and the distribution of digital products.

State of Chronicle Q1 2025

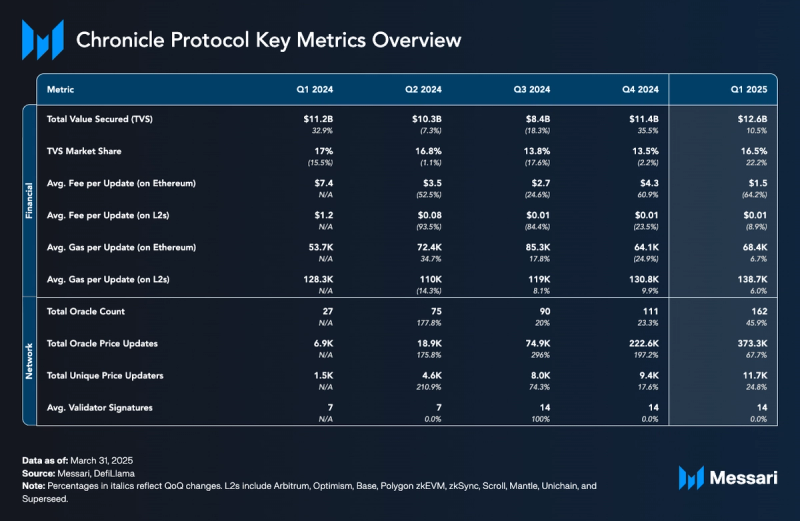

- Chronicle’s TVS increased 10.5% quarter-over-quarter (QoQ), from $11.4 billion in Q4 2024 to $12.6 billion in Q1 2025.

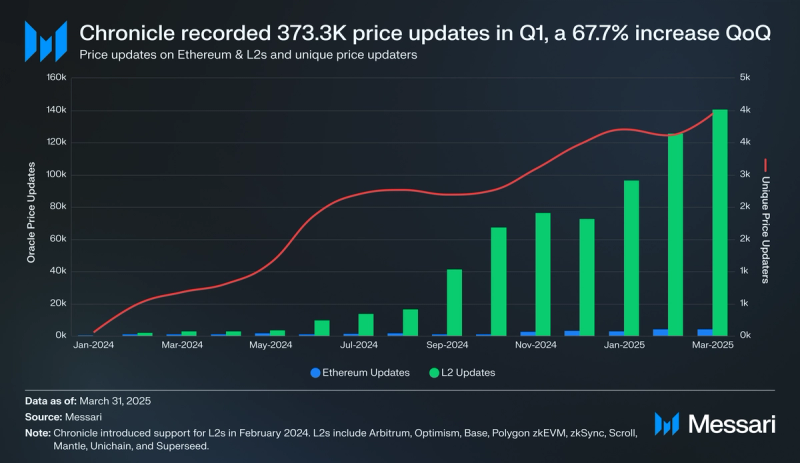

- Chronicle Protocol recorded 373,300 oracle price updates in Q1, marking a 67.7% increase QoQ.

- Operating costs via gas fees per Chronicle oracle update decreased by 64.2% on Ethereum and decreased by 8.9% on Layer-2s QoQ.

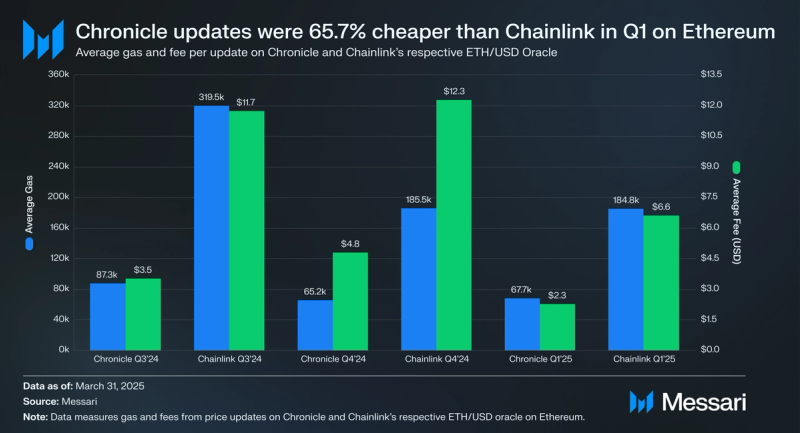

- Using the respective ETH/USD oracle as a proxy, Chronicle updates on Ethereum were 63.4% more computationally efficient and 65.7% less expensive than Chainlink.

