and the distribution of digital products.

State of Core Q1 2025

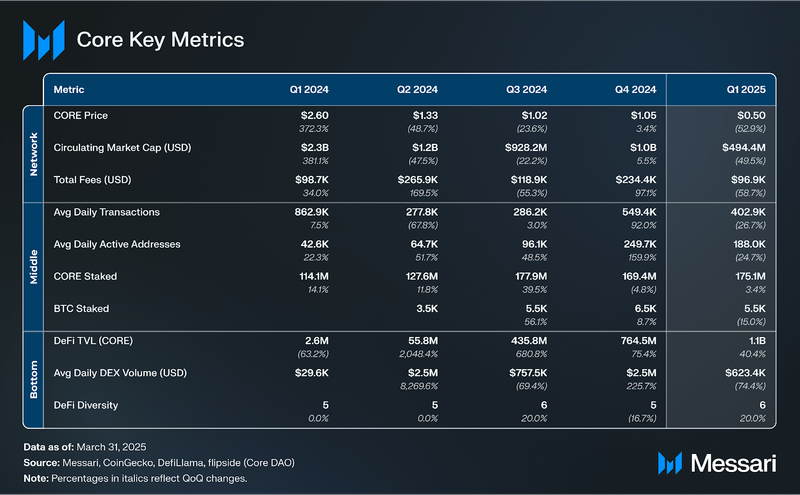

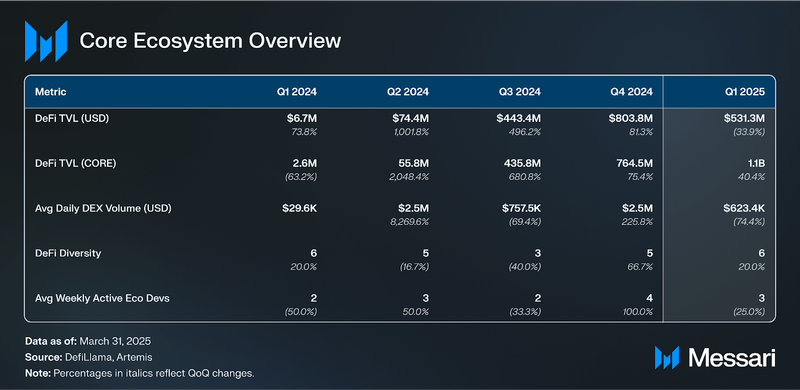

- Core’s native DeFi TVL increased by 40% QoQ to 1.1 billion CORE. Colend led TVL in Q1 (266.5 million CORE), followed by Pell Network (248.4 million CORE) and BitFLUX (183.1 million CORE).

