and the distribution of digital products.

State of Sonic Q1 2025

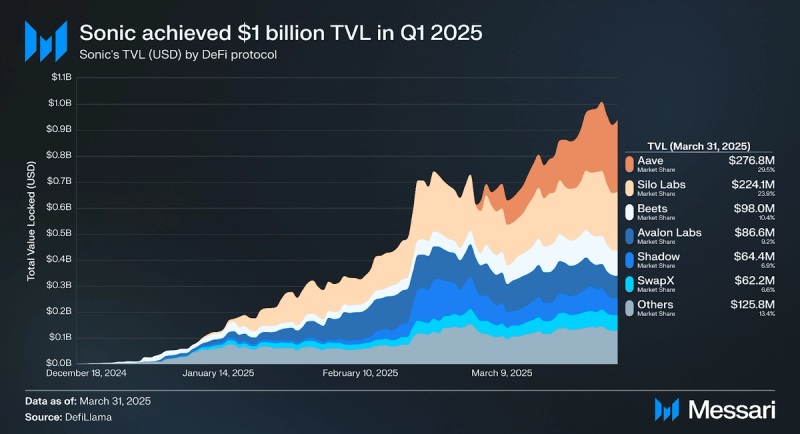

- Sonic's total value locked (TVL) reached $1 billion in Q1 2025, largely fueled by lending protocols. Aave accounted for 29.5% of total TVL, with Silo contributing 23.4%.

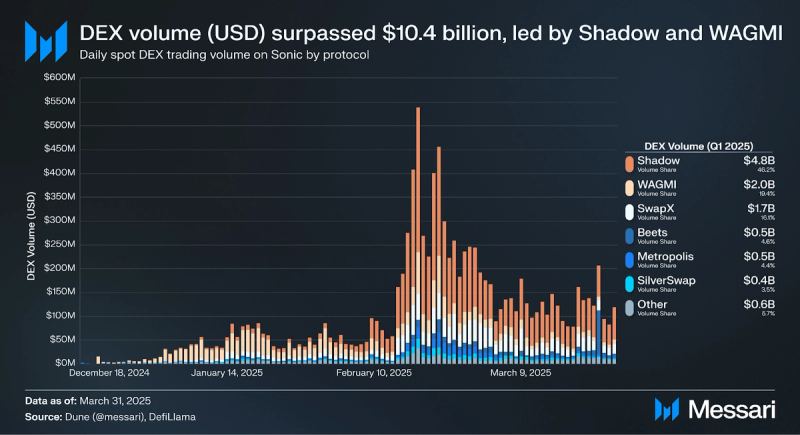

- Sonic-native DEXs led $10.4 billion in trading volume (USD). Shadow Exchange and WAGMI together accounted for 65.6% of total trading activity.

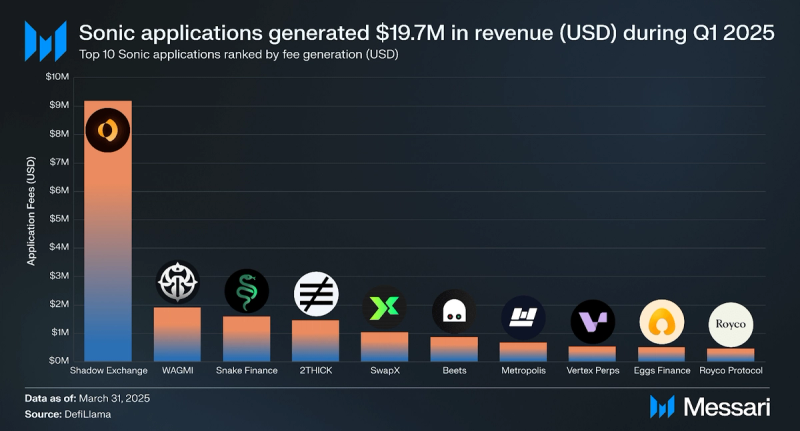

- Sonic surpassed 150 live applications by the end of Q1’25. Total Chain GDP for the quarter reached $19.7 million, led by revenue from Shadow Exchange ($9.2 million) and WAGMI ($1.9 million).

