and the distribution of digital products.

State of Boba Network Q1 2025

- Boba Ethereum’s average daily active addresses increased 24.9% QoQ, rising from 317 to 396, while its unique contract callers rose 72% QoQ to 177, reflecting a rebound in developer and user interaction.

- Boba Ethereum emerged as the primary driver of network activity, accounting for 93% of total transactions in Q1 2025—a sharp increase from just 1% a year prior.

- Total revenue declined 68.4% QoQ to $1,624, driven by lower transaction volumes and higher settlement costs on Boba BNB, partially offset by improved fee efficiency on Boba Ethereum following Ethereum’s gas limit increase.

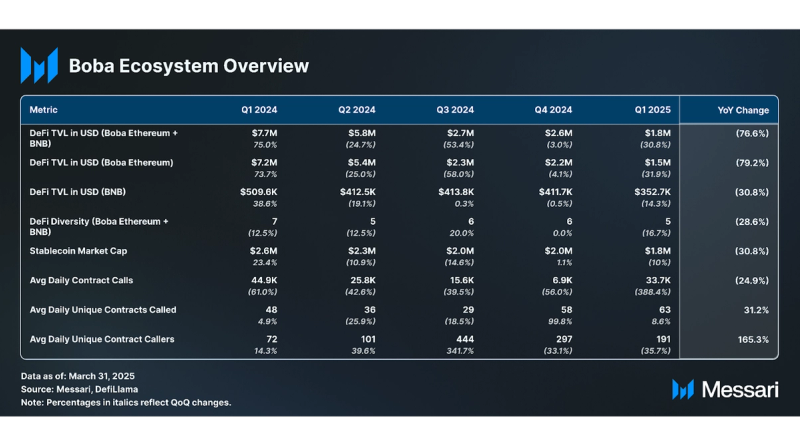

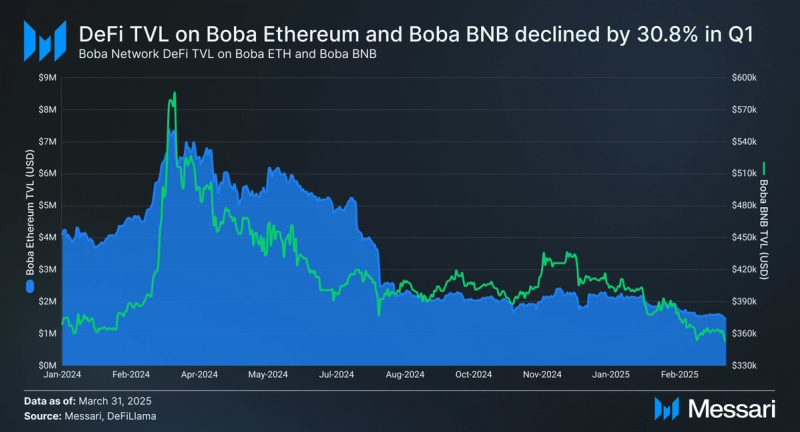

- DeFi TVL across Boba Network fell 30.8% QoQ to $1.8 million; however, smaller protocols and new entrants like Symbiosis and UMA gained share, suggesting early signs of diversification.

Boba Network (BOBA) is a Layer-2 (L2) multichain scaling solution focusing on decentralized finance (DeFi), gaming, AI, and RWA. Boba, which is operated and maintained by Enya Labs, is deployed on both Ethereum (ETH) and BNB Chain (BNB). As an optimistic rollup (OR) based on Optimism’s software development kit (SDK) OP Stack, Boba offers reduced gas fees, increased transaction throughput, L1 security guarantees, and EVM compatibility for smart contracts, such as NFTs and DeFi. Boba Network is also a part of Optimism’s Superchain ecosystem, providing interoperability across L2 networks within the Superchain.

