and the distribution of digital products.

State of Livepeer Q2 2025

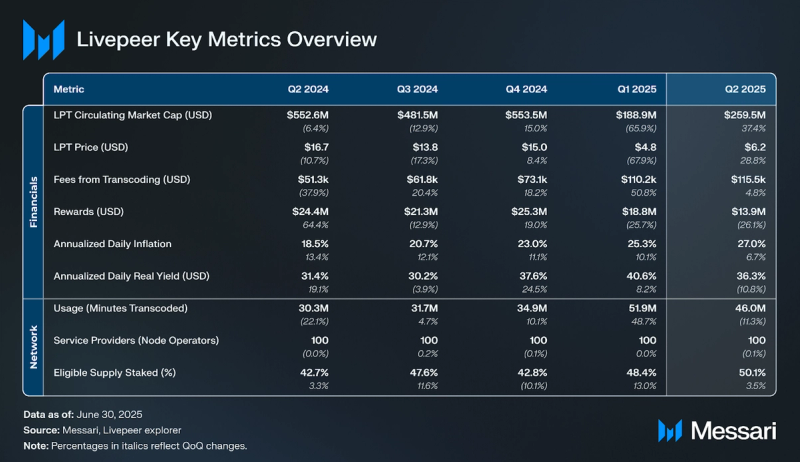

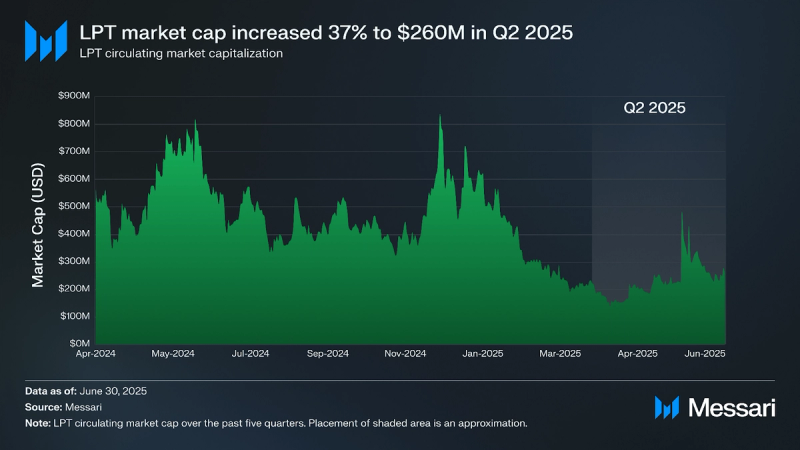

- LPT’s circulating market capitalization grew 37% QoQ, rising from $189 million to $260 million in Q2 2025.

- Demand-side fees rose 5% QoQ to $115,500, despite an 11% decline in total minutes transcoded to 46 million, reflecting a shift toward higher-value, AI-native workloads.

- AI Subnet fees increased 21% QoQ to $63,700, driven by Daydream’s public beta, ComfyStream usage, and developer activations via hackathons and SPE funding.

- Livepeer Foundation launched as a non-profit organization to coordinate decentralized ecosystem growth and guide long-term protocol strategy.

- Staking participation rose from 48.4% to 50.1% of the circulating token supply, crossing the protocol’s target threshold and triggering a potential tapering of inflation in future quarters.

Building decentralized video apps that resemble Twitch or TikTok requires live and on-demand video streaming infrastructure. Based on a user’s bandwidth and device, video content needs to be processed; i.e., transcoded, into viewable formats. While cloud providers like AWS, Google, or Microsoft are commonplace solutions for video transcoding, they incur high costs.

Livepeer (LPT) is an open, permissionless network that provides a decentralized marketplace for video infrastructure, supporting both live and on-demand streaming. Its compute marketplace enables participants to contribute GPU resources for various workloads, including video transcoding and AI-powered video processing. As AI-driven video models demand significantly more GPU compute than text and image generation, Livepeer offers a scalable and cost-efficient solution for video-related compute tasks. The network is designed to lower transcoding costs for end users by up to 10x. Within Livepeer’s decentralized transcoding network, there are three key participants:

- Node operators, called "Orchestrators," route transcoding jobs. The amount of work a node operator can perform is proportional to how many Livepeer native tokens (LPT) it stakes. Node operators earn ETH fees and newly minted LPT rewards.