- Chronicle integrated Berachain, Unichain, Corn, Plume, and Superseed; expanded its validator set by onboarding three new validators; and announced a $12 million Seed round led by Strobe Ventures.

Chronicle Protocol is an oracle network that aims to provide transparent, verifiable, and cost-efficient price feed oracles to blockchains. Chronicle has supported Sky Protocol (formerly Maker) and its ecosystem since 2017 and, by the end of Q1 2025, secured $12.6 billion in total assets across DeFi protocols.

The project evolved from the Oracles Core Unit at Maker, established by Niklas Kunkel and Mariano Conti. Together, they co-developed Ethereum’s first onchain oracle in 2017 to facilitate SAI, the predecessor to Maker’s USD-pegged DAI stablecoin and the current USDS stablecoin. Chronicle began expanding beyond the Sky ecosystem in September 2023.

Chronicle developed Scribe, a gas-efficient oracle based on aggregated Schnorr signatures, introducing a new approach to oracle network architecture. Unlike competitors that rely on trust-based systems, Chronicle is trustless, ensuring full transparency through end-to-end verifiability. This architecture enables every data point to be traced back to its original source queries. For a complete primer on Chronicle, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

Key Metrics Performance AnalysisTotal Value Secured

Performance AnalysisTotal Value Secured

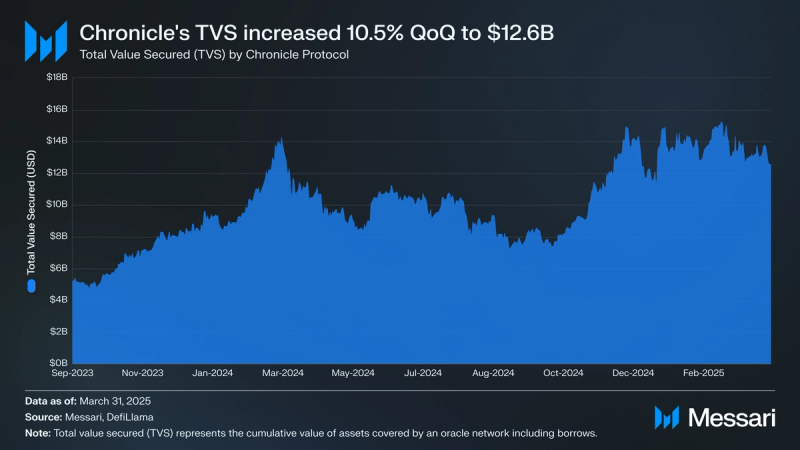

Total value secured (TVS) represents the cumulative value of assets secured by an oracle network, including borrows. Chronicle’s TVS increased 10.5% quarter-over-quarter (QoQ), from $11.4 billion in Q4 2024 to $12.6 billion in Q1 2025.

Historically, Chronicle’s TVS has been primarily composed of Sky, with TVS peaking at just over $20 billion in December 2021. Since Chronicle began offering its oracles to the public, Sky’s dominance decreased to 57.4% by the end of Q1, while Spark’s share increased to 28.2% and Euler’s share increased to 8.4%.

Currently, DefiLlama only tracks the eight protocols where Chronicle supports the majority of price feeds: Sky, Spark, M^0, Euler, Morpho, Dolomite, Ionic Protocol, and Keep Network. However, in total, Chronicle supports 68 protocols.