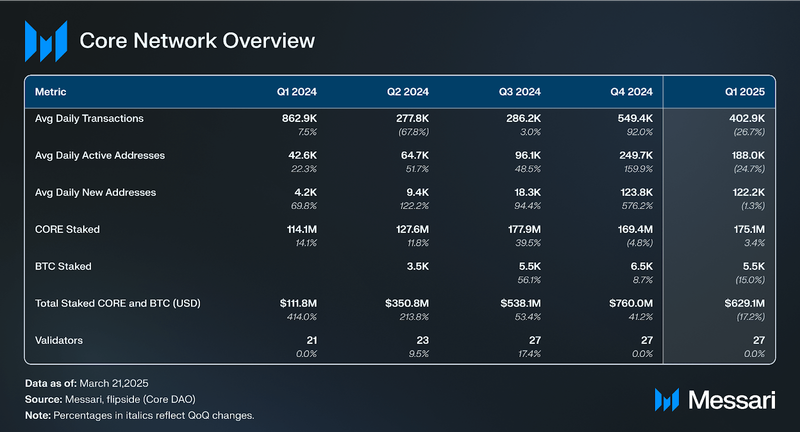

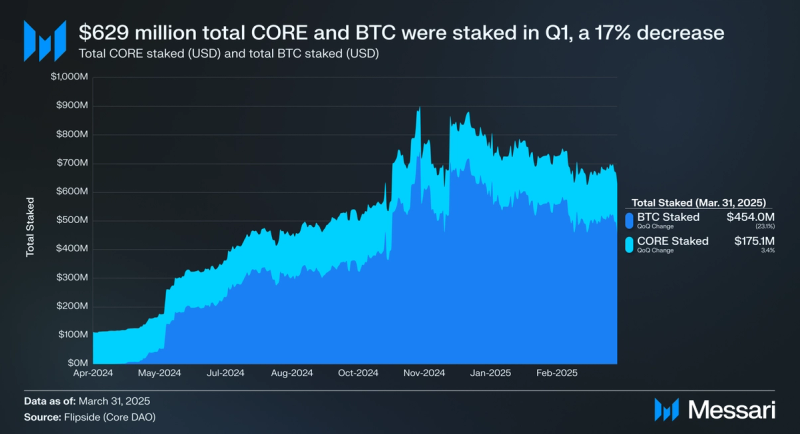

- CORE and BTC Staked (USD) decreased by 17% QoQ to $629.1 million. BTC staked decreased 15% QoQ to 5,500, while CORE staked increased by 3% to 175.3 million at Q1 close.

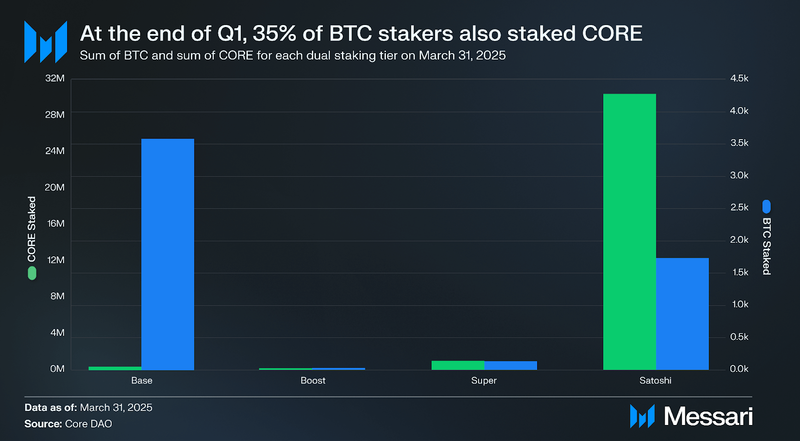

- 35% of BTC stakers were staking CORE as well to earn boosted dual staking yields. The top 9% of BTC stakers accounted for 59% of all dual-staked CORE.

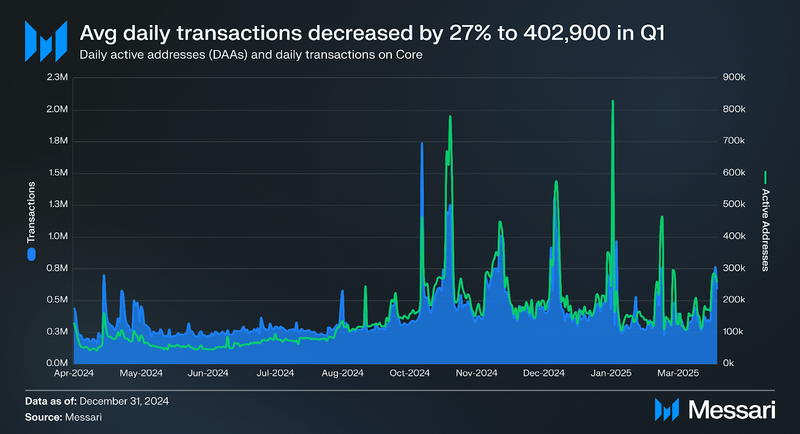

- Average daily transactions decreased 27% QoQ to 402,900, while average daily active addresses decreased 25% to 188,000.

- In February 2025, Core and Maple Finance announced the upcoming lstBTC token. lstBTC is an upcoming liquid staking token issued on the Core network representing staked BTC.

