participating exchanges like Binance, Bitget, Gate.io(END),MEXC, Hashkey(END), Ourbit, Bitmart, BingX, Lbank, Flipster offer fee-free withdrawals of these stablecoins to BNB Smart Chain.

- Free Bridging via Celer cBridge: Celer cBridge and MESON allows users to bridge supported stablecoins to BNB Smart Chain or opBNB networks without cost.

Since the launch of the initiative, the Gas-Free Carnival has covered a total of $3 million in stablecoin gas fees. On March 25 2025, the Gas-Free Carnival was extended 3 months, to be able to include USD1, a new stablecoin which launched on BNB Chain on March 24 2025.

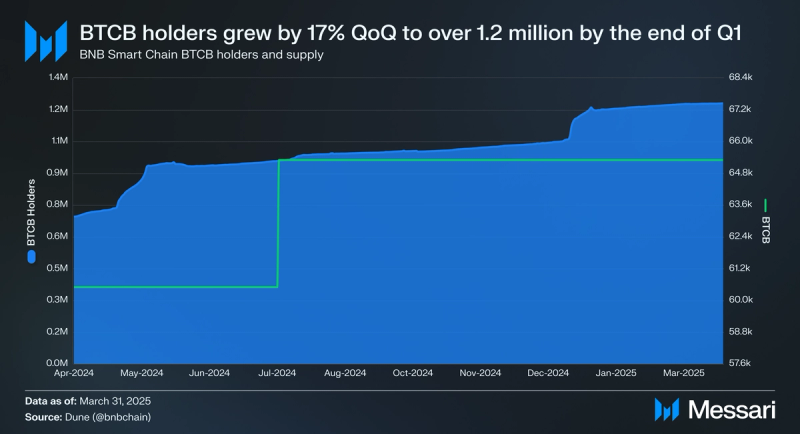

BTCB is one of the largest assets by market cap on the BNB Smart Chain, outside of BNB and stablecoins. It is a tokenized version of Bitcoin on the BNB Smart Chain. The supply of BTCB in Q1 was flat QoQ at 65,300, equivalent to $5.4 billion. As for BTCB holders, they increased by 7% QoQ to 1.2 million. BNB Smart Chain has been bolstered by its emergent BTCFi ecosystem. Projects like Solv Finance, Lorenzo, Lombard Finance, and more offer BTCB holders on BNB Smart Chain the opportunity to participate in various DeFi opportunities.

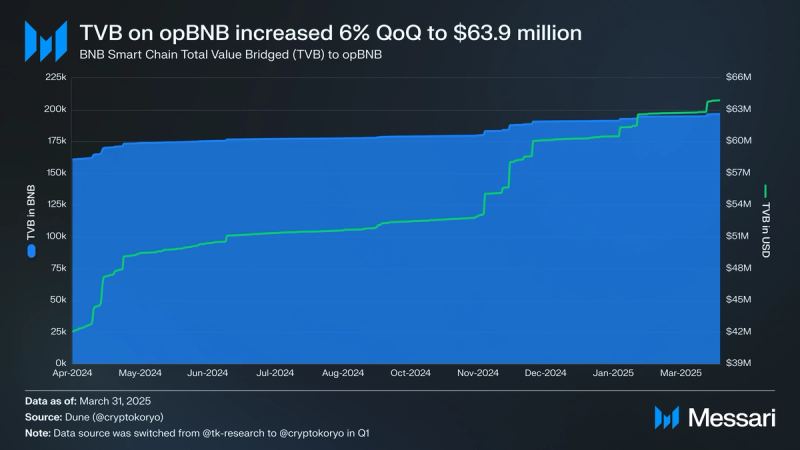

opBNB

opBNB is an EVM-compatible optimistic rollup that helps scale execution throughput for BNB Smart Chain. Since launching in the middle of Q3 2023, total value bridged (TVB) has been in a consistent uptrend. In Q4, TVB to opBNB increased 6% QoQ from $60.2 million to $63.9 million. In BNB terms, TVB grew 3.1% QoQ from 190,917.5 BNB to 196,700BNB.

In order to improve the performance and user experience of opBNB, BNB Chain announced BEP-543, which was recently included in the Volta Upgrade on April 21, 2025. The upgrade reduced the network’s block interval from 1 second to 500 milliseconds. This change was necessary to maintain synchronization with BNB Smart Chain’s shorter block times and to improve transaction finality. The upgrade introduced millisecond-level timestamps within block headers to enable sub-second block production, while maintaining backward compatibility for applications. By halving the block interval, opBNB significantly enhanced its transaction efficiency, lowered latency for user interactions, and positioned itself to better support high-frequency applications such as gaming and decentralized exchanges.

NFTs

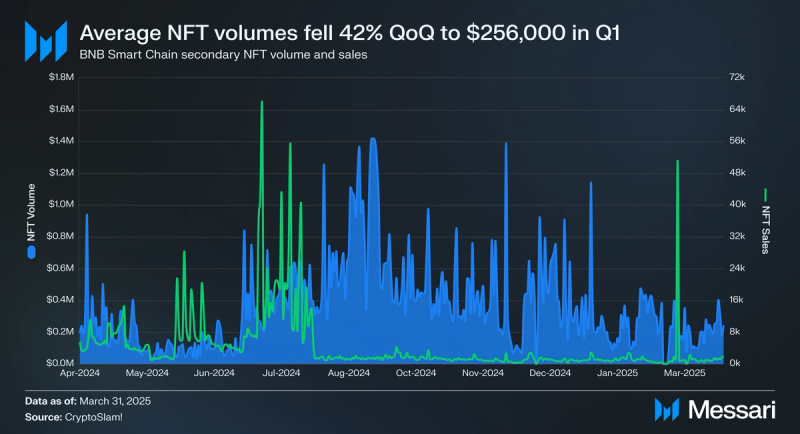

NFT activity on BNB Chain presented a mixed picture in Q1 2025. Average daily NFT trading volume fell 42% QoQ from $441,200 to $256,000, continuing the downward trajectory observed in Q4. This suggests that dollar-denominated demand for NFTs on the network remained under pressure despite the recent addition of support from MagicEden, a major NFT marketplace, in late 2024.