- Service nodes, called "Transcoders," provide compute resources for node operators and deliver video transcoding. In return, they earn ETH fees. Typically, Orchestrators and Transcoders run within the same machine (combined setup).

- Delegators stake LPT towards effective node operators to help secure the Livepeer network. Staking is rewarded with a portion of both ETH fees and LPT rewards.

Livepeer has also expanded beyond video transcoding by introducing Livepeer AI, a specialized network for AI inference tasks. Livepeer AI supports AI-powered video generation capabilities, including text-to-image, image-to-image, and image-to-video processing. These services cater to use cases in entertainment, social media, and gaming. Livepeer AI is currently in its beta phase and is expected to expand model support and enable broader AI workloads in the future.

Key Metrics Performance Analysis

Performance AnalysisDemand for Livepeer comes from apps and developers needing video transcoding, live-streaming, and video generation capabilities. This includes decentralized social media (DeSoc) applications, Web3-native platforms, and traditional Web2 applications requiring scalable video infrastructure. While platforms like TikTok, Twitch, Spotify, and SoundCloud rely on centralized infrastructure for streaming, similar applications in the Web3 space, such as decentralized video platforms, music streaming apps with tokenized incentives, or NFT-based media platforms, could leverage Livepeer’s decentralized video streaming and transcoding services.

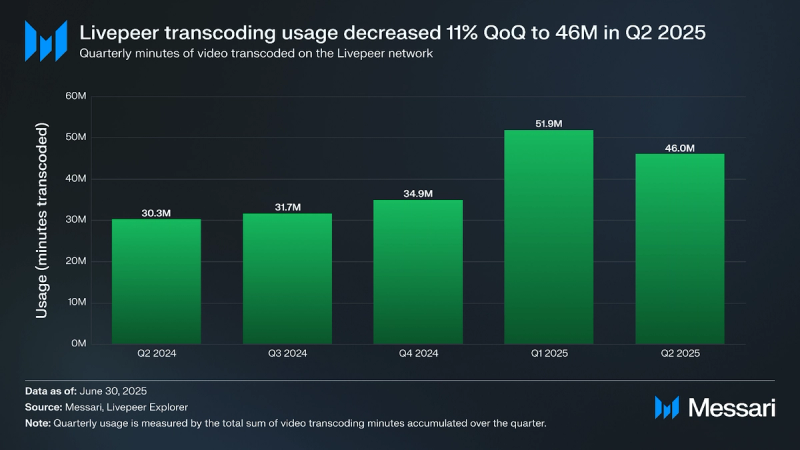

NetworkLivepeer’s network usage can be gauged by estimating the number of minutes of video transcoded.

Livepeer’s transcoding network usage decreased 11% QoQ, falling from 52 million minutes in Q1 2025 to 46 million in Q2 2025. This drop is likely due to a shift in usage from traditional long-form video transcoding to real-time AI workloads such as Daydream and ComfyStream, which emphasize low-latency inference and prompt-based rendering rather than continuous video processing. While these workloads are more compute-intensive, they result in fewer aggregate minutes processed. As Livepeer expands into AI-native workloads, traditional usage metrics like minutes transcoded may become less representative of total compute demand.

Fees from TranscodingServices using the Livepeer network pay demand-side fees in ETH to access video transcoding and AI-powered processing tasks. Node operators (orchestrators) earn these fees for processing video and distribute a portion to their delegators based on their fee-sharing structure. The likelihood of receiving transcoding work is influenced by stake weight; orchestrators with higher stake are prioritized for more work, leading to greater earnings in transcoding fees. This system incentivizes both node operators and delegators, reinforcing network participation and security.