The Core blockchain (CORE) is a scaling and programmability solution for Bitcoin powered by its Satoshi Plus consensus, EVM execution environment, Bitcoin-based DeFi (BTCFi), and Core governance. Launched in January 2023, Core has built an ecosystem of Bitcoin-focused applications that inherit security from Bitcoin’s consensus resources (i.e., Bitcoin miners, etc.) wherever possible.

Core’s biggest differentiator from other Bitcoin layers (and merge-mining in general) is its Satoshi Plus consensus mechanism, a hybrid model of Delegated Proof-of-Work (DPoW), Delegated Proof-of-Stake (DPoS), and Self-Custodial BTC Staking. DPoW is performed by Bitcoin miners and mining pools who delegate their existing Bitcoin hash rate to select validators on Core. DPoS is performed by CORE tokenholders staking/delegating their CORE tokens to select validators on Core. Core introduced Self-Custodial BTC Staking in April 2024, offering consensus participation to BTC holders who lock their tokens on Bitcoin using absolute time locks. In return, holders receive voting power on Core, which they delegate to elect validators, earning users CORE token rewards. Core relayers monitor the BTC network for valid lockup transactions and forward approved transactions to Core’s Consensus Engine. The DPoW hash, DPoS stake, and BTC stake contribute to the calculation of a weighted score that determines which validators qualify for the next round of block creation. Certain parameters of the weighting are variable and set by Core.

In November 2024, Core introduced Dual Staking, a feature allowing Bitcoin holders to multiply their rewards by simultaneously staking CORE tokens alongside their Bitcoin. It also set the stage for lstBTC, a BTC liquid staking token that enables users to earn yield while retaining BTC liquidity in Core's fully expressive execution environment. The network's EVM compatibility allows Core to run smart contracts and applications by leveraging existing Ethereum developer tools and the Ethereum ecosystem. For a complete primer on Core, refer to our Initiation of Coverage report.

Key Metrics

Financial Analysis

Financial Analysis

CORE is the native token of the Core blockchain and is used as the primary medium of exchange when transacting on the network. CORE has three additional primary use cases:

- Paying transaction fees.

- Staking to secure the network and earn rewards, including boosted BTC-staking yield rates via Dual Staking.

- Granting holders onchain voting power.

The total supply of CORE is fixed at 2.1 billion tokens. Block rewards are distributed over 81 years and decrease by 4% annually. CORE also has a minor deflationary burn mechanism to counteract inflationary pressure.