- SonicCS 2.0 aims to double consensus speed and cut memory usage by 68%. The upgrade introduces overlapping elections and vectorized voting to improve performance while maintaining sub-second finality.

- Sonic’s FeeM program gained early adoption, as over 87 applications activated the protocol and earned more than 350,000 S tokens in Q1 (over 1.3 million as of this writing).

Sonic (S) is a general-purpose Layer-1 network designed to be the fastest and most developer-friendly platform for DeFi applications. Sonic launched in December 2024 along with S, its native token. The S token serves functions related to (i) transaction fees, (ii) staking, (iii) incentives, (iv) governance, and (v) an airdrop.

Sonic combines sub-second finality, EVM compatibility, and high-performance infrastructure to support scalable DeFi applications. Built by the creators of Fantom, the team builds on prior experience to deliver faster execution and a supportive environment for builders. Sonic’s incentive design includes a fee monetization model that allows developers to earn up to 90% of the transaction fees their applications generate. The network also introduced a 200 million S Innovator Fund and a matching airdrop to attract new projects and engage users from both Fantom and Sonic.

The Sonic Gateway connects the network to Ethereum. The bridge features a fail-safe mechanism to protect user assets during transfers. With a performance-first architecture and aligned incentives, Sonic aims to provide a durable foundation for long-term DeFi growth. Further details regarding the underlying architecture and specific technical implementations can be found here.

Website / X (Twitter) / Discord

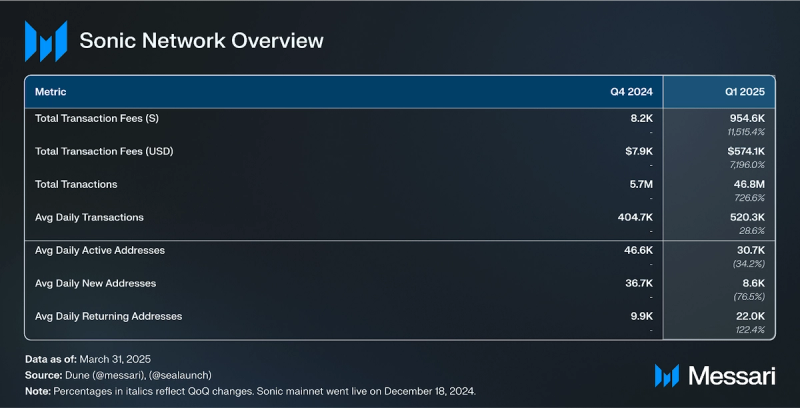

Key Metrics Ecosystem Analysis

Ecosystem Analysis

DeFi

DeFi

DeFi growth on Sonic has been strong since its mainnet launch in December 2024. In Q1 2025, TVL (USD) hit $1 billion followed by Aave’s deployment in March 2025. Meanwhile, TVL (S) grew from 39.6 million to 1.9 billion, a 4,788.1% QoQ increase.

Sonic ended Q1’25 with $937.9 million in TVL, the majority of which is concentrated in lending markets:

- Silo Labs: A borrowing and lending protocol that allows users to create isolated lending markets, or “silos,” with customizable risk parameters. Each market operates on an overcollateralized, peer-to-pool model, where borrowers must lock up more value in collateral than the amount they borrow. After deploying on Sonic in January 2025, Silo ended the quarter with $224.1 million in TVL for a total share of 23.9% of Sonic’s TVL.

- Avalon Labs: A CeDeFi platform that specializes in Bitcoin-backed lending and stablecoin solutions. Its flagship product, USDa, is a collateralized debt position (CDP) that allows users to mint a stablecoin backed by overcollateralized Bitcoin assets. Avalon ended the quarter with a TVL of $29.3 million for a total share of 8.1% of Sonic’s TVL.

Beyond lending and borrowing, Beets, Sonic’s flagship liquid staking protocol, also holds substantial TVL. Beets plays a key role in the network’s staking economy and accounts for $98 million in TVL for a total share of 10.4% of Sonic’s TVL.