Livepeer’s demand-side fees from transcoding increased by 5% QoQ, from $110,000 in Q1 2025 to $115,500 in Q2 2025, despite an 11% drop in usage (from 52 million to 46 million minutes). Since fees are paid in ETH, the revenue increase was primarily driven by an approximately 36% rise in ETH’s price over the quarter. Additionally, the divergence between usage and revenue likely reflects a shift toward higher-value workloads, such as real-time AI video remixing and prompt-based effects, which command greater fees per unit of compute. As a result, even with fewer aggregate minutes processed, overall fee generation increased.

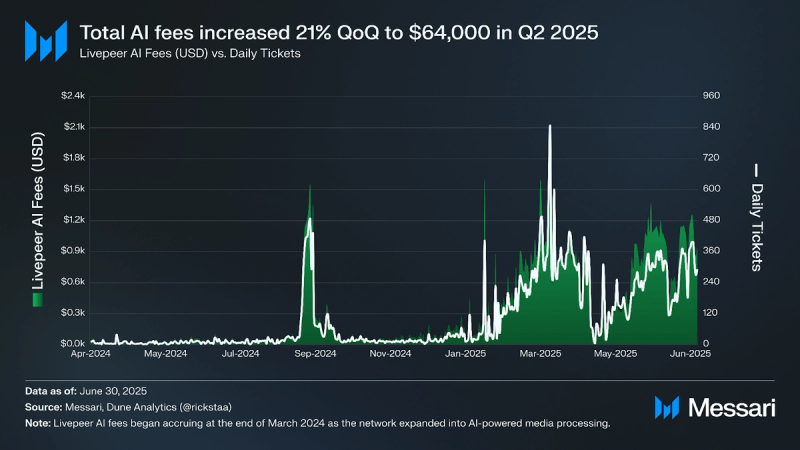

Fees from Livepeer AIIn Q2 2025, Livepeer continued expanding its role beyond video transcoding through ongoing development of Livepeer AI, which launched in Q3 2024 to support decentralized AI-powered video generation. This progress included the refinement of Cascade, a real-time AI video processing pipeline introduced in late 2024. Cascade enables applications such as automated video agents, live analytics, and interactive overlays by orchestrating GPU resources for continuous media workflows. These developments further positioned Livepeer as a decentralized media compute provider, extending its infrastructure to support emerging AI-driven video use cases.

A total of 20,351 winning tickets were processed during Q2 2025, up 17% from 17,434 in Q1, while the average fee per ticket remained stable, increasing slightly from $3.02 to $3.13.

AI workloads accounted for over 55% of total protocol fee revenue in Q2, up from 48% in Q1, signaling a continued shift in network usage toward compute-intensive, short-form video tasks. This growing demand coincided with the launch of Daydream’s public beta on May 12, which enabled real-time prompt-based video effects and avatar transformations, and the "Live Video AI Meets Fashion" hackathon co-hosted with ChatandBuild between May 27 and June 10. These initiatives encouraged developers to experiment with Livepeer’s GPU-backed infrastructure and ComfyUI workflows, driving increased adoption of AI-native media applications. As orchestrators onboarded to the AI Subnet and creators leveraged new tooling, the protocol saw consistent growth in AI-related compute activity through the end of June.

Staking RewardsThe Livepeer network distributes staking rewards in LPT to node operators and delegators. To provide video services on the Livepeer network, node operators must stake LPT. A node operator’s stake weight comprises their own tokens and tokens they were delegated.

In Q2 2025, total staking rewards declined by 26% QoQ, falling from approximately $19 million in Q1 to $14 million, marking the second consecutive quarter of contraction in USD-denominated rewards. Unlike Q1, where the decline was driven by LPT’s price decrease, the Q2 decline occurred despite a 29% rebound in LPT price, which rose from $4.81 to $6.19. This suggests that lower reward output was driven by a slowdown in token emissions or a smaller inflationary reward pool, even as market conditions improved.

Protocol-level metrics underscore this divergence. Annualized daily inflation increased slightly from 25% to 27%, continuing a four-quarter upward trend, while real yield (USD) declined from 41% to 36%. The increase in inflation and token price was not sufficient to counteract the fall in aggregate rewards, pointing to growing competition for a relatively fixed emission pool.