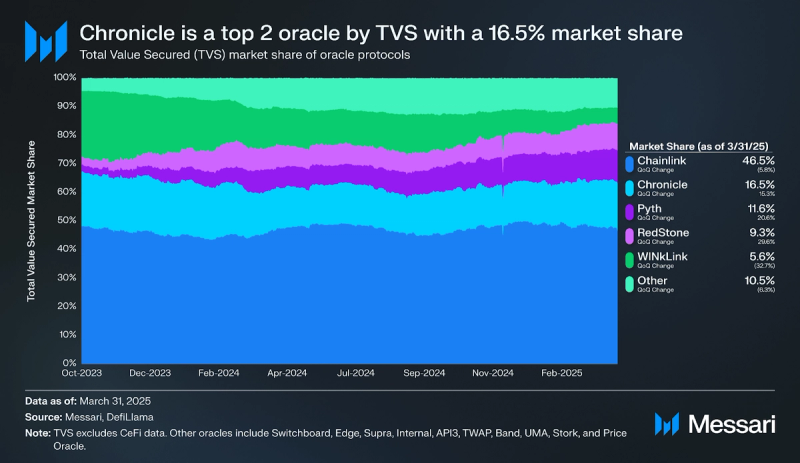

Chronicle is the second-largest oracle by TVS, with a market share gap of 30 percentage points behind leader Chainlink. Chronicle’s TVS dominance among oracle protocols by TVS increased by 15.3% QoQ, from 14.3% in Q4 2024 to 16.5% in Q1 2025. The gain in market share reflects a shift away from Chainlink and WINkLink.

OraclesOracles are onchain relays that provide blockchains with access to offchain data, such as real-time prices. Data models define the logic of how an oracle operates. For example, when Chronicle creates an oracle for a new asset, it curates a data model using various data sources and employs a data aggregation methodology to produce a final value for the specific oracle. This technique allows Chronicle to deploy any existing data model to a supported chain.

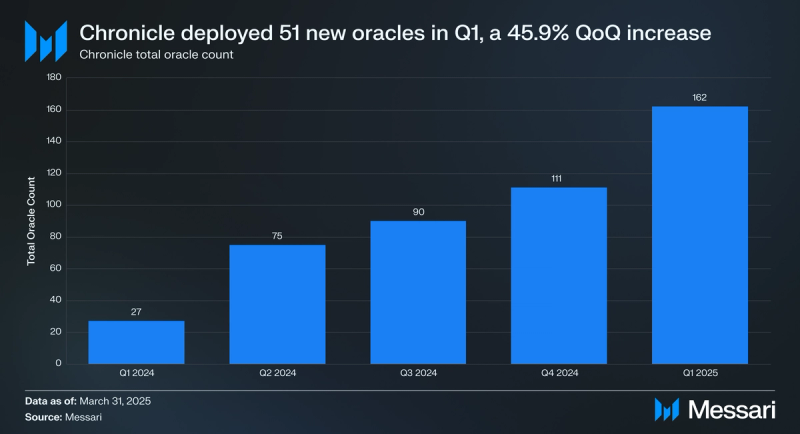

In Q1, Chronicle deployed 51 new oracles, increasing its total to 162, a 45.9% QoQ increase from 111 oracles. Additionally, Chronicle expanded its data model set to 98, up from 92 in Q4 2024, increasing the catalog of data models that can be deployed as oracles on any supported blockchain.

Oracle Price UpdatesOracle price updates refer to the process where the oracle network retrieves the latest market price of a specific asset and records the price onchain. This price retrieval process is completed by distinct validators or nodes, which are known as unique price updaters.

In Q1, Chronicle recorded 373,300 oracle price updates, marking a 67.7% increase from the 222,600 updates in Q4 2024. Of these, 362,600 updates were recorded on Ethereum Layer-2s (L2s), while only 10,700 were on Ethereum. This surge in updates can be primarily attributed to an expansion of partnerships, including the integration of oracles into Berachain, Unichain, and Corn, and the launch of several new price feeds. In addition, the number of unique price updaters grew to 11,700, a 24.8% QoQ increase from 9,400.