DEXs

Sonic experienced significant DEX trading activity in Q1’25. Total DEX volume (USD) during the quarter was $10.4 billion. Sonic’s most active DEXs include:

- Shadow Exchange: A high-performance DEX built natively on Sonic. The platform uses a concentrated liquidity model, which allows liquidity providers to fine-tune their positions and maximize capital efficiency. Shadow also introduces features like x(3,3) incentives, dynamic fees, and MEV-aware mechanisms to enhance user experience. After launching in January 2025, the protocol recorded $4.8 billion in trading volume, representing 46.2% of Sonic’s total DEX activity in Q1’25.

- WAGMI: A DEX designed to optimize liquidity utilization and enhance user experience in DeFi. The protocol introduces GMI, a multi-pool system that aggregates various V3 pools and allows users to earn shared yields across the protocol. WAGMI processed $2 billion in trading volume and accounted for 19.4% Sonic’s total DEX volume in Q1’25.

- SwapX: A DEX on Sonic that leverages Algebra V4 to offer concentrated liquidity pools and modular plugin architecture. The protocol integrates advanced trading features like Orbs, dLIMIT, and dTWAP protocols, which provide users with enhanced order types and execution strategies. SwapX recorded $1.7 billion in trading volume and accounted for 16.1% of total DEX activity on Sonic in Q1’25.

- Metropolis: A trading platform on Sonic that uses the Liquidity Book model to enable zero-slippage swaps and customizable liquidity provisioning. Its Dynamic Liquidity Market Maker (DLMM) lets users target specific price ranges to improve capital efficiency. Metropolis processed $0.5 billion in volume during Q1’25, making up 4.4% of Sonic’s DEX activity.

- SilverSwap: Designed with sustainability in mind, SilverSwap introduces distinct tokenomics and fee mechanics to support long-term protocol health. Its Flare and Snatch auctions let users redirect protocol fees and earn rewards, which adds a gamified layer to DEX participation. In Q1’25, SilverSwap recorded $0.4 billion in trading volume, or 3.5% of total DEX activity on Sonic.

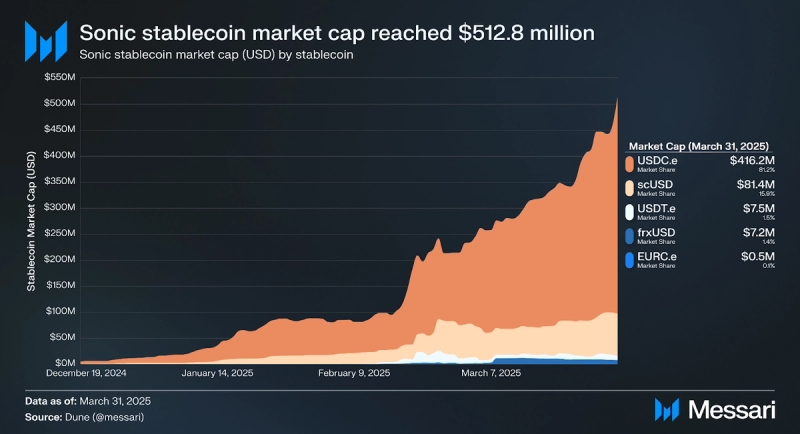

Sonic’s stablecoin market cap surged during Q1 2025. The total market capitalization of stablecoins on Sonic at the end of the quarter was $512.8 million, which was the quarter’s peak. The network’s stablecoin market is dominated by bridged USDC (USDC.e), which contributed a $416.2 million market capitalization and accounted for 81.2% of stablecoins on Sonic. In second was scUSD by Rings Protocol, with a market capitalization of $81.4 million and 15.9% of stablecoins on Sonic. Smaller stablecoins followed: bridged USDT (1.5% market share), frxUSD (1.4% market share), and bridged EURC (0.5% market share).

Rings has emerged as the leading native stablecoin protocol on Sonic. Users can mint scUSD and scETH without fees by depositing ETH or stablecoins. These assets are backed by Veda BoringVaults, which allocate collateral into DeFi strategies on Ethereum to generate yield. Holders can stake or lock scAssets to earn rewards and receive veNFTs, which grant governance rights and control over protocol incentives. Users also benefit from Sonic’s points program, earning up to 8x boosted Sonic Points and a large share of the Sonic Gems through Rings' Emerald Tier status and weekly Rings Point campaigns.