However, average daily NFT sales rose 29.6% QoQ from 1,200 to 1,555, reversing the sharp decline seen in Q4. The increase in transaction count, alongside a decrease in trading volume, points to a shift toward lower-value sales. While BNB Chain’s NFT market has yet to regain its previous momentum in terms of total trading volume, the rise in sales activity suggests that user engagement is recovering.

Ecosystem GrowthBNB Chain continues to support new projects within its ecosystem through its Most Valuable Builder (MVB) Accelerator Program. In October, BNB Chain announced the results of the ninth season of MVB. There were over 500 applications, and 16 different projects were chosen as a part of the Season 8 cohort. Projects ranged across AI, DeFi, DePin, DeSci, gaming and entertainment, and infrastructure.

BNB Chain also launched a series of community and ecosystem initiatives in Q1 2025:

- AI Agents Competition (January 16) - BNB Chain launched an ongoing competition to identify and reward top-performing AI agents. Each round awards $10,000 USD worth of tokens from the winning AI Agent to 1,000 random holders. Evaluation is based on metrics like trading volume, market cap growth, and engagement. The competition is supported by leaderboard data from cookie.fun and offers broad participation for AI-native dApps on BNB Chain.

- BNB Chain Memecoin Solution (January 20) - The Memecoin Solution is a no-code platform allowing users and businesses to create and scale memecoins with ease. It supports token creation, launchpad access, analytics, and liquidity provision. The initiative builds on BNB’s earlier Meme Innovation Campaigns and aims to capitalize on memecoins’ cultural resonance and user acquisition potential.

- AI Agent Solution Toolkit (January 21) - BNB Chain introduced a comprehensive AI Agent development stack, including Eliza, ShellAgent, TermiX, and Revox. These tools allow developers to build modular, autonomous agents capable of trading, asset management, and social engagement across platforms. The solution supports both no-code and advanced developer workflows, reinforcing BNB Chain’s strategy as an AI-first blockchain.

- Eliza AI Plugin Launch (February 13) - BNB Chain launched a dedicated plugin for the Eliza AI Framework, enabling seamless integration of AI agents with DeFi, NFT, and bridging functionalities. The plugin supports multiple LLMs (e.g., OpenAI, Claude, Llama) and allows developers to automate asset management, cross-chain swaps, and AI-driven interactions via platforms like Discord and Twitter.

- BNB Incubation Alliance (BIA) during BNB Demo Day at ETH Denver (February 25) - BNB Chain and YZi Labs co-hosted a BIA event at ETH Denver, providing a platform for early-stage blockchain projects to pitch to investors and gain incubation support. Winning teams, including LIKWID (a permissionless margin trading platform) and Mighty Network (a secure data access protocol), received fast-tracked entry into the MVB accelerator and support packages worth up to $300,000.

- $100M Liquidity Incentive for CEX Listings (March 24) – BNB Chain launched a $100 million liquidity incentive program to strengthen market foundations for BNB Chain-native tokens. The program rewards projects for achieving new listings on major centralized exchanges, with payouts ranging from $50,000 to $500,000 depending on the exchange tier. Eligibility criteria include meeting on-chain security standards, maintaining a minimum $5 million market capitalization, and achieving significant on-chain trading volume. Liquidity support will be provided as perpetual liquidity on platforms like PancakeSwap, ensuring greater depth and stability for listed tokens.

BNB Smart Chain entered 2025 with mixed but forward-moving momentum. Despite a 14.8% QoQ decline in market cap, the network generated $70.8 million in revenue during Q1, up 58.1% from the previous quarter. Wallet-to-wallet transactions overtook DeFi as the top revenue contributor, while total onchain activity, both transactions and active addresses, continued to rise. The chain maintained its position as a top-four Layer-1 by DeFi TVL, with notable growth in restaking protocols and continued dominance by PancakeSwap across DEX volume.

The quarter was marked by the Pascal hard fork, a major upgrade introducing EIP-7702 smart contract wallet support, BLS12-381 cryptography, and other enhancements aimed at improving EVM compatibility and scalability. Validator participation remained strong, with all 45 slots filled post-Feynman Upgrade, while MEV protection infrastructure expanded to retail and institutional users.

Ecosystem activity reflected a focus on user and developer engagement. Initiatives such as the Gas-Free Carnival, $100 million incentive program, MVB Accelerator, and multiple AI- and memecoin-focused programs supported ecosystem diversification. Although NFT volume fell, transaction counts rose, signaling renewed user activity.

With technical upgrades underway and expanding ecosystem programs, BNB Chain remains focused on enhancing network performance, developer accessibility, and application diversity. Looking ahead, BNB Chain plans to build on its momentum with the Lorentz and Maxwell upgrades, which are set to significantly reduce block times and further advance scalability, laying the groundwork for a more performant and developer-friendly network in the quarters to come.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.