and the distribution of digital products.

State of Polygon Q1 2025

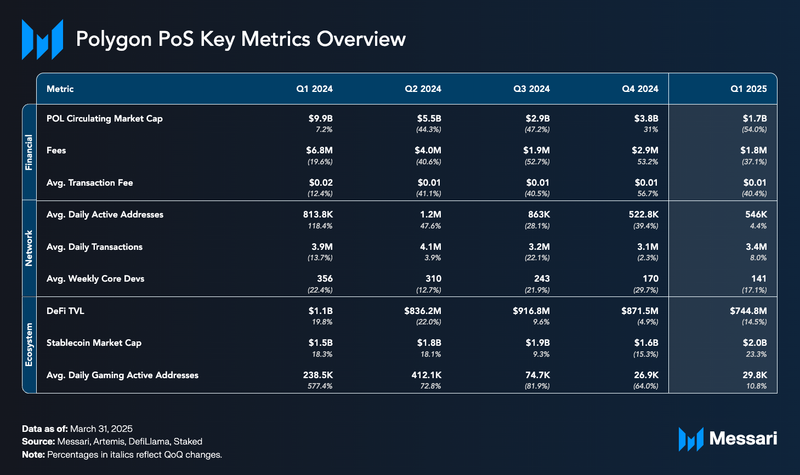

- On Feb. 3, 2025, pessimistic proofs went live on Agglayer mainnet, enabling the protocol to safely unify chains that have different security models. Agglayer integrations include Tria, SOCKET Protocol, Karate Combat, and Rome Protocol.

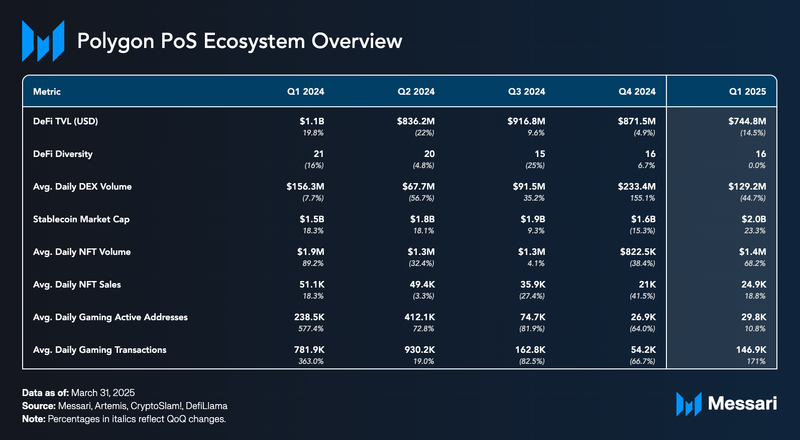

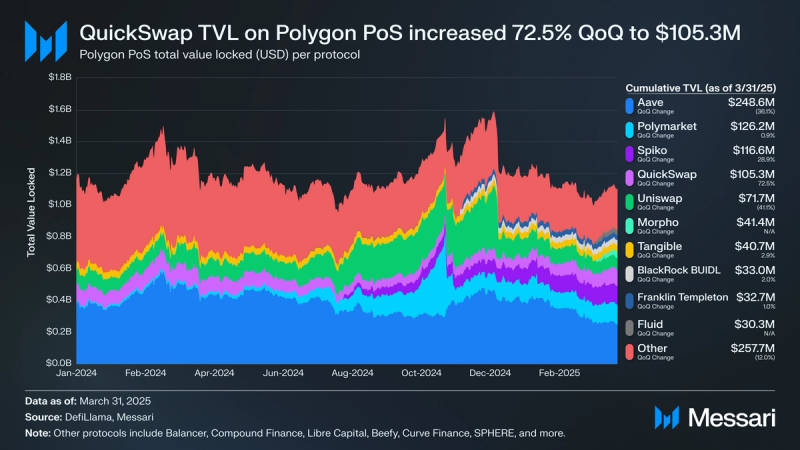

- Polygon PoS DeFi TVL ended Q1 at $744.8 million, with Spiko and QuickSwap increasing their TVL QoQ by 28.9% and 72.5%, respectively.