The stablecoin market on Sonic is set to expand further with the arrival of native USDC. In March 2025, Sonic announced upcoming support for native USDC and Circle’s Cross-Chain Transfer Protocol (CCTP) V2. Once live, the upgrade will automatically convert bridged USDC (USDC.e) to native USDC, requiring no user action or contract changes. With CCTP V2, Sonic will join a broader collective of supported networks and enable fast, capital-efficient USDC transfers.

Application Revenue

Applications on Sonic generated significant revenue as a result of strong user activity in Q1’25. During the quarter, Sonic’s Chain GDP, which refers to the total application revenue generated on the network, totaled $19.7 million. In this context, revenue means the total amount users spent to use applications. The leaders by application revenue during the quarter were as follows:

- Shadow Exchange: $9.2 million (50.5% share)

- WAGMI: $1.9 million (10.5% share)

- Snake Finance: $1.6 million (8.8% share)

- 2THICK: $1.5 million (8% share)

- SwapX: $1 million (5.7% share)

Sonic closed Q1 2025 with over 150 live applications deployed across the network. The quarter saw a diverse range of new launches spanning DeFi, payments, infrastructure, gaming, and yield protocols.

- In DeFi and lending, protocols like Aave, Napier, and Euler deployed on Sonic, expanding the network’s lending and credit market depth. Yield-focused platforms such as Royco, Pendle, Gearbox, and Origin also went live, further diversifying earning opportunities on Sonic.

- Payments and fiat integration gained momentum with the arrival of Travala, Sonic Pay (Reddot), and fiat on-ramp support through Alchemy Pay. These additions provide user accessibility and real-world use cases.

- On the infrastructure side, Sonic welcomed several data, tooling, and devops providers including SubQuery, ChainGPT, Chainstack, Safe Wallet, and Infinex. These launches strengthen the backend capabilities available to developers building on the network.

- Sonic’s interoperability stack continued to grow with the integration of bridging and messaging protocols such as Stargate, Relay, and Stable Jack, supporting crosschain connectivity. Meanwhile, consumer and gaming experimentation began to surface, with Abbyss among the first gaming titles to go live.

The breadth of launches demonstrates Sonic’s appeal across verticals and stages, from mature protocols expanding to a new network, to early-stage projects exploring novel use cases.

Financial Analysis

In Q1 2025, the S token migration from FTM was executed at a 1:1 ratio. The process, managed through the MySonic portal, was supported by major exchanges like Binance, Bybit, and Crypto.com. FTM deposits and trading pairs were suspended by Jan. 13, 2025, with S token trading launched on Jan. 16, 2025.

S (formerly FTM) fell from $0.67 to $0.48 in Q1 2025, a 27.7% QoQ drop. Circulating supply rose 11.6% over the same period, from 2.8 billion to 3.2 billion. Despite the higher supply, circulating market capitalization fell 19.3% to $1.5 billion. Still, the token’s circulating market cap rank increased from 61st to 55th, indicating relative outperformance against the broader market.