The network also has unique features that set it apart from other ORs and Optimism forks, such as Hybrid Compute, which is the ability to connect to offchain computational resources, data, and APIs. Boba Network also provides a multichain focus and zkRand, a non-interactive distributed verifiable random function (NI-DVRF). Boba’s combination of features, specifically Hybrid Compute, enables decentralized applications (dApps) to run at a fraction of the cost of L1 dApps, leverage offchain computation such as generative AI, and provide the multichain solutions needed for blockchain applications. Boba Network was previously active on Avalanche, Fantom, and Moonbeam, but those implementations have since been deprecated. For a full primer on Boba Network, refer to our Initiation of Coverage report.

Website / X (Twitter) / Telegram

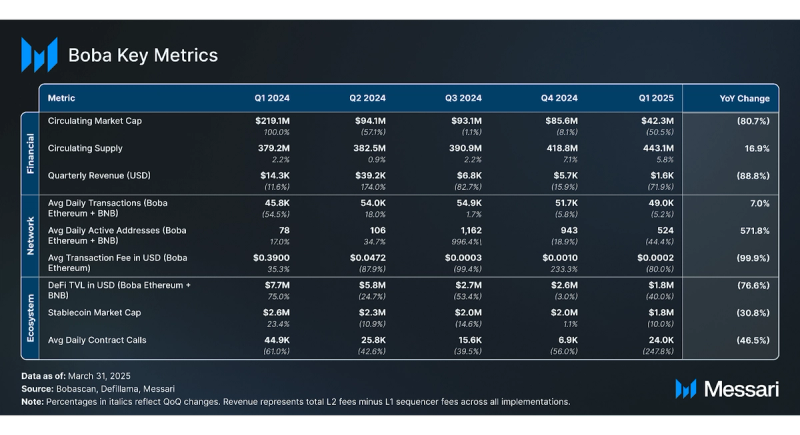

Key Metrics Financial Overview

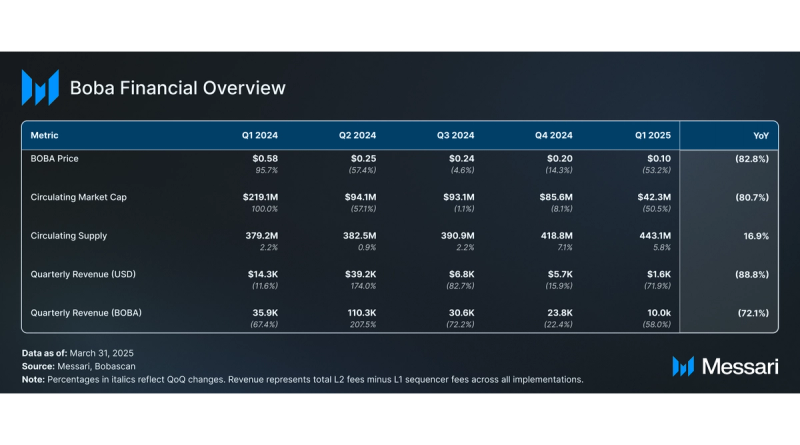

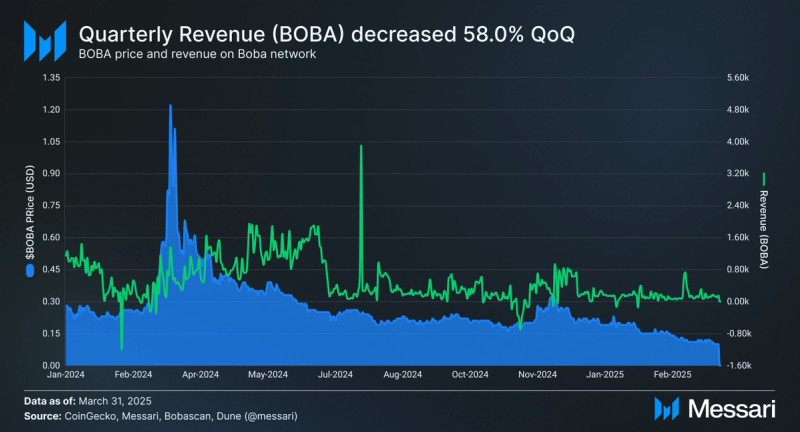

Financial Overview Market Cap and Revenue

Market Cap and Revenue

In Q1 2025, BOBA’s market cap fell 50.5% QoQ from $85.6 million to $42.3 million. As the native asset of Boba Network, BOBA’s primary use cases include settling gas fees, engaging in governance, and invoking Hybrid Compute within smart contracts. BOBA is an ERC-20 on Ethereum, Boba Ethereum, and Boba BNB. BOBA ended Q1 with a circulating supply of 443.1 million. BOBA primarily experiences inflationary pressure due to staking rewards and unlocks from the initial allocation of the 500 million BOBA. Each quarter, 30 million BOBA is unlocked, which will continue until all tokens are unlocked in June 2025.

