and the distribution of digital products.

State of Venus Q2 2025

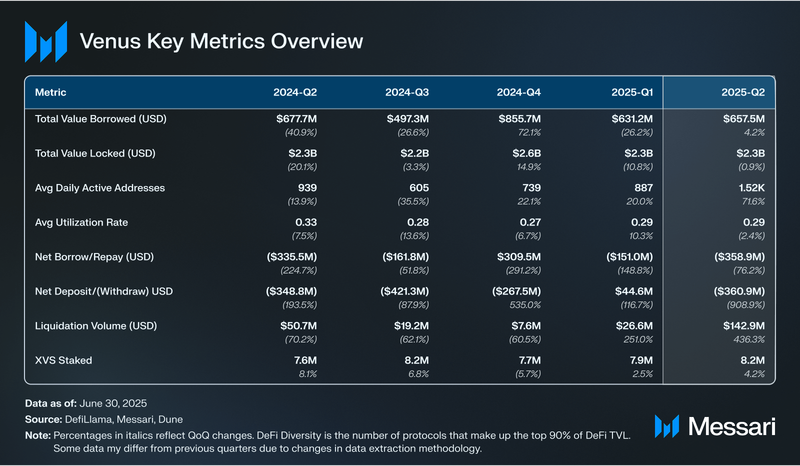

- TVL remained steady at $2.27B as gains in BTC-backed collateral, which rose 25.9%, were offset by declines in BNB and stablecoin positions. Shifting market preferences and new asset listings drove composition changes without affecting total value.

- Borrowing activity increased 9.3% QoQ to $657.6M, led by higher demand for BNB and ETH loans. Despite uneven asset-level trends, this marked a partial recovery in protocol utilization.

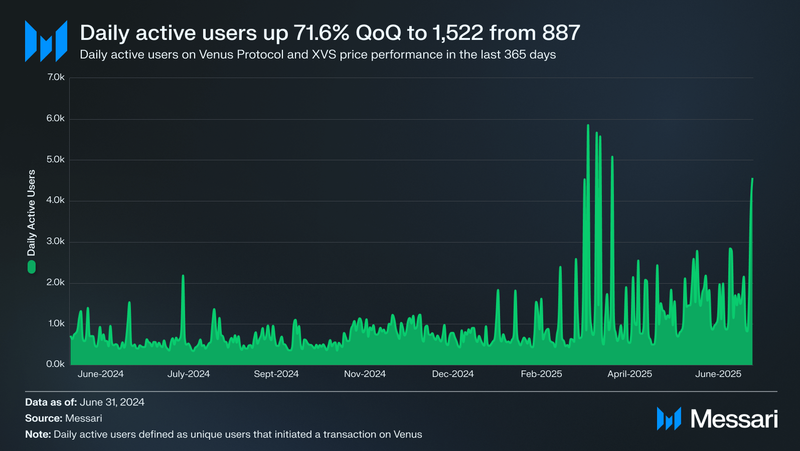

- User engagement surged with DAUs up 71.6% to an average of 1,522. This rise in daily activity reflected stronger ecosystem participation, particularly amid incentives and new collateral integrations.

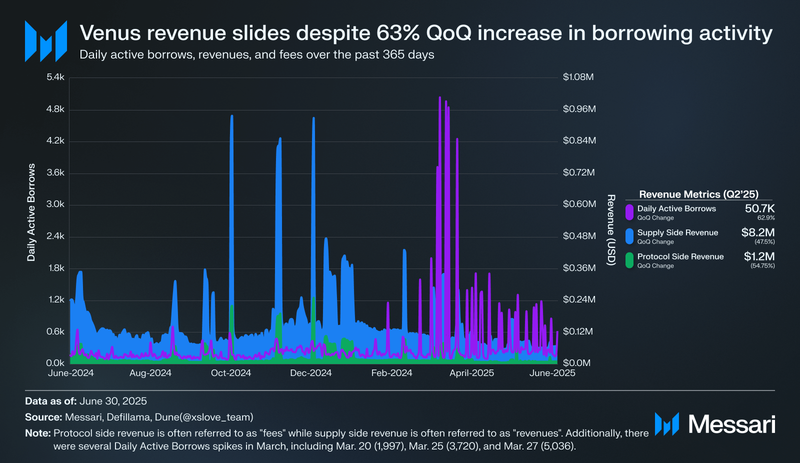

- Protocol-side revenue declined 47.5% to $8.2M, while supply-side revenue fell 54.6% to $1.2M. The revenue contraction occurred despite higher user and borrowing activity, signaling lower effective yield capture per unit of usage.