This trend highlights structural dynamics in Livepeer’s staking economy: as staking participation rises and inflation stabilizes near its upper bound, per-staker yields may remain under pressure unless protocol revenue increases meaningfully or inflation adjusts further.

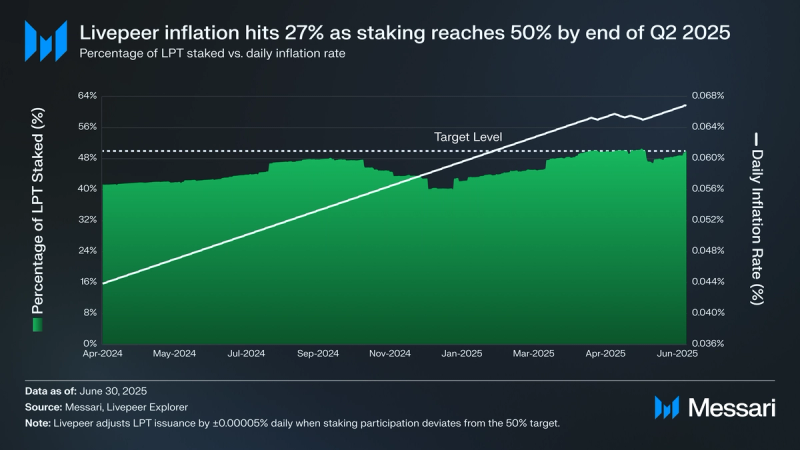

Staking ParticipationThe Livepeer Token (LTP) operates under a Stake-for-Access (SFA) model, requiring node operators to stake LPT to perform work on the network. Over the past seven quarters, staking participation, the percentage of circulating LPT supply that is staked, has remained below the 50% target level. Additionally, the number of delegators has declined, decreasing from 3,332 in Q2 2024 to 2,845 in Q2 2025, reflecting a contraction in the number of active participants helping to secure the network.

In Q2 2025, staking participation increased from 48.4% to 50.1%, marking the first time the network crossed the 50% target threshold since the launch of the Streamflow upgrade. This shift signals renewed validator and delegator engagement, potentially influenced by the protocol’s dynamic inflation model, which increases issuance when staking falls below 50% and tapers issuance when the threshold is exceeded. Because staking remained below the 50% target for most of the quarter, the protocol’s inflation rate rose incrementally throughout Q2.

Livepeer’s daily inflation rate increased from 0.0593% in Q1 to 0.0643% in Q2, corresponding to an annualized inflation rate of 25% to 27%. This continued a four-quarter upward trend in issuance, reinforcing staking incentives to encourage broader network participation. However, as staking surpassed the 50% threshold near the end of Q2, the inflation rate may begin to decrease in Q3 if elevated participation levels are sustained.

Real yield in USD terms also fell, declining from 41% to 36%, indicating that increases in inflation and token price were not sufficient to offset the shrinking reward pool.

These dynamics underscore structural tensions in Livepeer’s staking economy. While inflation incentivizes participation, a decoupling between staking rewards and actual network usage persists.

Prior research has shown that the top five Orchestrators by stake captured 40–50% of total staking rewards but only ~20% of transcoding fees, highlighting an inefficiency in aligning stake weight with real workload execution. Additionally, the 11% drop in overall network usage during the quarter further limited fee-based revenue, placing more pressure on inflation-driven incentives. Without meaningful increases in protocol usage or changes to the reward allocation model, per-staker yields are likely to remain compressed, even if staking participation continues to grow.

Market Capitalization

LPT’s circulating market capitalization increased by 37% QoQ, rising from $189 million in Q1 2025 to $260 million in Q2 2025. This growth was driven primarily by a 29% increase in token price, with LPT rising from $4.81 to $6.19 over the quarter.