As a rollup, Boba Network implementations mainly focus on execution while outsourcing other core functions — such as settlement, consensus, and data availability — to their respective Layer-1s (L1s). As such, its revenue is measured as total L2 fees generated minus L1 sequencer fees, respectively, on Boba Ethereum and Ethereum Mainnet or Boba BNB and BNB Chain.

In Q1 2025, Boba Ethereum generated $124 in revenue, marking a recovery from previous quarters that recorded negative revenue due to high L1 settlement costs. The improvement followed Ethereum’s gas limit increase in February, which raised the limit to nearly 32 million units. This adjustment allowed more transactions to be included per block, reducing congestion and lowering average fees on the base layer, thereby improving net revenue for rollups such as Boba Ethereum.

Boba BNB, which settles on BNB Chain for lower settlement costs, saw its revenue fall 71.3% QoQ to $1,500. The decline coincided with a surge in memecoin trading activity on BNB Chain, which led to heightened congestion and elevated settlement costs. As retail interest migrated from Solana to BNB Chain, fueled by new token launches and promotional trading campaigns, network fees spiked, reducing Boba BNB’s ability to capture transaction fee revenue.

Combined, Boba Ethereum and Boba BNB generated $1,624 in revenue, down 68.4% QoQ. Despite its pullback, Boba BNB remained the primary contributor, accounting for 92% of total revenue. The decrease in aggregate revenue reflects a more complex set of drivers. Beyond fee compression and shifting cost dynamics at the chain level, broader market conditions also weighed on outcomes.