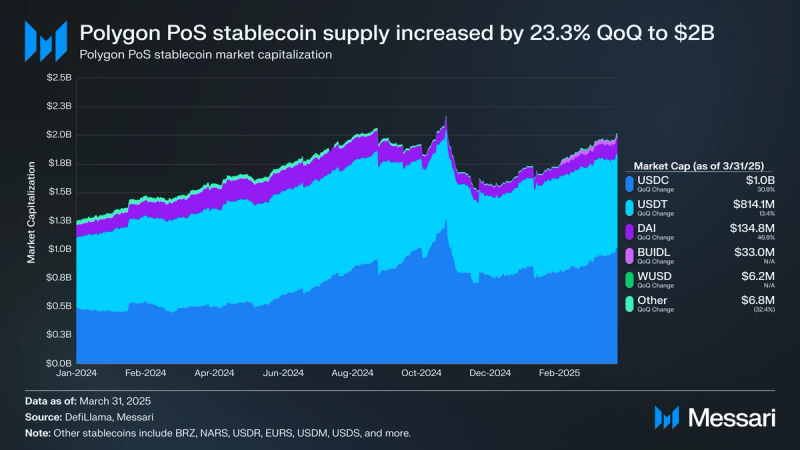

- Polygon PoS stablecoin supply increased by 23.3% QoQ to $2 billion, and the stablecoin sector emerged as the leading category by active addresses on Polygon.

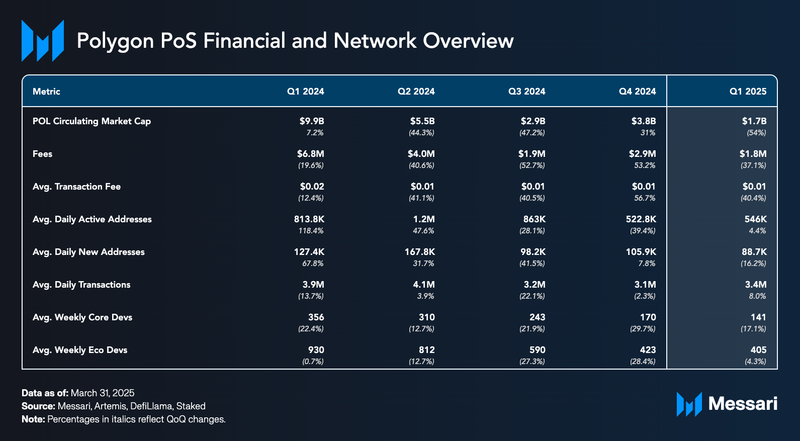

- Average daily active addresses on Polygon PoS grew to 546,000, a 4.4% increase QoQ, while average daily transactions increased to 3.4 million, an 8.0% increase QoQ.

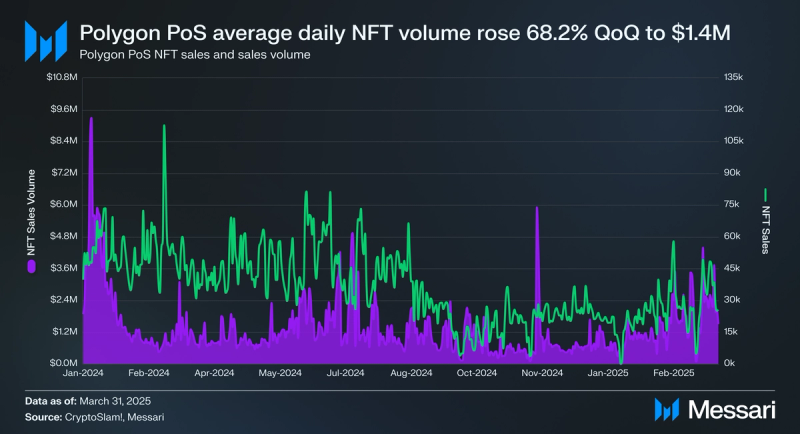

- Average daily NFT trading volume grew to $1.4 million, representing a 68.2% QoQ increase. In March 2025, Courtyard recorded $56.5 million in sales, up 439.5% QoQ. Pokémon NFTs comprised a significant portion of this activity, accounting for $28.9 million (51.2% of March sales).