- Venus Afterburn was approved through VIP 515 to allocate 25% of BNB Chain-based revenue to XVS token burns. This governance-driven mechanism aims to tie protocol performance more directly to long-term supply reduction.

Venus (XVS) is a borrow/lend protocol built originally on BNB Chain, recently launched on Base in Q4 2024, and currently deployed on 8 blockchains. At its core, Venus enables users to deposit various cryptoassets as collateral, allowing them to borrow other assets based on their collateral value. Unlike traditional financial systems, where central authorities manually set interest rates through policy decisions, Venus employs an algorithmic interest rate model that adjusts automatically based on real-time supply and demand dynamics for each asset. The interest rates for borrowing and lending on Venus are dynamically adjusted based on a jump rate model and a whitepaper rate model. These models leverage the utilization ratio, which is the proportion of collateralized deposited assets against the borrowed assets.

The utilization ratio is a critical component of the Venus Protocol. As borrowing demand rises, the ratio and interest rates increase. Conversely, lower demand decreases both, maintaining balance by incentivizing lenders in high demand and borrowers when demand wanes.

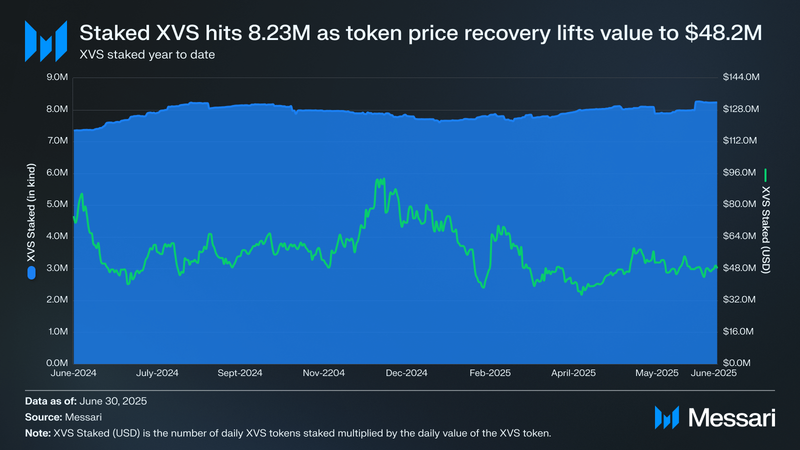

The Venus Protocol is governed by its DAO community and is enabled by the XVS governance token. Tokenholders can propose and vote on governance decisions. Furthermore, they can stake their tokens in a specialized vault to receive financial incentives, following the Venus tokenomics model. This model allocates a portion of the protocol’s revenue to stakers through a buyback and redistribution mechanism, rewarding active participation in governance. For a full primer on Venus, refer to our Initiation of Coverage report.

Website / X (Twitter) / Discord

Key Metrics Performance AnalysisFinancial Overview

Performance AnalysisFinancial Overview Network OverviewTotal Value Locked (TVL)

Network OverviewTotal Value Locked (TVL)Total Value Locked (TVL) represents the total value of assets deposited into Venus Protocol across its supported markets. It serves as a key indicator of the platform’s size, liquidity, and overall user trust.

Venus Protocol ended Q2 2025 with TVL flat QoQ at $2.27 billion, maintaining the same level recorded at the end of Q1. The steady performance reflected offsetting trends across collateral types, with gains in BTC and newer asset categories balancing declines in BNB and stablecoins.

BTC-backed collateral grew 25.9% QoQ to $847.4 million, recovering its position as the largest collateral type. Its share of total TVL rose from 29.6% to 33.7%, though still below Q4’24 levels. BNB fell 27.2% to $479.5 million, reducing its market share from 28.9% to 19.1%, reflecting a shift in user preferences during the quarter.