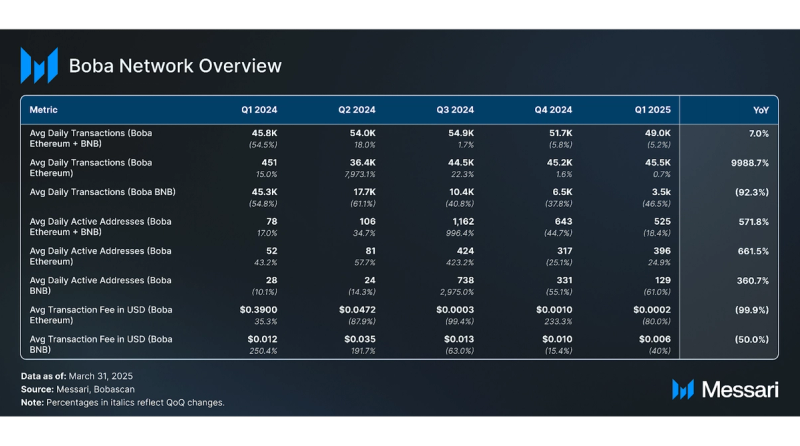

Network Overview Usage

Usage

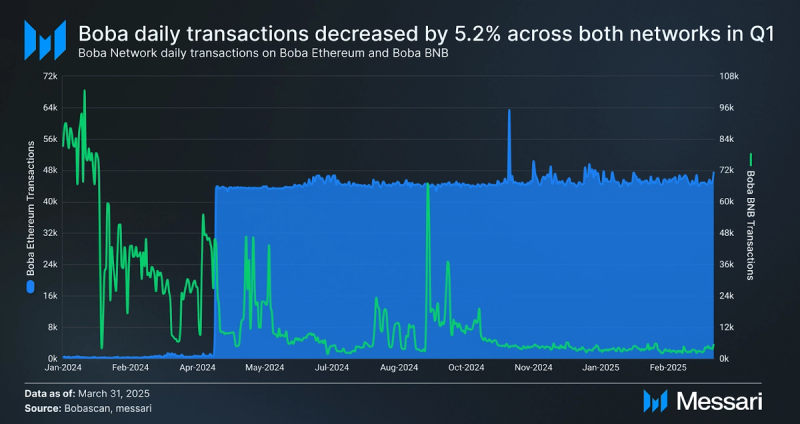

In Q1 2025, average daily transactions combined from Boba Ethereum and Boba BNB declined slightly by 5.2% QoQ, falling from 51.7K to 49.0K. This marked the second consecutive quarterly decrease in total network activity.

A deeper breakdown reveals that Boba Ethereum drove nearly all transaction volume this quarter. Average daily transactions on Boba Ethereum held steady at 45.5K, up slightly from 45.2K in Q4 (+0.7% QoQ), and now represent a dominant 93% of total activity. In contrast, Boba BNB’s daily transactions dropped sharply from 6.5K to 3.5K (–46.5% QoQ), continuing a multi-quarter decline from its peak of 45.3K in Q1 2024.

Over the past year, Boba Network’s activity has shifted sharply toward Boba Ethereum. In Q1 2024, Boba Ethereum accounted for just 1% of total transactions, but by Q1 2025, it made up over 93%. While Boba BNB saw higher usage early on, Boba Ethereum has become the primary driver of activity.

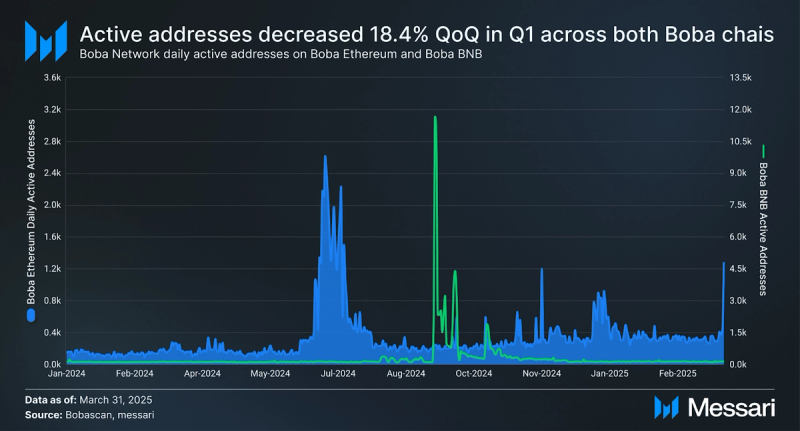

Boba Network’s daily active addresses fell 18.4% QoQ in Q1 2025, decreasing from 643 to 525 across Boba Ethereum and Boba BNB. The drop was driven by Boba BNB, where average daily active addresses declined 61% QoQ. In contrast, Boba Ethereum saw a 24.9% increase in average daily users, rising from 317 to 396. This growth on Boba Ethereum may be partially attributed to the launch of the Boba DeFi Journey campaign, which likely incentivized user participation through quests and yield opportunities.