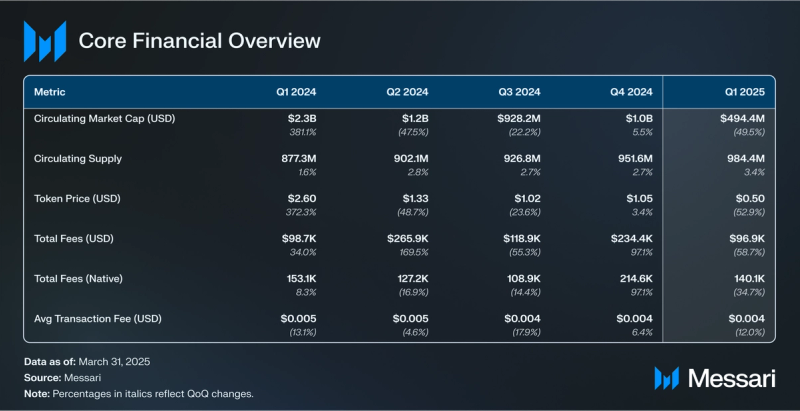

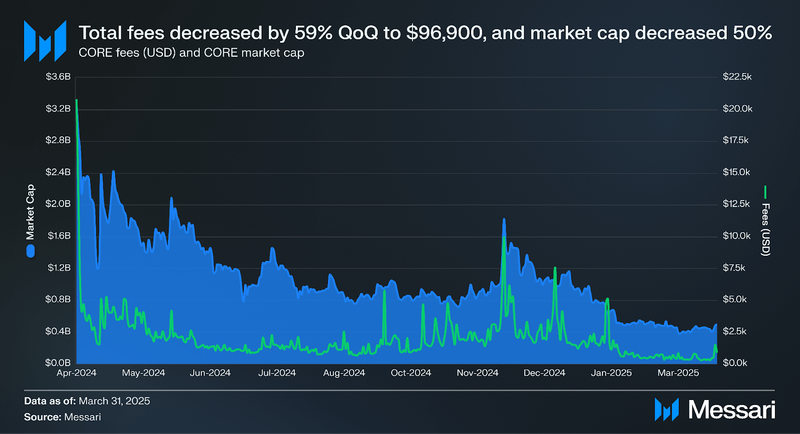

Market Cap & Fees

Core’s market cap decreased by 50% QoQ to $494.4 million. A 3% increase in the circulating supply of CORE drove the divergence between market cap and token price. The market cap of all L1s (excluding Bitcoin) decreased by 34% in Q1, while Bitcoin sidechains decreased by 57% in aggregate. This suggests that Core was susceptible to the crypto market decline but more resilient than similar chains.

Core fees denominated in USD decreased by 59% QoQ to $96,900, while fees denominated in CORE decreased by 35%. Core’s fees come from transactions on the network. This quarter's decrease in fees can be attributed to a 27% decrease QoQ in average daily transactions to 402,900, coupled with a 53% decrease in token price to $0.50.

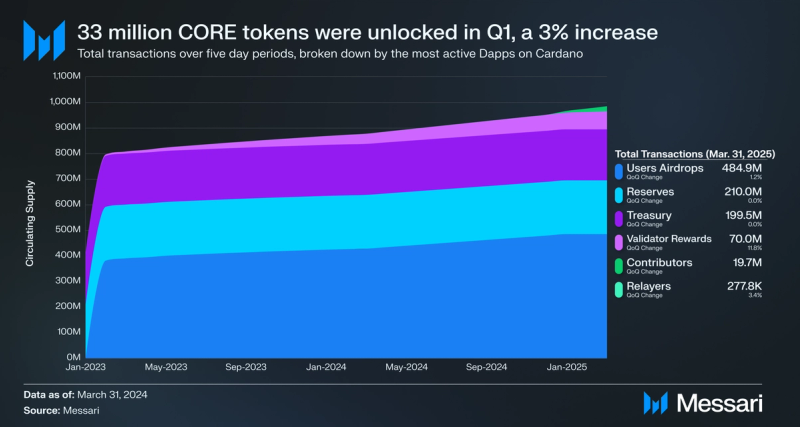

Token Supply

In Q1, 32.8 million CORE (3% of the total token supply) was unlocked. Of these, 5.6 million were for airdrop participants, 7.4 million were for validator rewards, 19.7 million were for contributors, and 30,900 were for relayers.

Contributor tokens were unlocked for the first time in Q1, with 6.6 million CORE unlocked monthly until the allocation is fully vested in 2029. The 484.9 million airdrop allocation was fully vested in January.

Average daily active addresses decreased 25% QoQ to 188,000, and average daily transactions decreased 27% to 402,900. At the end of Q1, Core reached 46.1 million unique lifetime wallets, a 32% increase QoQ.

In Q1, the average block time on Core was only 3 seconds, whereas the average block time on Bitcoin was 10 minutes. Core is not limited by Bitcoin’s block time and can execute at an independent pace in any instance since the Core network is an independent L1.

At the close of Q1, Core had 27 active validators. Core uses its Validator Election Mechanism to rank the top 27 validators based on a weighted score of their hash, CORE stake, and BTC stake, creating the validator set for a consensus period of 200 slots, known as an epoch. In May 2024, Core DAO passed CIP-2 to expand Core’s active validator set from 21 to 31 by Q2 2025. As of the end of Q1, there are 27 active validators on Core.

StakingCore uses the novel Satoshi Plus consensus mechanism. Satoshi Plus is a hybrid model of Delegated Proof-of-Work (DPoW), Delegated Proof-of-Stake (DPoS), and Self-Custodial BTC Staking. Unlike merge-mined sidechains, where multiple chains are mined simultaneously using the same computational resources, Core delegates the responsibility of producing new blocks to its validators, rather than Bitcoin miners.