Network analysis Usage

Usage

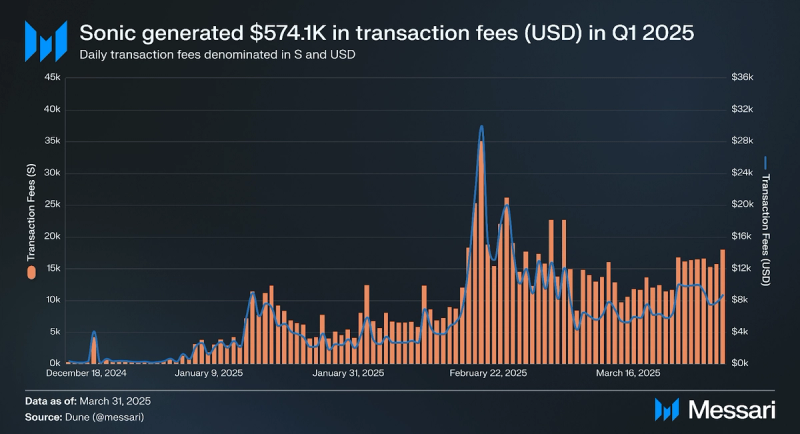

Sonic generated $574,100 in transaction fees during Q1 2025, equivalent to 954,600 S tokens. The network’s fee monetization program (FeeM), which launched on March 12, allows developers to earn a share of the fees generated by applications built on Sonic, up to 90% in some cases. Since launch, more than 87 applications have activated FeeM, collectively earning over 350,000 S tokens (over 1.3 million as of this writing), or approximately $300,000 in dollar terms.

Some applications are using these earnings to support long-term protocol sustainability. For example, Beets integrates FeeM into a governance-controlled quarterly budget system. Half of its FeeM revenue goes toward buybacks of the BEETS token, while the other half is directed to its treasury. Bought-back tokens can then be recycled into future incentive programs. Each quarter, the Beets DAO votes on how to allocate these emissions, enabling flexible adjustments to changing market conditions.

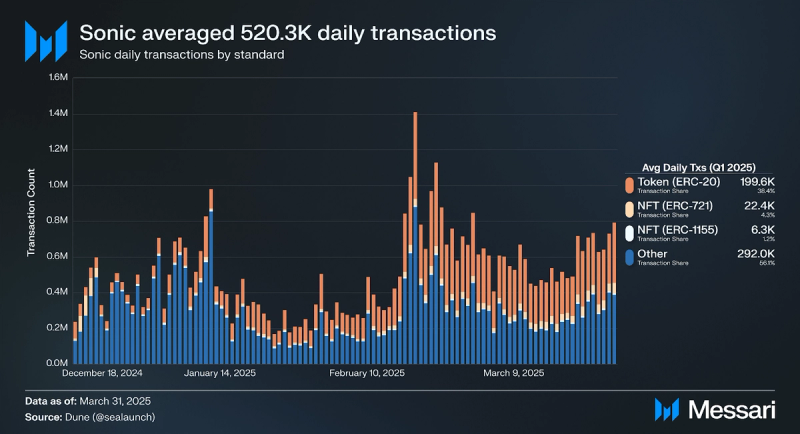

Sonic averaged 520,300 daily transactions in Q1 2025. ERC-20 token transfers accounted for 199,600 per day (38.4%), making up the largest share of identifiable categories. ERC-721 and ERC-1155 NFTs saw 22,400 (4.3%) and 6,300 (1.2%) daily transactions, respectively. The remaining 56.1%, or roughly 292,000 transactions per day, fell into the “Other” category, likely including native S token transfers, smart contract interactions, and unclassified activity. On March 28, 2025, Sonic also recorded a new all-time high for maximum throughput on mainnet, reaching 1,542 transactions per second in a single block.

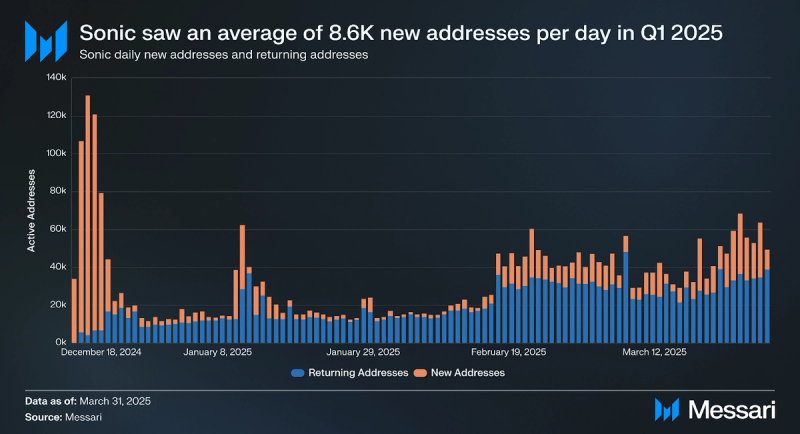

Sonic averaged 30,669 daily active addresses (DAAs) in Q1 2025, consisting of approximately 8,600 new addresses and 22,000 returning addresses per day. The consistent mix of new and repeat users suggests steady user acquisition and retention throughout the quarter. The highest daily activity in Q1’25 occurred on March 27, 2025, when Sonic recorded 68,357 active addresses.