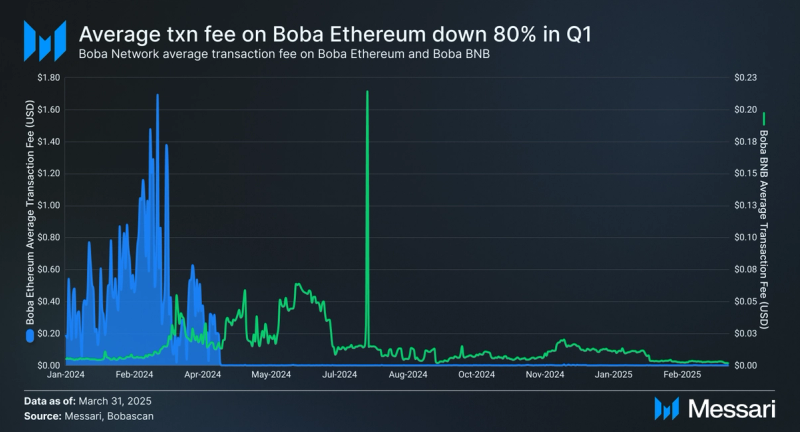

Transaction fees on Boba Ethereum are paid in ETH, while transaction fees on Boba BNB are paid in BOBA. In Q1, the average transaction fee on Boba Ethereum decreased 80% QoQ from $0.0010 to $0.0002, driven in part by a gas limit increase on Ethereum that allowed more transactions per block, reducing per-user costs. This continues a broader trend since the Anchorage update in April 2024, where average Ethereum transaction fees have remained significantly lower. On Boba BNB, the average transaction fee fell 40% QoQ from $0.010 to $0.006.

Technical DevelopmentsThis quarter, Boba Network executed two mainnet updates on Boba Ethereum to maintain infrastructure reliability and prepare for upstream protocol changes. These updates addressed internal configuration improvements and alignment with Ethereum’s upcoming upgrades. Key details for each release are outlined below:

- V1.6.15 – Boba Holocene Upgrade: On February 5, Boba Network successfully completed the Holocene Mainnet Upgrade on Boba Ethereum. This update incorporated the Docusaurus test run, resolved broken documentation links, updated the SystemConfig address, and applied a fix to the FP upgrade. Node operators were advised to upgrade to v1.6.15 ahead of the deployment to ensure compatibility.

- Ethereum Pectra Prep Upgrade: On March 5, Boba Network initiated a scheduled mainnet downtime on Boba Ethereum from 21:00 to 21:30 UTC to support Ethereum’s Layer-1 Pectra upgrade. This maintenance window was part of the network’s preparation for compatibility with Pectra, which merges the Prague (execution layer) and Electra (consensus layer) upgrades. The downtime ensured alignment with upstream protocol changes ahead of broader Ethereum network updates.

These technical updates reflect Boba Network’s continued work to maintain compatibility with evolving Ethereum standards while refining its own infrastructure. Together, they support greater stability, operational readiness, and developer usability across Boba Ethereum.

Ecosystem Overview DeFi

DeFi

This quarter, DeFi total value locked (TVL) for both Boba implementations fell 30.8% QoQ, falling from $2.6 million to $1.8 million. The contraction was led by Boba Ethereum, which saw its TVL drop 31.9% QoQ from $2.2 million to $1.5 million. Boba Ethereum continues to account for the majority of Boba’s TVL, making its performance the dominant driver of network-wide changes. On Boba BNB, TVL decreased by 14.3% QoQ, from $411,700 to $352,700, marking the third consecutive quarter of gradual TVL reduction.

Over a one-year horizon, aggregate DeFi TVL on Boba Network has declined 76.6%, down from $7.7 million in Q1 2024. The majority of outflows came from Boba Ethereum, which lost $5.7 million in TVL over the year. Despite a smaller absolute contribution, Boba BNB’s TVL also fell 30.8% YoY.

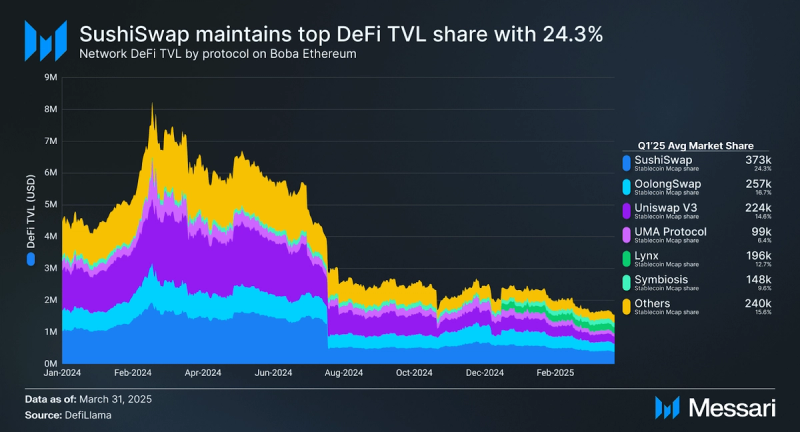

In Q1 2025, the top three protocols on Boba Ethereum remained the same as Q4. SushiSwap, OolongSwap, and Uniswap V3 combined for 55.6% of the total DeFi TVL. SushiSwap maintained its lead with a 24.3% share, followed by OolongSwap at 16.7% and Uniswap V3 at 14.6%.