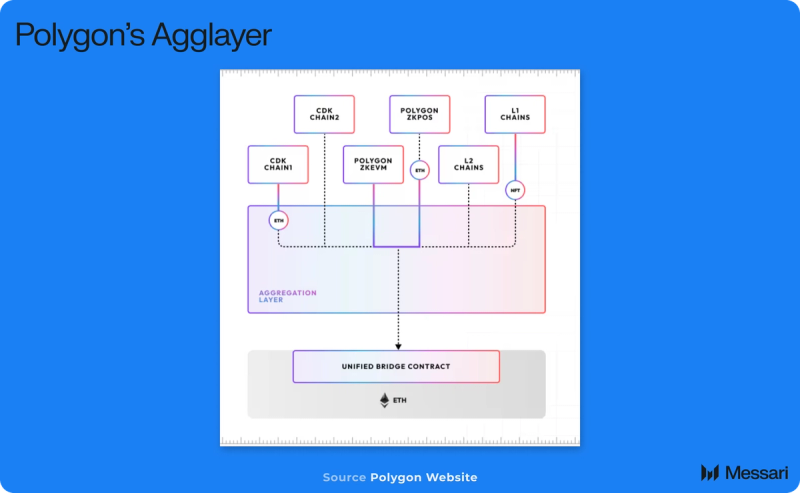

Polygon Labs is a zero-knowledge (ZK) focused software company building a network of aggregated blockchains via the Agglayer. As a public infrastructure, the Agglayer aims to unify user bases and liquidity across connected chains while leveraging Ethereum as a settlement layer. Polygon Labs has contributed to the core development of several scaling protocols and tools for launching blockchains, including the Polygon Proof-of-Stake (PoS) network, Polygon zkEVM, and Polygon Miden. Additionally, the Polygon Chain Development Kit (CDK) provides open-source tools for developers to create and deploy ZK-powered Layer-2 blockchains on Ethereum, connecting to the Agglayer.

The vision of the Agglayer is to enable a horizontally scalable network with a shared state and unified liquidity, creating a web of chains that functions like the internet. As part of this roadmap, a proposal is underway to connect the Polygon PoS network to the Agglayer, marking the first step in upgrading Polygon PoS to a zkEVM Validium network. Discussions about updates to protocol architecture, tokenomics, and governance are ongoing within the community and among core developers.

Website / X (Twitter) / Discord

Key Metrics Polygon Technical DevelopmentsAgglayer

Polygon Technical DevelopmentsAgglayer

The Agglayer is being built as an interoperability protocol to unify chains by aggregating proofs, verifying chain states, and settling to Ethereum. Leveraging ZK proofs, the Agglayer enables secure cross-chain communication, asset transfers, data sharing, and unified liquidity across diverse chains, similar to how TCP/IP revolutionized the internet. Key features include a unified bridge for seamless cross-chain asset connectivity and a pessimistic proof mechanism to ensure safety. These features enable low-latency coordination and safe interoperability, allowing developers to focus on project design without needing to bootstrap liquidity.