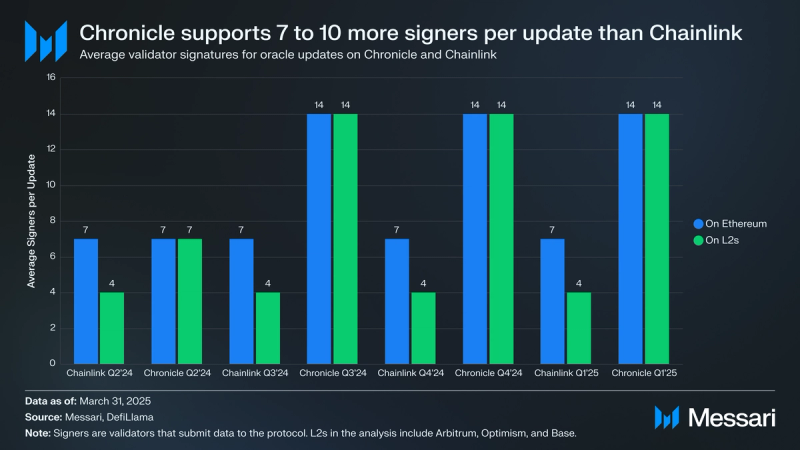

SignersSigners are validators that run a node within decentralized oracle networks and are responsible for gathering raw data and submitting it to the protocol. Signers attach a digital signature to the data, allowing the protocol to verify the data’s authenticity and the specific validator that submitted it. Only a predefined number of validators are required to act as signers for each oracle transaction. The number of signers is directly related to the security of the oracle price feed; a higher number of signers strengthens security by making it more difficult for colluding validators to manipulate reported values. Successfully manipulating oracle-reported values can result in the theft of TVL from protocols that rely on them.

In Q1 2025, Chainlink averaged 7 signers on Ethereum and 4 signers on L2s such as Base, Optimism, and Arbitrum. The number of signers on Chainlink oracles has not changed since Q2 2024.

In mid-August 2024, Chronicle began supporting 14 signers per oracle update on Ethereum and L2s, which remained constant through Q1 2025. The seven additional signers directly improved Chronicle’s price feed security, resulting in a 100% higher threshold for oracle price feed manipulation than Chainlink on Ethereum and a 250% higher threshold on L2s.

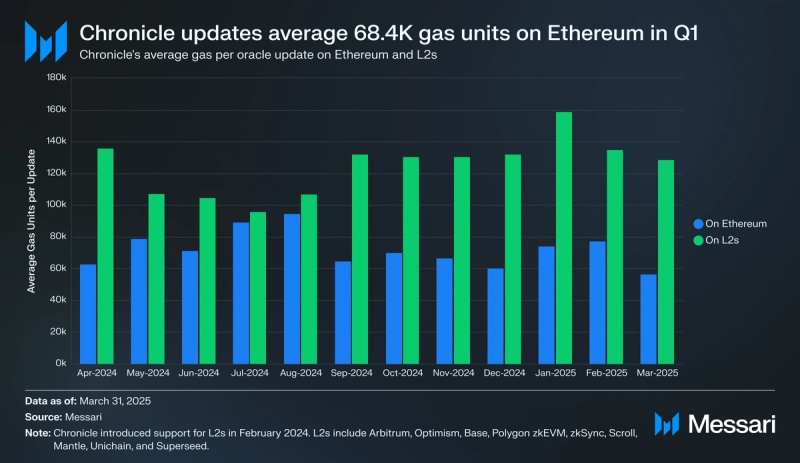

Gas and FeesGas Usage

Chronicle Labs utilizes Scribe, a gas-efficient oracle based on aggregated Schnorr signatures, which reduces the gas costs of oracle updates by over 60% on L1 and over 68% on L2 blockchains. On Ethereum, ETH transfers require 21,000 gas units, ERC-20 transfers require 65,000 gas units, and a swap on Uniswap requires 184,000 gas units. In Q1, Chronicle updates on Ethereum used an average of 68,400 gas units, a 6.7% QoQ increase. On L2s, Chronicle updates used, on average, 138,700 gas units, a 6.0% QoQ increase.