Note that Uniswap V3’s liquidity pools on Boba Network are accessed through Oku Trade’s front-end, as Uniswap did not deploy its own interface. For consistency, this report will refer to these pools as Uniswap V3.

Compared to Q4, OolongSwap’s share of DeFi TVL declined from 21.1% to 16.7%, reflecting a pullback in usage. Additionally, Symbiosis and UMA Protocol emerged as new entrants in the leading cohort, with market shares rising to 9.6% and 6.4%, respectively.

The “Others” category also expanded notably, growing from 8.6% to 15.6% QoQ. This dispersion of liquidity indicates rising adoption among smaller or emerging protocols, potentially driven by diversification of strategies or early experimentation within Boba’s DeFi ecosystem.

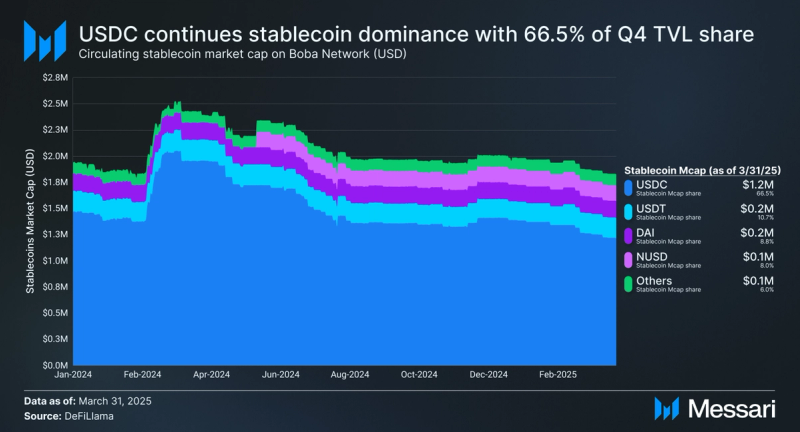

USDC continues to dominate the stablecoin market on Boba Network, accounting for 66.5% of the total stablecoin market cap as of the end of Q1 2025. While its share declined slightly from the previous quarter, it remains the primary stablecoin used across the network. Other leading stablecoins, including USDT, DAI, and NUSD, saw marginal fluctuations, each maintaining a share within 1% of their Q4 levels.

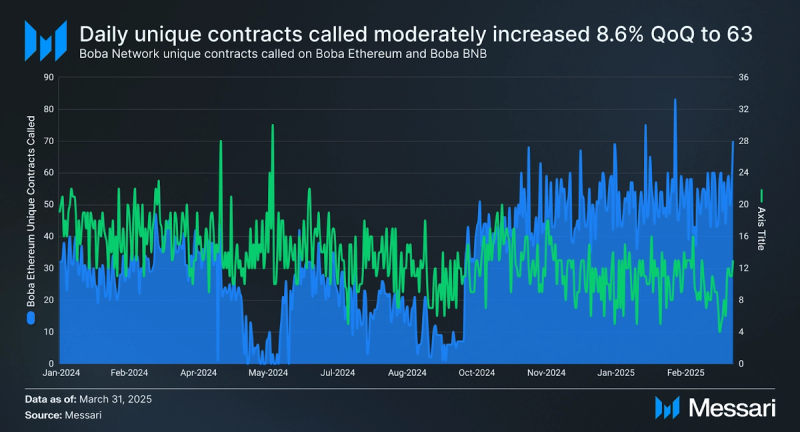

Contract Activity

The average daily unique contract calls for both Boba implementations increased by 8.6% QoQ from 58 to 63. Notably, Boba Ethereum accounted for a larger share of this activity, increasing from 78% in Q4 2024 to 83% in Q1 2025. This shift suggests a growing concentration of developer or dApp interaction on Boba Ethereum relative to Boba BNB, despite the overall network-level increase in unique contract activity.