Stablecoin-backed collateral showed mixed performance. USDT declined 20.2% to $346.4 million, with its share dropping to 13.8%. In contrast, USDC decreased 34.7% to $120.3 million, falling to a 4.8% share of total TVL. ETH rebounded by 17.9% to $104.4 million, recovering some of the ground lost in Q1 and raising its share to 4.2%.

The “Other” category, which includes all collateral assets outside the top five, increased 56.8% QoQ to $372.1 million. This reflects continued adoption of newly integrated tokens and staking derivatives, particularly following asset listings on Unichain and Ethereum.

Overall, Q2 marked a shift in collateral composition and early signs of recovery across the Venus ecosystem, with increased BTC usage and new asset activity offsetting declines in stablecoin and BNB collateral.

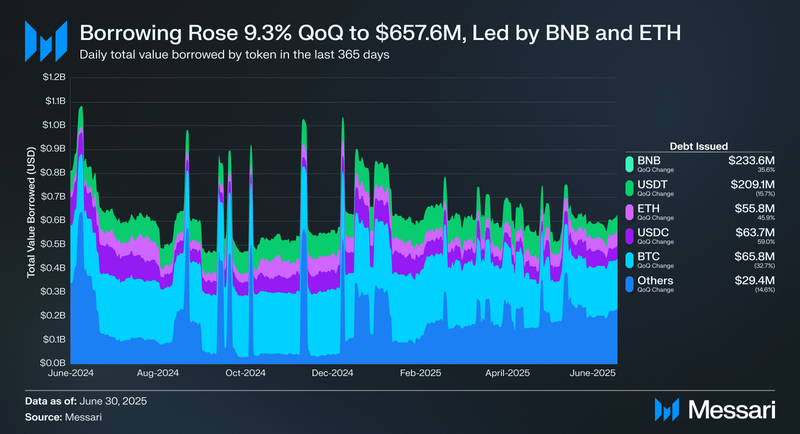

Total Value Borrowed (TVB)Total Value Borrowed (TVB) represents the aggregate value of all assets borrowed from Venus Protocol across its supported markets. It serves as a key metric for evaluating the protocol’s utilization and overall demand for its lending services. Unlike TVL, which measures deposits, TVB reflects the borrowing activity that drives revenue generation and lending efficiency.

Borrowing activity on Venus Protocol slightly rebounded in Q2 2025, with total value borrowed (TVB) increasing 9.3% QoQ to $657.6 million, up from $601.8 million in Q1. The recovery was led by renewed demand for BNB and ETH-backed loans, offsetting continued weakness in BTC and stablecoin borrowing.

BNB borrowing rose 35.6% QoQ to $233.6 million, reclaiming its position as the top borrowed asset and increasing its share of TVB from 27.3% to 35.5%. Despite a 15.7% decline to $209.1 million, USDT remained the second-largest borrowed asset, accounting for 31.8% of total borrowing.

ETH borrowing grew 45.9% to $55.8 million, following a sharp contraction in Q1, and now represents 8.5% of TVB. USDC borrowing saw the strongest relative growth, rising 59.0% QoQ to $63.7 million, lifting its share from 6.4% to 9.7%.

BTC borrowing declined 32.7% to $65.8 million, with its share falling to 10.0%, continuing a trend of reduced leverage demand for volatile assets. The “Other” category contracted by 14.6% to $29.4 million, reflecting ongoing caution among users of less liquid assets.

The rebound in Q2 was uneven across assets, but overall TVB growth suggests improving sentiment and a return of risk appetite in select markets, particularly for BNB and Ethereum-based borrowing.