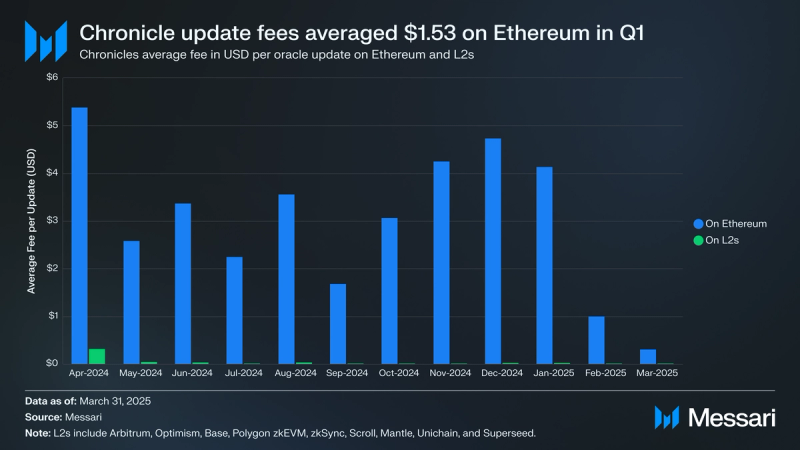

FeesOracle update fees are not revenue generated by Chronicle but rather represent gas fees paid by Chronicle to update oracles with the latest values. Since gas fees are considered an operating expense and are often passed on to customers by oracle providers, efforts are focused on minimizing these costs over time.

In Q1, the average fee per oracle update on Ethereum cost $1.53, a 64.2% decrease QoQ. On L2s, average fees cost $0.01, an 8.9% decrease QoQ. Although the computational effort (gas units) for updating Chronicle oracles on Ethereum increased by 6.7%, the fees per oracle update on Ethereum decreased due to a 45.3% drop in ETH’s price. In Q1, Chronicle paid $16,400 in total fees on Ethereum and $2,500 on L2s, reflecting a decrease of 42.8% and an increase of 67.4% QoQ, respectively.

Chainlink Comparison

Using Chronicle’s and Chainlink’s respective ETH/USD oracles as a proxy, Chronicle updates outperformed Chainlink updates in computational efficiency and fees. On average, in Q1, Chronicle’s ETH/USD oracle used 67,700 gas units at $2.27 per update. Compared to Chainlink’s ETH/USD oracle, which used 184,800 gas units at $6.61 per update, Chronicle’s oracle was 63.4% more computationally efficient and 65.7% less expensive.