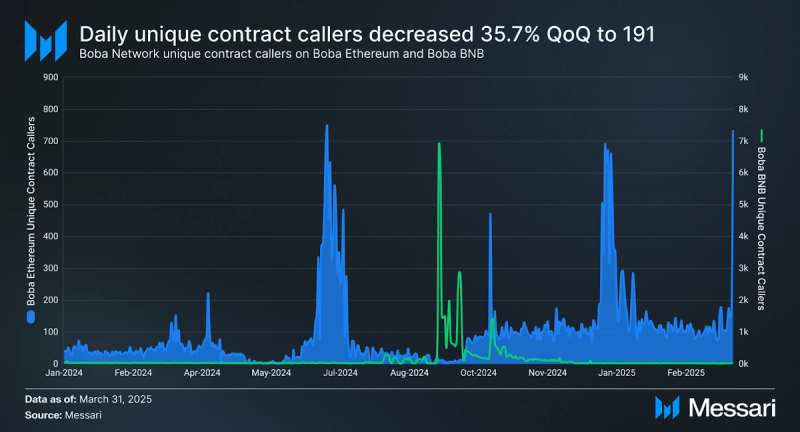

The number of unique contract callers decreased 35.7% QoQ in Q1 2025, falling from 297 to 191. This decline was driven by a sharp drop in Boba BNB activity, where unique contract callers fell 97% QoQ from 425 to just 13. Meanwhile, Boba Ethereum saw a 72% QoQ increase in unique contract callers, rising from 103 to 177—its highest level since Q2 2024.

Growth and DevelopmentGenerative AI Education SeriesFrom January 21 to February 14, Boba Network partnered with Encode Club to host the Generative AI Educate Series, a four-week educational program focused on building AI-powered applications using Boba’s Hybrid Compute infrastructure. The series featured six expert-led workshops covering topics such as large language models (LLMs), smart contract integration, AI-driven chatbots, data transformation, and cybersecurity automation.

The program introduced developers to generative AI concepts while providing hands-on experience implementing AI models within dApps. Boba’s Hybrid Compute played a central role, enabling smart contracts to interact with offchain data and computation in real time. Participants gained exposure to real-world use cases, such as automated content generation, AI-enhanced data processing, and reinforcement learning for cyber defense.

The initiative brought together developers, researchers, and AI practitioners. Through practical training and ecosystem engagement, the series helped expand participants' technical capabilities and supported experimentation with AI-native applications in a Web3 context.

Nucleus DeploymentOn January 22, Nucleus launched on Boba Network, introducing a channel for users to earn Ethereum mainnet yield by bridging ETH, liquid staking tokens (LSTs), or liquid restaking tokens (LRTs) to the network. Nucleus is a cross-chain yield protocol that aggregates staking and restaking rewards from Ethereum and distributes them to users on supported networks.

Once bridged, assets are routed through Nucleus’s smart contracts, enabling yield accrual without additional user actions. This allows users to participate in Boba-based applications while continuing to earn base-layer rewards. The integration also provides developers with modular yield components for building dApps with native reward mechanisms.

Boba DeFi JourneyOn February 1, Boba Network introduced the “Boba DeFi Journey,” a coordinated initiative to deepen DeFi integration and improve capital efficiency across its Layer-2 ecosystems. The program centers around BobaETH, a synthetic asset minted by depositing WETH into Nucleus. Users can deploy BobaETH across multiple platforms: providing liquidity via Teahouse, trading on OkuTrade, lending or borrowing through LendLand, and accessing additional yield opportunities on Lynx.

To incentivize participation, BOBA token rewards are distributed in monthly tranches, starting with BobaETH minting on Nucleus. Future phases will extend incentives to activity on Teahouse, LendLand, OkuTrade, and Lynx. The program aims to bootstrap liquidity, encourage cross-platform usage, and align user incentives with ecosystem growth.

Saproling PartnershipOn February 19, Boba Network partnered with Saproling, a Web3 growth platform focused on onboarding and user education. The collaboration introduces interactive tools aimed at guiding users through Boba’s ecosystem, with a focus on lowering entry barriers for those unfamiliar with DeFi, gaming, and AI-powered applications.