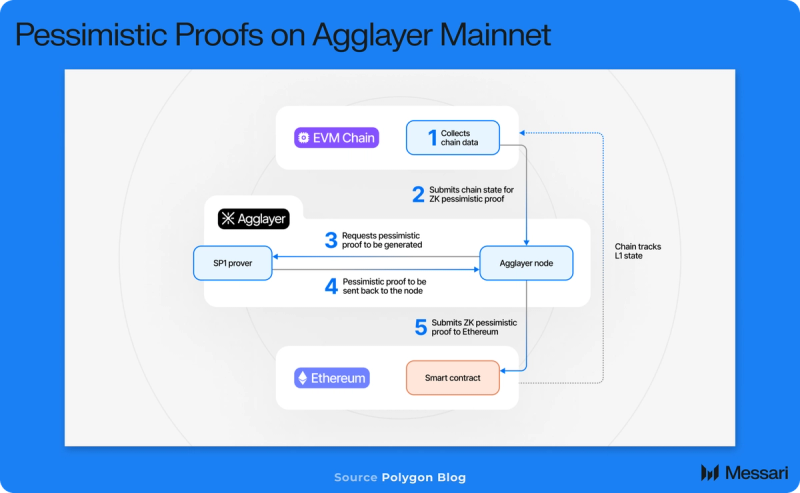

On Feb. 3, 2025, pessimistic proofs went live on Agglayer mainnet, introducing a foundational security mechanism that enables the protocol to safely unify chains that have different security models. By treating all chains with a default level of skepticism, regardless of whether they utilize zero-knowledge proofs, pessimistic proofs ensure that no individual chain can withdraw more assets than have been deposited into the unified bridge. This mechanism provides safety guarantees for cross-chain transactions and enables chains that have disparate proving systems to interoperate without compromising the security of the network.

The pessimistic proof works by verifying three critical conditions: that each chain (1) updates correctly, (2) performs accurate internal accounting, and (3) does not attempt to withdraw unbacked funds. This creates a robust interoperability framework where misbehaving chains become isolated threats, unable to endanger the broader network.

Agglayer IntegrationsIn Q1 2025, Agglayer deepened its role as a unifying interoperability layer with integrations across infrastructure, protocol, and consumer application layers. These partnerships extend Agglayer’s reach across virtual machines, security models, and use cases, demonstrating growing demand for secure, low-friction cross-chain functionality.

Tria

On Jan. 7, 2025, Tria introduced its all-VM chain abstraction stack to Agglayer, enabling unified user and liquidity access across EVM, Solana VM, MoveVM, and other execution environments. With Tria’s BestPath AVS, dApps on Agglayer can tap into users and liquidity from multiple chains without requiring swaps, bridges, or specialized wallets. The integration positions Agglayer as a hub for real-time, VM-agnostic interaction and enhances developer reach with minimal overhead.

SOCKET Protocol

On Feb. 5, 2025, SOCKET Protocol joined the Agglayer ecosystem to power chain abstraction for developers building asynchronous, cross-chain dApps. Through SOCKET’s app-gateway design and Agglayer’s security through pessimistic proofs, developers can compose contracts across chains without using traditional bridging or messaging infrastructure. This enables seamless UX for users, removing direct onchain interaction, gas fees, or bridge delays, paving the way for chain-abstracted accounts and intent-based applications.

Karate Combat

On Feb. 19, 2025, Karate Combat integrated Agglayer to extend KARATE token access across multiple chains, anchored by its new L2 presence on Hedera via UPLAYERTWO. With Agglayer as the official interoperability layer, KARATE is no longer siloed to a single chain, allowing users from various ecosystems to participate in Karate Combat’s decentralized sports entertainment platform.

Rome Protocol

On Feb. 25, 2025, Rome Protocol integrated Agglayer to bridge Ethereum and Solana in a zk-enabled, high-performance environment. Rome EVM will adopt Agglayer as its canonical bridge to Ethereum, streamlining cross-chain token transfers and messaging. Additionally, the broader Rome Stack, including data availability, EVM compatibility, interop tools, and shared sequencing, will be supported within Agglayer. Rome RaaS chains will also gain native Agglayer access, enabling secure interoperability with Ethereum and other Agglayer-connected chains.

Agglayer Roadmap

Agglayer’s roadmap continues to advance its vision of secure, low-latency interoperability across diverse blockchain environments. Upcoming events include:

- Agglayer v0.3 (Q2 2025): Scheduled to introduce full multistack support, enabling any EVM-compatible chain to connect through Agglayer.

- Agglayer v0.4 (H2 2025): Planned to deliver fast interoperability with sub-5-second finality, improving user experience and real-time application performance.