The total amount of CORE and BTC staked, denominated in USD, was $629.1 million, a 17% decrease QoQ. Core’s 53% price decrease in Q1 drove this decrease. CORE staked (USD) was up 3% QoQ to $175.1 million despite the token price decreasing 53% to $0.50. In contrast, BTC's stake (USD) decreased by 23% QoQ to $454.0 million, and BTC’s price declined 11% QoQ to $82,400. BTC staked declined from 6,500 at the close of Q4 to 5,500 BTC at the close of Q1. BTC is staked (locked) on Core through Self-Custodial BTC Staking, which uses a CheckLockTimeVerify (CLTV) Timelock to lock BTC tokens on the Bitcoin network.

stCORE, Core’s native liquid staking product, launched in January 2024. stCORE enables CORE stakers to participate in DeFi and other yield opportunities while contributing to the Core blockchain. stCORE supply increased 57% QoQ to 20.0 million, equivalent to $8.6 million. Core had an 11% liquid staking rate in Q1, a 52% increase QoQ. Liquid staking rate is the percent of liquid-staked CORE compared to total staked CORE, and can be used to measure ecosystem activity.

Dual StakingDual Staking provides boosted CORE rewards to participants who stake both Bitcoin and CORE tokens (“dual stakers”), incentivizing BTC stakers to acquire and stake CORE to maximize their yield. This mechanism aims to enhance Core’s security by raising the economic incentive to stake BTC and CORE.

The staking process remains unchanged, but reward allocation follows a tiered system. Previously, all BTC stakers received the same rewards rate, but under Dual Staking, rewards tiers are determined by the amount of CORE staked relative to BTC staked. The higher the rewards in that tier, the more CORE staked relative to BTC staked. While staking CORE introduces risks beyond holding BTC, the principal BTC holdings remain unaffected, as the BTC remains self-custodially locked on the Bitcoin network.

At the end of Q1, 35% of BTC stakers were also staking CORE. Stakers can select from three tiers—Boost, Super, or Satoshi—determined by the ratio of CORE staked relative to their staked BTC. Higher tiers require more staked CORE to unlock greater yields. On March 30, Core proposed increasing the CORE staking requirements for each tier to incentivize BTC stakers to stake more CORE, and the proposal passed after Q1. The updated tier requirements are:

- Satoshi Tier (Highest Rate) – 24,000:1

- Super Tier – 9,000:1

- Boost Tier – 3,000:1

Although just 9% of BTC dual-stakers are staking at the Satoshi tier, their combined CORE stakes account for 59% of all dual-staked CORE. This disparity reflects a strong interest in dual staking to boost BTC yields, suggesting BTC tokenholders are comfortable holding CORE to maximize their returns.

lstBTCIn February 2025, Core and Maple Finance announced the upcoming lstBTC token. lstBTC is an upcoming liquid staking token issued on the Core network representing staked BTC. Users who lock BTC on the Bitcoin network receive lstBTC on Core in return. Maple Finance, a lending protocol, will borrow against some of the BTC for CORE tokens, which they will Dual Stake on Core.

The Core Foundation has also partnered with BitGo, Copper, and Hex Trust to expand lstBTC opportunities to institutional clients. Institutional BTC holdings are often less capital efficient. Profits are eroded by custody, leverage, and/or management costs. By adopting lstBTC, institutions can earn yield on top of their BTC, unlocking potentially greater returns for themselves and their stakeholders. lstBTC enables participation in activities like lending, liquidity provision, borrowing stablecoins for trading, or engaging with various BTCFi apps. As of the end of Q1, interested parties can join the waitlist to use lstBTC.