Saproling specializes in gamified learning and contextual education. Through this integration, users are introduced to Boba Network via structured onboarding experiences that include quests, tutorials, and guided exploration. These tools are designed to reduce the complexity typically associated with blockchain onboarding and help users interact with key features of Boba’s infrastructure.

World of Rogues Launch on BobaIn February, Rogues Studio launched World of Rogues on Boba Network, bringing its post-apocalyptic social survival MMORPG to a new audience with blockchain-integrated features. Supported by the Thrive Boba Grant, the game introduced social login for easier onboarding, minting of in-game items directly on Boba, and a new point-based reward system tied to seasonal campaigns and leaderboards.

BrownFi Trading CompetitionOn March 20, BrownFi, a Season One grantee on Boba Network, announced a trading competition to promote its AMM, which features near-zero slippage and a Uniswap V2-style interface. Running from March 1 to April 10, 2025, the competition offered a $2,500 BOBA prize pool and automatically included users who provided liquidity or executed swaps. Top participants were rewarded based on trading volume, transaction count, and liquidity provided, while all eligible users received a commemorative NFT badge.

Pheasant Swap LaunchOn March 21, Pheasant Swap launched on Boba Network, introducing a fast and secure solution for cross-chain asset transfers. Leveraging Boba’s HybridCompute infrastructure, the platform minimizes transfer latency while preserving strong security guarantees for user funds.

Flipside PartnershipOn March 25, Boba Network expanded its DeFi onboarding strategy through a multifaceted partnership with Flipside. The initiative began with a structured quest system designed to guide users through the process of bridging assets into Boba via Nucleus, where they mint BobaETH and engage in a yield-generating loop across staking, liquidity provision, trading, and borrowing protocols. These quests reward participation while introducing users to key components of the Boba DeFi stack.

Beyond quests, the partnership includes a broader DeFi activation strategy and the full integration of Boba Network data into Flipside’s analytics infrastructure. This unlocks real-time access to transaction trends, user behavior, and protocol-level metrics, equipping developers and ecosystem teams with actionable insights to improve product design and liquidity targeting.

FoxWallet IntegrationOn March 26, Boba Network integrated with FoxWallet, introducing native bridging and on-ramping support to simplify access to its multichain Layer-2 ecosystem powered by HybridCompute. Users can enable Boba within the FoxWallet app, switch networks, and initiate swaps directly through the interface.

DappRadar IntegrationOn April 8, DappRadar integrated Boba Network into its platform, allowing users to discover and track dApps built on Boba through individual project pages, network-wide listings, and DeFi rankings. With this integration, DappRadar enables deeper visibility into the Boba ecosystem while inviting developers to list their projects and expand user reach through the World’s Dapp Store.

Closing SummaryThis quarter, Boba Network experienced a shift in network dynamics alongside weaker financial performance. BOBA’s market cap declined 50.5% QoQ to $42.3 million, while Boba Ethereum emerged as the primary driver of usage, accounting for 93% of total transactions. Average daily active addresses on Boba Ethereum rose 24.9% QoQ, supported by ecosystem campaigns and reduced transaction fees following Ethereum’s gas limit increase.

On the technical front, Boba Network implemented two mainnet upgrades on Boba Ethereum: the Holocene Upgrade and the Ethereum Pectra Prep Upgrade. These upgrades focused on infrastructure stability and alignment with upstream protocol changes. Developer activity consolidated around Boba Ethereum, with unique contract callers increasing 72% QoQ and average daily contract calls up 8.6% QoQ across the network. DeFi TVL fell 30.8% QoQ to $1.8 million, extending a multi-quarter decline, though smaller protocols gained traction and USDC remained the dominant stablecoin.

Ecosystem efforts continued through initiatives such as the Boba DeFi Journey and partnerships with Nucleus and Saproling, introducing new yield strategies and onboarding tools. These developments, coupled with increased usage and technical upgrades on Boba Ethereum, provide a foundation for renewed experimentation and sustained network activity in the quarters ahead.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.