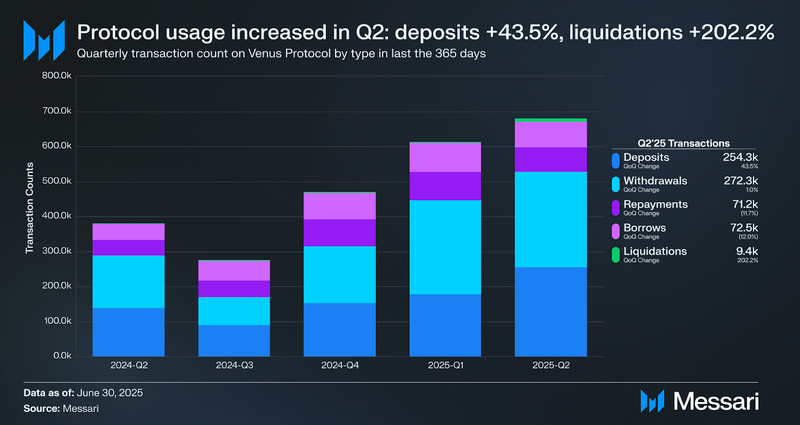

User ActivityUser activity refers to the total volume of user-driven transactions on Venus Protocol, including asset deposits, withdrawals, loan repayments, and new borrows. These activities directly impact metrics like TVL and TVB, offering a clear picture of the protocol’s utilization and user engagement trends.

Despite only a modest increase in total value borrowed, several user activity metrics on Venus Protocol rose significantly in Q2'25, indicating growing engagement across the platform.

- Deposits increased 43.5% QoQ to 254,318, marking continued inflows and renewed user activity.

- Withdrawals rose 1.0% QoQ to 272,300, remaining elevated as users actively managed positions across volatile markets.

- Repayments declined 11.7% to 71,181, in line with reduced borrowing balances and suggesting more conservative debt behavior.

- Borrows decreased 12.0% to 72,533, reflecting lower average loan sizes or reduced leverage appetite.

- Liquidations surged 202.2% to 9,389, coinciding with sharp price fluctuations and forced position unwinds during periods of increased market volatility.

While overall borrowing volumes saw only a partial recovery, the uptick in deposits and persistent user interactions highlight an active user base continuing to adjust to evolving market dynamics.

Daily Active Users

The average daily number of users on Venus Protocol rose to 1,521.8 in Q2’25, up from 886.8 in Q1. This represents a 71.6% QoQ increase and signals a significant rise in user engagement across the protocol, coinciding with broader activity growth and increased adoption of new collateral assets.

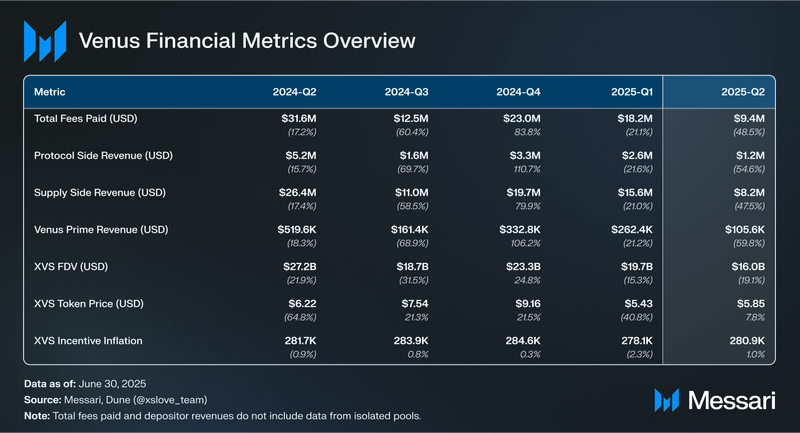

Revenue MetricsIn the context of Venus Protocol, revenue is categorized into two primary types: protocol revenue (often referred to as "fees") and supply-side revenue (commonly referred to as "revenues"). These metrics provide insight into the financial performance of the protocol and its participants.

- Protocol Revenue (Fees): This represents the portion of total revenue retained by the protocol itself. Protocol revenue includes fees collected from borrower interest payments and penalties accrued during liquidations. It is retained to support protocol operations, governance, and treasury reserves.

- Supply-Side Revenue (Revenues): This refers to the revenue earned by users who supply assets to the protocol. Supply-side revenue is generated from interest paid by borrowers and distributed to lenders as compensation for providing liquidity.

Within Venus, interest revenue is the interest paid by borrowers on loans, which is split between supply-side and protocol revenue. Liquidation revenue arises when borrowers fail to maintain the required collateral ratio, triggering liquidations that generate additional funds for the protocol. Liquidation revenue typically contributes entirely to protocol revenue, as it stems from penalties rather than interest payments.