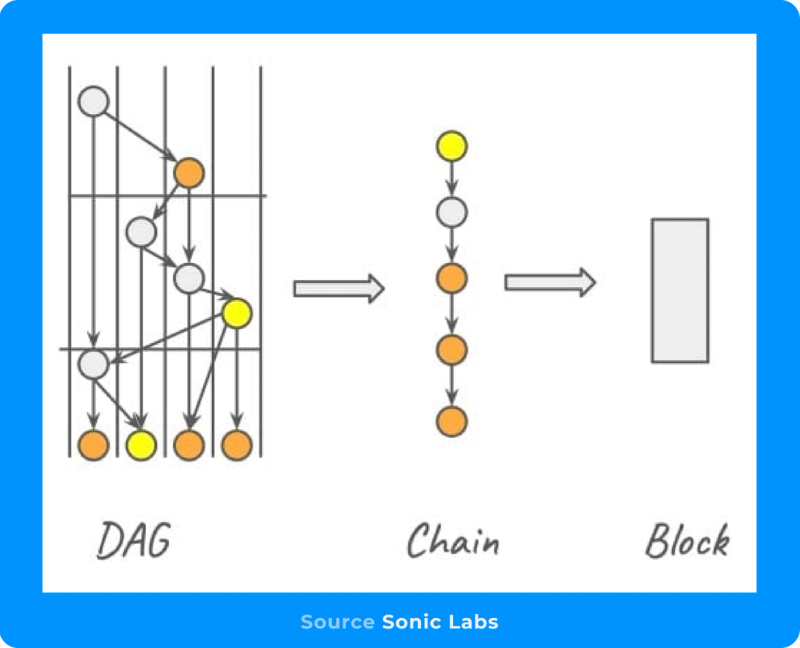

Technical DevelopmentsOn March 27, 2025, Sonic unveiled SonicCS 2.0, a revamped consensus protocol aimed at improving the network’s scalability. The update introduces overlapping elections, a structural change that enables multiple block elections to proceed in parallel rather than sequentially. This adjustment allows validator events to serve multiple roles, such as leader candidates, voters, and aggregators, across different elections. As illustrated in the figure below, overlapping elections create a pipeline-like structure where events contribute to several layers of consensus at once.

SonicCS 2.0 also incorporates a vectorized, matrix-based voting mechanism that replaces the more iterative logic used in SonicCS 1.0. By representing votes and aggregations as compact 0–1 matrices, the protocol can process elections more efficiently, particularly when using modern CPU instruction sets like AVX2. Preliminary benchmarks using 200 epochs of mainnet data show that SonicCS 2.0 delivers an average 2x speedup in block finalization and a 68% reduction in memory usage per epoch compared to the previous version.

Closing SummarySonic’s first full quarter since mainnet launch showed rapid ecosystem expansion, strong user activity, and growing protocol diversity. DeFi TVL reached $1 billion, powered by the arrival of blue-chip protocols like Aave and Silo, while DEX trading volume reached $10.4 billion with Sonic-native platforms leading usage. The launch of the FeeM monetization program created a new revenue path for builders, and the stablecoin market gained depth with both bridged and native assets. Across categories — from infrastructure to payments — over 150 applications are now live. Driven by strong user activity, these applications generated $19.7 million in Chain GDP during Q1 2025.

On the technical side, Sonic announced SonicCS 2.0, a major consensus upgrade planned for future client releases. The update introduces overlapping elections and matrix-based voting to improve scalability and resource efficiency. These developments align with strong network performance during the quarter, including 520,300 average daily transactions and a new throughput high of 1,542 transactions per second. Sonic enters Q2’25 with momentum across adoption, infrastructure, and ecosystem depth.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.