Ecosystem Analysis DeFi

DeFi

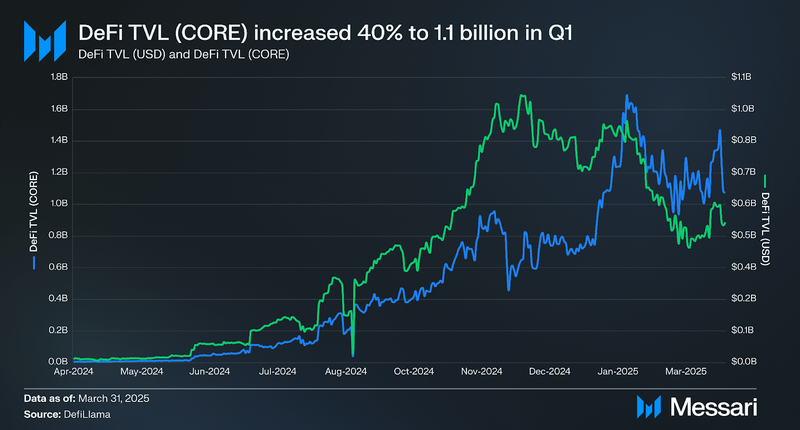

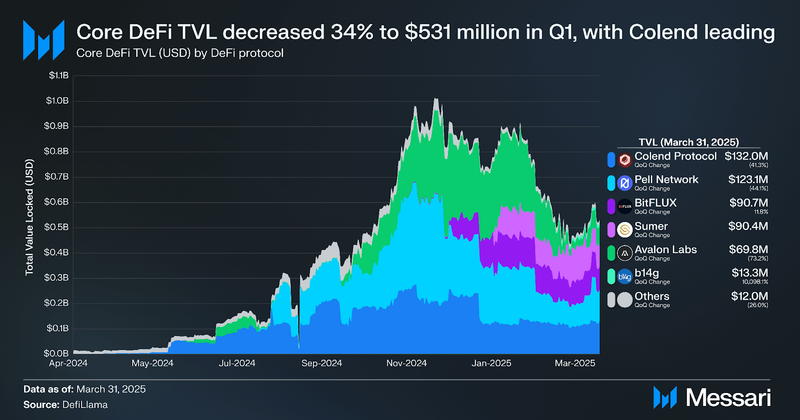

DeFi TVL denominated in CORE increased 40% to 1.1 billion in Q1, marking an active quarter for the network’s ecosystem. However, DeFi TVL denominated in USD decreased 34% QoQ to $531.3 million, with the discrepancy due to CORE decreasing 53% QoQ from $1.05 at Q4 close to $0.50 at Q1 close.

Colend, a lending and borrowing platform native to Core, had $132.0 million TVL at Q1 close, a 41% decrease QoQ. SolvBTC.CORE, a wrapped version of BTC custodied by Solv, was the largest contributor to Colend’s TVL.

Pell Network, a Bitcoin restaking layer, was the second-largest application behind Colend at the end of Q1 with $123.1 million TVL, a 44% decrease QoQ. Pell Network launched on Core in August 2024, offering users higher yields for restaking coreBTC or SolvBTC, among other BTC derivatives. Obelisk’s oBTC is the largest restaked asset for Pell on Core, with a TVL of $118.6 million, an 8% decrease QoQ. Pell announced their $2.5 million raise on January 27, in which Core Ventures participated. Pell airdropped their token on March 13.

BitFLUX is a stableswap DEX on Core designed for low-slippage swaps between BTC-pegged assets. It enables single-sided liquidity provision, letting users earn yield on BTC without impermanent loss risk. BitFLUX’s TVL rose 12% QoQ to end Q1 at $90.7 million. oBTC had the highest TVL on BitFLUX with $28.7 million in Q1, a 166% increase QoQ.

Sumer is a multichain synthetic asset and lending protocol. The synthetic assets (SuUSD, SuETH, and SuBTC) are backed by collateral from lending markets. The protocol is forked from Compound V2. Sumer launched on Core January 6 and ended Q1 with $90.4 million in TVL.

DeFi diversity represents the number of protocols that make up >90% of DeFi TVL. Core’s DeFi diversity was 3 in Q1, with TVL concentrated in Colend, Pell Network, and BitFLUX.