Qualitative AnalysisTechnological Upgrade

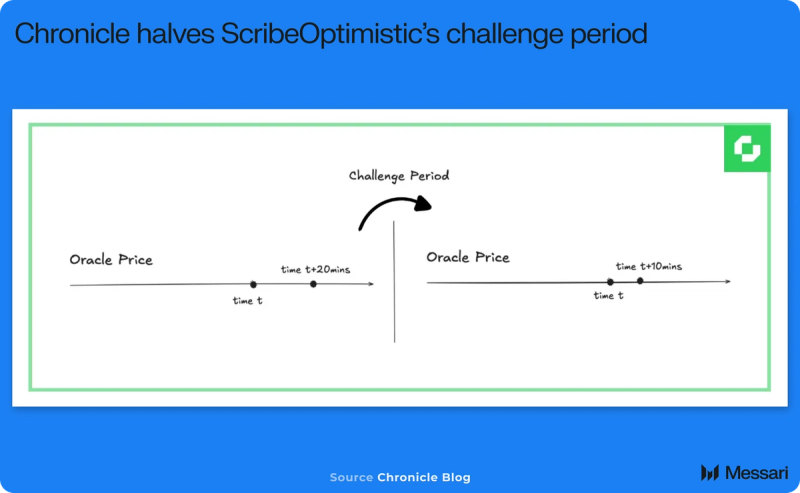

On Jan. 28, 2025, Chronicle reduced the challenge period for its ScribeOptimistic oracle from 20 minutes to 10 minutes, aiming to deliver faster data updates while preserving the integrity of its decentralized fraud-proof system. Built for high-cost environments like Ethereum Mainnet, ScribeOptimistic leverages optimistic submission and offchain signature verification, with onchain challenges incentivized through ETH rewards and validator slashing. After 18 months of production use and demonstrated reliability, where valid challenges occur within seconds, Chronicle deemed the system mature enough to support the reduced window. This change enables fresher price feeds, though it requires users, particularly in DeFi lending, to respond more quickly to potential liquidation events.

Oracle IntegrationsDuring Q1 2025, Chronicle Labs expanded its integrations with various applications, beginning the quarter with 59 integrated apps and ending with 68, a 15.3% QoQ increase.

CornOn Jan. 8, 2025, Chronicle oracles went live on Corn, a Bitcoin-secured Layer-1 designed for Bitcoin DeFi (BTCFi). The integration provides access to over 100 real-time data models for crypto assets, tokenized assets, and yield rates. Using BTCN, a hybrid tokenized Bitcoin, as gas, Corn features a swap facility inspired by MakerDAO’s Peg Stabilization Module.

Resolv LabsOn Jan. 10, 2025, Chronicle launched the USR/USD oracle in collaboration with Resolv Labs. USR is a delta-neutral stablecoin backed by ETH and its derivatives. The integration provides verifiable and resilient onchain pricing to support USR’s stability and composability across DeFi.

AvalonOn Jan. 17, 2025, Avalon, a BTCFi protocol on Plume Network, integrated Chronicle’s oracles to secure its DeFi infrastructure. Avalon offers Bitcoin holders access to fixed-rate lending through USDa, a stablecoin designed for instant liquidity without asset liquidation.

Credit CoopOn Jan. 22, 2025, Credit Coop integrated Chronicle’s oracles to secure its structured finance protocol on Plume Network. By bringing future revenue onchain, Credit Coop enables businesses to access non-dilutive capital. Chronicle’s oracles ensure reliable asset pricing and enhance capital efficiency for borrowers and lenders.

BerachainOn Feb. 6, 2025, Chronicle’s oracles launched on Berachain mainnet, providing data feeds for Berachain assets including STONE, HONEY, and NECT. Designed to support builders from day one, the integration ensures reliable pricing infrastructure for Berachain’s DeFi ecosystem. On March 17, 2025, Chronicle expanded coverage on Berachain with the launch of the PYUSD/USD price feed, supporting PayPal’s stablecoin.

UnichainOn March 18, 2025, Chronicle’s oracles became available on the Unichain mainnet and testnet, enabling developers to access over 90 real-time data feeds or request new ones as needed. Unichain is a high-performance Superchain Layer-2 built to unify liquidity and enable seamless DeFi interactions across chains.

Other integrations during Q1 2025 include Superseed Mainnet, Plume Nexus, Monad Testnet, Beraborrow, and more.

Validator ExpansionIn Q1, Chronicle expanded its decentralized oracle network by onboarding three new validators operated by Steakhouse Financial, Bitcoin Suisse, and Block Analitica. Adding validators enhances the protocol’s security and resilience. With this addition, the network comprises 25 validators, including Sky, Infura, Gitcoin, dYdX, Etherscan, Gnosis, and others.