Protocol-side revenue fell 47.5% QoQ, from $15.6 million to $8.2 million, while supply-side revenue declined 54.6%, from $2.6 million to $1.2 million. The disconnect between rising borrowing activity and falling revenue suggests continued shifts in borrow composition, such as lower-interest-rate assets or increased participation in incentivized markets with reduced fee capture.

Staked XVSXVS staking on Venus allows tokenholders to participate in the protocol’s governance and earn rewards. By staking XVS, users gain voting power to influence Venus Improvement Proposals (VIPs), which guide protocol development, treasury management, and risk parameters.

Additionally, staked XVS contributes to the protocol’s buyback and redistribution mechanism, with 20% of the protocol’s revenue allocated to buying back XVS tokens for distribution to vault stakers. This ensures that stakers receive a share of the platform’s earnings while also supporting token demand. Beyond direct rewards, the Venus Prime Program offers additional incentives by providing enhanced APYs and exclusive benefits for long-term participants, further aligning staking with the protocol’s sustainability.

Staked XVS on Venus increased 4.2% QoQ, rising from 7.9 million to 8.23 million in Q2’25. The dollar value of staked XVS also grew 12.4%, reaching $48.2 million, up from $42.88 million in Q1. The increase was driven by a recovery in XVS price, which rose from $5.40 to approximately $5.86 over the quarter. Staking participation remained steady in token terms for the fourth consecutive quarter, suggesting continued engagement with the protocol’s governance and reward mechanisms.

Qualitative AnalysisProtocol UpdatesInfrastructure and Operational ContinuityThroughout Q2 2025, Venus Protocol maintained stable multichain operations across eight supported networks. While no major architectural upgrades or product launches were publicly disclosed during the quarter, the protocol continued to support a diverse range of collateral markets and lending activity through its core pool-based model.

The interest rate mechanism remained governed by utilization-based parameters, adjusting borrowing and lending rates in real time to reflect market demand. Protocol reserves funded by interest payments and liquidation penalties remained in place to mitigate the impact of market volatility and contribute to long-term sustainability.

Venus Vaults continued to play a dual role in incentivizing XVS staking while reinforcing protocol stability through user-aligned participation. As Venus scales its multichain presence, cross-network security, oracle coordination, and interface consistency remain foundational to its ongoing operations.

GovernanceVenus Protocol governance revolves around the XVS token, a BEP-20 token that grants holders voting power to participate in decision-making. Tokenholders can stake XVS on the Venus application to create and vote on Venus Improvement Proposals (VIPs), which guide the protocol’s development and operations. Governance encompasses treasury management, collateral parameters, stablecoin minting fees, and more.

Venus Improvement Proposals (VIPs) serve as the mechanism for implementing changes within the protocol. They are categorized based on their scope, ranging from adjustments to token emissions and liquidity to the introduction of new features and integrations. Each XVS token equals one vote, and decisions require community approval through on-chain voting.

During Q2 2025, governance activity was particularly intense, with more than 20 proposals progressing through the forum, Snapshot, and on-chain VIP stages. These included the integration of a wide range of new assets (such as sUSDe, USDe, PT-sUSDe, USD1, tBTC, xSolvBTC, asBNB, ynETH, cbBTC, WBTC, USD₮0, USDD 2.0, gmWBTC, BR, OGN), new partnerships, reward funding for markets, and technical upgrades such as enhanced oracles and audit retainer renewals. Key proposals also covered new product launches (BNB as Prime Market, BNB Afterburn), hardware wallet integrations (Arculus), and support for cross-chain expansion (Berachain, Unichain, Arbitrum).

Venus Afterburn (VIP 515)On June 17, 2025, Venus Protocol executed VIP 515, launching the Venus Afterburn program. This initiative allocates 25% of the protocol’s BNB Chain revenue to quarterly XVS token burns, with funding sourced entirely from operating income.

The program begins with revenue generated in Q3 2025 and is designed to scale with protocol usage. Increased borrowing activity historically boosts Venus revenue, which in turn raises the budget for future token burns. The initiative includes built-in safeguards. If protocol income declines materially, the community can amend or suspend the program through governance to protect the treasury.