Qualitative AnalysisPartnerships and Ecosystem ExpansionsLaunch of Livepeer Foundation: In Q2 2025, the Livepeer Foundation (LF) was formally launched as a neutral, non-profit entity designed to coordinate the next phase of growth and decentralization across the Livepeer ecosystem. The Foundation serves as a lightweight, purpose-built vehicle for ecosystem participation, with a focus on long-term strategy, core network development, and contributor onboarding. Its mandate is to help guide the protocol’s evolution into a performant, secure, and accountable infrastructure network, while fostering a broad ecosystem of applications, gateway operators, and builders. As part of its early initiatives, the Foundation plans to publish a synthesis of current ecosystem priorities, accompanied by a long-term project roadmap and a public strategy hub to guide contributors and communicate the network’s direction.

Advisory Boards and Community Survey: Based on community survey feedback, Livepeer Foundation launched four advisory boards in late June: Growth, Governance, Markets, and Network. The boards, composed of contributors from Livepeer Inc., the Foundation, and stakeholders, were established to help shape protocol priorities and long-term direction. Each board completed an initial strategic guidance phase in Q2 and submitted preliminary guidance to inform future roadmap development.

ComfyStream Integration: Following its initial integration in Q1, ComfyStream became a core component of Livepeer’s AI video infrastructure in Q2 2025. Built on ComfyUI, ComfyStream enables real-time video transformation through modular workflows and low-latency inference. In Q2, it was further advanced through its use in the Daydream product, powering live, prompt-based video effects. ComfyStream also served as the technical foundation for the AI Video SPE Stage 4, which secured funding to scale real-time AI pipelines and productionize Bring Your Own Container (BYOC) deployment. By enabling complex workloads such as avatar rendering and generative overlays, ComfyStream established itself as a foundational component of Livepeer’s shift toward developer-controlled, AI-driven video infrastructure.

ChatandBuild Integration: Following their initial integration in March 2025, Livepeer and ChatandBuild co-hosted a no-code hackathon titled “Live Video AI Meets Fashion” on May 27, 2025. The event highlighted their collaboration by inviting participants to build real-time livestream applications using Livepeer’s GPU-backed infrastructure and ComfyUI pipelines. Focus areas included AI-generated overlays, interactive creator tools, and Web3-native streaming interfaces. The hackathon emphasized accessibility through prompt-based design and no-code workflows. Prizes such as a $300 Vestiaire Collective gift card encouraged hands-on experimentation with real-time AI video tools.

Retake.tv Launch: On June 28, 2025, Retake.tv, a livestreaming platform built on Livepeer, launched publicly as a testbed for creator monetization. The platform introduces features such as multi-token tipping, token-gated livestreams with trade-based rewards, and the ability to launch new tokens during broadcasts. Retake.tv exemplifies an experimental monetization model aligned with the decentralized media thesis and reflects Livepeer’s growing adoption in creator-first streaming applications.

UFO Integrations: In Q2 2025, Livepeer deepened its collaboration with UFO Club as the platform advanced its onchain radio initiative. Using Livepeer’s video infrastructure, UFO Club expanded decentralized broadcasting capabilities and introduced new creator incentive programs.

Product and Infrastructure UpdatesDaydream’s Beta Expansion: Following its initial launch on February 28, 2025, Daydream evolved throughout Q2 into a more robust and interactive tool for real-time video manipulation. Initially introduced as a creator-facing application that enabled users to apply visual effects using natural language prompts, Daydream was designed to expand access to Livepeer’s AI infrastructure without requiring technical expertise. It allowed streamers and creators to generate dynamic overlays, stylized visuals, and avatar-based transformations from webcam inputs with minimal latency.

On May 12, 2025, Daydream entered public beta. Built on top of ComfyStream and powered by Livepeer’s GPU subnet, the platform supported prompt-based remixing workflows, generative video overlays, and avatar embodiment. Q2 updates introduced features such as trending prompt discovery, access to previously generated clips, and a continuous live DJ stream that encouraged real-time audience interaction. The Daydream team also leveraged the product as a testbed for AI-native UX design, using tools like ChatGPT’s Data Analyst to analyze prompt composition and user behavior, guiding future interface enhancements.

Advanced Sidestream Proposal: A technical proposal titled “Advanced Sidestream” was introduced by the protocol team to enhance throughput and data resiliency across the network. This proposal outlines architectural improvements for optimizing the delivery of AI-powered video streams, reflecting growing technical requirements of real-time video workloads.