By relying solely on projects that Chronicle defines as “reputable,” Chronicle believes it creates a unique and additional layer of security against a 51% attack by the validator set, a vulnerability to which all decentralized oracle networks are susceptible.

Chronicle Points and CLE Token

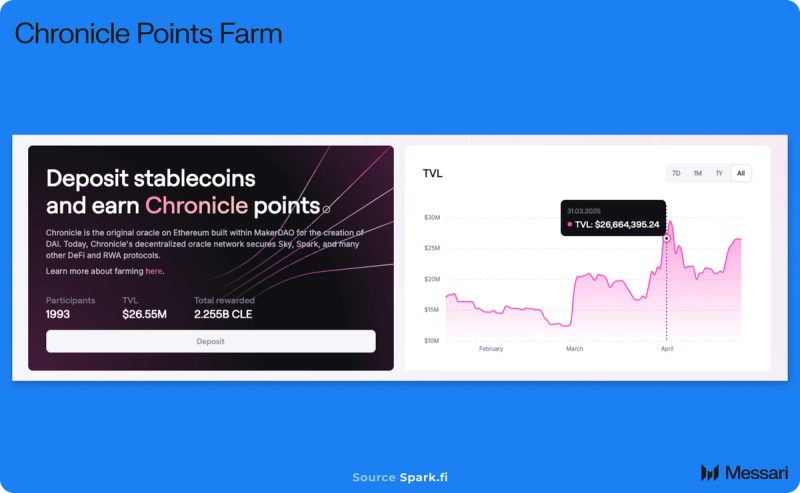

In September 2024, Chronicle introduced Chronicle Points, its first community initiative to reward eligible participants with future CLE tokens. Participants can earn points by supplying USDS through Sky and Summer.fi, or depositing stablecoins on Spark. Chronicle plans to expand earning opportunities via its dashboard.

As of March 31, 2025, 26.49 million USDS was locked and earning Chronicle Points on Sky, with more than 2.6 billion Chronicle Points rewarded. Chronicle Points will eventually be redeemable for CLE tokens at a conversion rate of 10 points per 1 CLE token. The total supply of CLE tokens is set at 10 billion, with Chronicle Points being issued at an annual rate of 3.75 billion.

Seed Round FundraiseOn March 25, 2025, Chronicle announced a $12 million Seed round led by Strobe Ventures, with participation from Fenbushi Capital, Robot Ventures, Galaxy Ventures, 6th Man Ventures, Tioga Capital, Brevan Howard Digital, and more. The funding supports Chronicle’s expansion as a core data infrastructure provider for tokenized assets, including its Verified Asset Oracle used by issuers such as Centrifuge, Superstate, and M^0.

Closing SummaryIn Q1 2025, Chronicle Protocol’s TVS increased by 10.5% QoQ to $12.6 billion, supported by growing adoption from protocols such as Spark, Euler, and Dolomite. The protocol recorded 373,300 oracle price updates, a 67.7% increase from Q4 2024, with over 97% of updates occurring on Ethereum Layer‑2 networks. The number of unique price updaters rose to 11,700, up 24.8% from the previous quarter. Leveraging its Scribe technology, Chronicle oracles demonstrated a 63.4% improvement in computational efficiency and a 65.7% reduction in cost compared to Chainlink, despite slight increases in gas consumption.

Chronicle also continued to expand its network and infrastructure. Key developments included integrations with Berachain, Unichain, Corn, Plume, and Superseed; the onboarding of three new validators to strengthen decentralization; and several new oracle deployments across DeFi protocols such as Resolv Labs, Avalon, and Credit Coop. The quarter also saw Chronicle reduce the challenge period for its ScribeOptimistic oracle, enabling faster data delivery while maintaining trustless guarantees. Additionally, the protocol launched a community rewards initiative through Chronicle Points and raised $12 million in a Seed round led by Strobe Ventures. Looking ahead, Chronicle is well-positioned to deepen its role in tokenized asset infrastructure and further enhance the scalability and resilience of its oracle network.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.