All parameters are subject to periodic review, and the protocol will publish burn-related metrics on an ongoing basis. Venus Afterburn represents a governance-driven approach to supply reduction, directly linking protocol performance to token supply dynamics while preserving flexibility through community oversight.

Partnerships and IntegrationsVenus Protocol expanded its ecosystem through new asset integrations and a partnership focused on smart wallet functionality. These initiatives enhanced user security, increased asset utility, and strengthened protocol accessibility across supported chains.

On May 27, Venus integrated smart wallet support through a partnership with Safe, formerly known as Gnosis Safe. This collaboration enables users to interact with the protocol through smart contract wallets rather than traditional externally owned accounts. By reducing reliance on private key access, the integration offers improved security and risk mitigation, especially for institutional users or organizations managing shared funds. Native multisig capabilities allow for more controlled transaction approvals and offer a flexible architecture for advanced asset management within the Venus platform.

Asset integrations during the quarter focused on expanding productive use cases for Ethereum and Bitcoin holdings. Venus added support for weETH, a restaked variant of Ethereum, and wstETH, a widely adopted liquid staking token issued by Lido Finance. Both assets were launched on Unichain’s Core Pool, allowing users to supply, borrow, and engage in leveraged strategies while retaining exposure to staking yields. These integrations reflect Venus’s continued efforts to align DeFi lending markets with emerging liquid staking and restaking primitives.

Additionally, Venus integrated SolvBTC, a tokenized representation of Bitcoin, enabling users to deposit SolvBTC and borrow USD1 against it. This approach unlocks yield opportunities for BTC holders by converting idle assets into productive capital, bridging Bitcoin with DeFi-native borrowing strategies. The integration demonstrates Venus Protocol’s expanding reach into tokenized yield-bearing assets and its commitment to supporting cross-chain DeFi infrastructure.

Several additional asset proposals and integrations were also completed or approved in Q2, including tBTC (Threshold), asBNB (Aster), PT-sUSDe (Pendle), USD1 (World Liberty Financial), cbBTC (Coinbase), USDD 2.0 (Tron), BR (Bedrock), OGN (Origin), and gmWBTC (GMX). The protocol also announced partnerships with Travala (XVS as a payment option), World Liberty Financial (USD1 integration), and Arculus (hardware wallet support). Technical upgrades included the integration of RedStone OEV for additional liquidation revenue, new market reward programs, and the launch of the BNB Afterburn mechanism.

Onchain Initiatives and Community EngagementVenus Protocol launched several incentive programs aimed at boosting user participation and attracting new capital to the platform. On May 5, the protocol introduced borrow incentives on Unichain, distributing over 30,000 USDC in rewards to USDC borrowers over several rounds of incentive periods in collaboration with Gauntlet. Later in the month, on May 23, Venus implemented USD1 supply incentives via Merkl, providing XVS rewards to early USD1 suppliers. These programs reflect Venus’s evolving strategy of using targeted, time-limited incentives to increase protocol activity and support ecosystem growth.

Closing SummaryVenus Protocol closed Q2 2025 with TVL holding flat at $2.27 billion, as growth in BTC and newer collateral types balanced declines in BNB and stablecoins. Borrowing activity rose modestly to $657.6 million, supported by increased demand for BNB and ETH, while BTC and stablecoin borrowing continued to soften. Daily user activity grew sharply, with DAUs reaching 1,522, up 71.6% QoQ, alongside significant increases in deposits and liquidations. These trends suggest more frequent user interaction despite a conservative lending environment.

Financial performance diverged from usage metrics. Protocol-side revenue dropped 47.5% to $8.2 million, and supply-side revenue fell 54.6% to $1.2 million, pointing to thinner fee margins or shifts in borrowing behavior. Governance remained active, most notably with the launch of Venus Afterburn via VIP 515. Meanwhile, new integrations with Safe, Lido, and SolvProtocol expanded access to smart wallets, LSTs, and tokenized Bitcoin. Together, these developments reflected a growing and engaged user base navigating changing market conditions while the protocol continued expanding its multichain infrastructure.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.