Infrastructure Upgrades by Orchestrators: Several orchestrators expanded their hardware capabilities to support GPU-intensive workloads. Notably, lpt-gzp-node.eth joined the Daydream subnet after upgrading to an RTX 4090, while Stronk Orchestrator surpassed 800k LPT in delegated stake and reduced its reward cut to 11%, signaling growing network alignment and competitiveness.

Community Engagement and Events"Beyond The Stream" Event Series: On June 26, 2025, Livepeer launched “Beyond The Stream,” a biweekly discussion series featuring ecosystem contributors from Streamplace, Livepeer Inc., and the AI SPE team. The series focused on infrastructure scaling, AI SPE adoption, and decentralized video strategies.

EthCC 2025 and AIAgentsSummit Demos: On July 1, Livepeer showcased real-time AI video workflows at EthCC 2025, and demoed Daydream and ComfyUI integrations. Earlier, on June 19 at the AI Agents Summit, Titan Node presented a live VTuber agent powered by real-time AI video inference.

Fireside Broadcasts and Creator Sessions: Throughout Q2, Livepeer hosted several Fireside sessions covering topics such as gateway infrastructure (GWID), monetization strategies for AI streaming, and VTuber tooling.

Open Ecosystem Call and Treasury Talk: On May 6 and June 6, Livepeer held treasury and ecosystem calls to update contributors on governance activity, roadmap planning, and treasury policy. The Treasury Talk confirmed the treasury had reached its 750,000 LPT cap, halting further inflationary distribution.

Capitol Hill Advocacy and Sector Recognition: In May, Livepeer co-founder Doug Petkanics joined Capitol Hill discussions alongside Akash, Bittensor, and DCG to advocate for decentralized AI infrastructure. That same month, Livepeer was added to Grayscale’s AI Crypto Index, signaling growing industry recognition of its role in real-time, open-source AI networks.

GovernanceAI Video SPE Stage 4 and the Launch of BYOC: On June 20, 2025, the Livepeer community approved a governance proposal allocating 56,560 LPT to fund the fourth phase of the AI Video Special Purpose Entity (SPE). Building on three previously funded stages, Stage 4 aimed to expand Livepeer’s infrastructure for real-time AI media processing through two major initiatives: continued development of ComfyStream and the launch of the Bring Your Own Container (BYOC) deployment model.

The BYOC framework, formally launched on June 30, 2025, allows external developers to deploy custom AI containers within Livepeer’s compute environment. Key Q2 deliverables included onboarding orchestrators to the GPU AI stack, publishing a BYOC RFC and development roadmap, and releasing new data-channel models for tasks such as transcription and video intelligence. These developments reinforced Livepeer’s strategic push to become a foundational infrastructure layer for decentralized, AI-native video applications, while expanding monetization opportunities for node operators.

Gateway Wizard SPE Governance Proposal: On May 25, 2025, the Livepeer community approved a 6,600 LPT grant to launch the Gateway Wizard (GWID) SPE, a managed DevOps platform that simplifies gateway deployment and monetization for builders in the Livepeer ecosystem. This initiative addresses gaps in onboarding, monetization, and documentation by enabling one-click gateway setup, customizable paywalls, and pricing dashboards. It also aims to revitalize Livepeer’s Catalyst “gateway-in-a-box” framework by decluttering documentation and supporting modular gateway infrastructure. Future deliverables include launching a public gateway directory, implementing referral and free credits systems, and enabling demand-side gateway monetization. The proposal is part of a broader effort to decentralize infrastructure provisioning and empower more participants to spin up custom gateway nodes with business-model flexibility.