DEX Volume Core Commit Program

Core Commit ProgramThe Core Commit Program is a three-month program for developers building on Core to receive support from the Core ecosystem, 1:1 mentorship, and funding from Core Ventures. This is Core Ventures’ first initiative to incubate a cohort of developers building applications native to Core. The program kicked off on Dec. 9, 2024, and Core Ventures selected 10 teams to participate and receive support:

- 0xBridge

- Focus: BTCFi, DeFi

- B14g

- Focus: BTCFi, BTC Staking

- Bitcoin Derby

- Focus: Game, BTCFi

- BQLabs

- Focus: Insurance, DeFi

- Celeriz

- Focus: BTCFi, Stablecoins, Infrastructure

- Coffer Network

- Focus: Infrastructure, BTCFi

- Degen Markets

- Focus: SocialFi

- Ordinistan

- Focus: Ordinals, NFTs, BTCFi, DeFi

- Sats Terminal

- Focus: BTCFi, Ordinals/Runes, DeFi, Infrastructure

- VaultLayer

- Focus: BTCFi, LSTs

In May 2024, Core DAO updated the Core Ignition incentive program to introduce Sparks to measure and reward user activity and engagement. Sparks are synonymous with the points several popular pre-airdrop protocols began offering over the past year.

Users receive a daily allocation of Sparks, determined by their level of engagement and participation in the Core ecosystem. The more active and involved a user is, the greater their daily allocation of Sparks will be. Additionally, Core offers a multiplier on specific assets that adjusts your conversion rate (i.e., if you hold an asset with a 1.5x multiplier and earn 100 base Sparks a day, you'll receive an additional 50 Sparks a day through the asset multiplier).

On March 12, Core launched Season 3 of Core Ignition, resetting Sparks to 0 for all participants. Season 3 introduced new multipliers to earn Sparks through Core network applications, bridging, and trading. Core also launched an Ignition Leaderboard to track Spark Points.

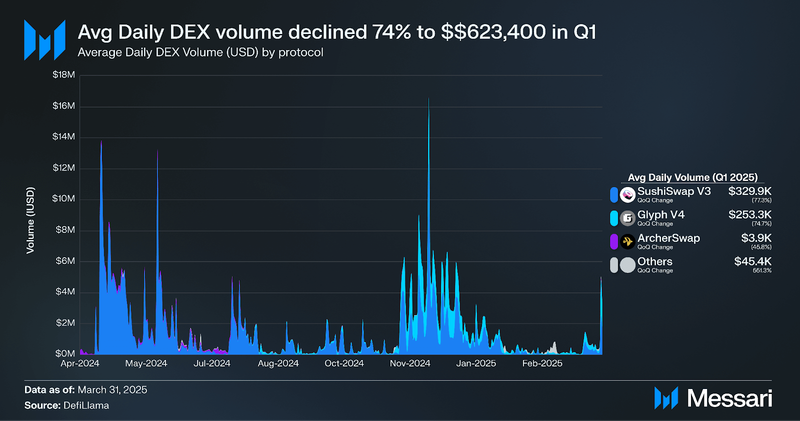

Closing SummaryIn Q1 2025, Core’s native DeFi TVL increased 40% QoQ to 1.1 billion CORE, while it decreased 34% in USD to $531.3 million due to a 53% QoQ CORE price decline to $0.50. Market cap rose 6% QoQ to $981.1 million, reflecting a 3% increase in circulating supply. Network activity declined, with average daily transactions falling 27% QoQ to 402,900, active addresses dropping 25% QoQ to 188,000, and DEX volume decreasing 74% QoQ to $623,400. Total CORE and BTC staked (USD) fell 17% QoQ to $629.1 million, with BTC staked down 15% to 5.500 million and CORE staked up 3% to 175.1 million. The liquid staking rate rose 52% QoQ to 11%, with stCORE supply increasing 57% to $8.6 million.

Core initiated Season 3 of the Sparks Incentive Program on March 12, resetting Sparks (points) and adding new multipliers and application campaigns. Additionally, the Core Commit Program began with a cohort of 10 developer teams working on BTCFi, DeFi, and infrastructure projects. Colend, Pell Network, and BitFLUX led DeFi TVL in Q1. Future developments include adjustments to Dual Staking tiers and the planned LstBTC launch with partners like Maple Finance, alongside ongoing developer support through Core Ventures to increase Core ecosystem and developer activity.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.