Streamplace 2.0 Governance Proposal: On April 26, 2025, the Streamplace team secured 100,000 LPT in treasury funding to continue developing its decentralized livestreaming infrastructure for social applications. Originally known as Aquareum, Streamplace operates a full-stack video platform with a custom WebRTC-based livestreaming engine, mobile and desktop apps, and native Livepeer transcoding integration. In Q2, the team announced a high-profile partnership with Skylight Social, a Mark Cuban-backed TikTok alternative, to deliver livestreaming to over 150,000 users. The funds will support infrastructure scaling, video-on-demand (VOD) feature development, SDK releases, moderation tooling, and creator monetization mechanisms. By positioning itself as the livestreaming layer for decentralized social protocols like AT Protocol, Streamplace reinforces Livepeer’s presence in consumer-facing video use cases and establishes an open-source foundation for future composable media apps.

Agent SPE – Phase 2 Governance Proposal: On April 15, 2025, the Agent SPE received 30,000 LPT in funding to develop the next iteration of its AI VTuber and autonomous agent infrastructure on Livepeer. Building on the success of its initial phase, the team’s roadmap for Q2 and beyond includes launching customizable 3D Metahuman avatars, integrating wallet and governance logic via ElizaOS, and streamlining creator onboarding. The proposal highlights a future vision where intelligent agents conduct live interactions, autonomously monetize content, and interface with decentralized infrastructure. In this phase, the SPE will also offer incentive programs for developers and creators, explore protocol partnerships, and expand to multi-platform deployment. The initiative positions Livepeer as a critical backend for emerging use cases in AI-driven streaming and virtual commerce, with autonomous agents acting as novel contributors to network demand.

FrameWorks SPE Pilot Governance Proposal: On April 2, 2025, the community approved a 15,000 LPT pilot proposal to fund the FrameWorks SPE, led by the MistServer team. The initiative focuses on enhancing the protocol’s transcoding performance, offering stability improvements, hardware support, and onboarding tools for Gateway and Orchestrator operators. Q2 objectives included integrating AV1 and Intel QSV support, implementing smarter GPU load balancing, and improving Gateway documentation. The SPE also launched a community bounty board to incentivize core contributions. By bridging the DevOps gap between Livepeer’s infrastructure and media application developers, FrameWorks aims to reduce complexity, support independent deployments, and accelerate the development of real-world streaming use cases powered by the network. If successful, the team plans to expand efforts into a full-service, modular E2E media pipeline.

LiveInfra SPE Governance Proposal: On July 6, 2025, a proposal to fund the LiveInfra SPE with 7,150 LPT passed with overwhelming support from the community. This initiative supports the continued operation and enhancement of the Community Arbitrum Node, a public good that provides free, authenticated RPC access to Arbitrum for Livepeer builders. With these funds, the team aims to upgrade infrastructure, reduce downtime through real-time health checks and failover mechanisms, and expand RPC support to Ethereum L1. The SPE also maintains and enhances the RPC Balancer, an open-source tool that allows users to route requests across multiple providers. This quarter’s funding covers operational costs and engineering work through Q3 2025, with future treasury proposals planned on a quarterly cadence to ensure sustainability, performance monitoring, and community oversight.

Closing SummaryIn Q2 2025, Livepeer expanded its focus on AI-powered video infrastructure, even as traditional network usage declined. Total transcoded minutes fell 11% QoQ to 46 million, but demand-side fees rose 5% to $115,500, driven by higher-value workloads and a 36% increase in the price of ETH.

AI-related activity generated $63,700 in revenue, accounting for over 55% of total protocol fees, up from 48% in Q1. Growth was fueled by the public beta of Daydream, increased use of ComfyStream, and developer initiatives like the “Live Video AI Meets Fashion” hackathon. Ticket volume rose 17% QoQ to 20,351, while average fee per ticket held steady at $3.13.

Staking participation rose from 48.4% to 50.1%. This coincided with a rise in annualized inflation from 25% to 27%, as issuance continued climbing under the dynamic reward model. Despite a 29% increase in LPT price, total staking rewards fell 26% QoQ to $14 million, signaling greater competition for emissions and a decline in real yield from 41% to 36%.

Governance activity accelerated with funding for AI Video SPE Stage 4, the launch of BYOC deployment, and grants for initiatives like Gateway Wizard, Streamplace 2.0, and the FrameWorks pilot. The Livepeer Foundation was also established as a non-profit organization focused on coordinating decentralized growth and long-term protocol strategy.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.