This roadmap underscores Agglayer’s commitment to building a scalable, modular framework for cross-chain coordination, moving toward a unified and secure Web3 infrastructure.

Polygon CDKIn Q3 2023, Polygon Labs released the Polygon Chain Development Kit (CDK), an open-source development framework for launching ZK L2s and transitioning existing EVM L1s to L2s. Polygon CDK focuses on customizability and ZK technology, with future functionality planned to make connecting Polygon CDK chains to the Agglayer seamless.

Adoption of the Polygon CDK continued in Q1 2025 with multiple chain launches and upgrades across varied use cases:

- Ternoa 2.0 launched its zkEVM+ mainnet on Jan. 28, developed with Zeeve and integrated with Avail DA. Optimized for PayFi, it aims to onboard over 1 million users and connect to the Agglayer in the first half of 2025.

- Ember Chain, announced on Feb. 5 by QuickNode and Fuse, is a CDK chain designed for business payments. It utilizes QuickNode’s RaaS to deliver enterprise-grade throughput and cost efficiency.

- Moonveil L2 Testnet went live on Feb. 18, targeting the gaming sector with a scalable, zk-powered infrastructure connected to the Agglayer.

- Lumia completed a mainnet upgrade on Feb. 19, becoming the first CDK chain to implement Erigon. From January to mid-February, Lumia processed over 620,000 transactions and settled more than 57,000 batches on Ethereum.

- Wirex deployed its CDK testnet on Feb. 25, focusing on scalable stablecoin payments. The network leverages Zeeve’s RaaS and is preparing for Agglayer integration.

In Q1, Polygon Labs made multiple upgrades to the CDK stack, advancing from CDK-Erigon v2.61.1 to v2.61.20. Improvements include enhanced RPC functionality for sequencers, performance optimizations to the SMT hashing module, and new safeguards such as gas counter overflow checks in eth_estimateGas. A complete list of changes can be found here.

Financial and Network Overview Market Capitalization

Market Capitalization

POL (formerly MATIC) reached an all-time high market capitalization of $12.9 billion in Q1 2024. However, the subsequent quarters saw significant declines, with POL retracing alongside the broader market. By the end of Q4 2024, its market cap had fallen to $3.8 billion. This considerable drop is partially attributable to the ongoing transition from MATIC to POL, which has temporarily split the market cap between the two tokens.

In Q1 2025, as market conditions worsened compared to Q4 2024, the token's market capitalization shrank 54% QoQ to $1.7 billion. By the end of Q1 2025, 92.7% of the supply had transitioned to POL, with the remaining 7.3% still in MATIC. POL ranks as the second-largest Ethereum Layer-2 token by market cap.

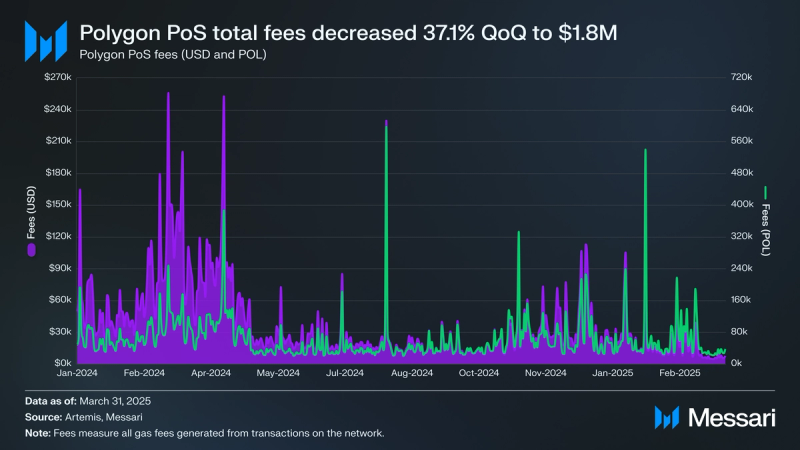

Transaction Fees

In Q1 2024, EIP-4844 was enacted on Polygon PoS mainnet, introducing blobs and significantly changing the Polygon cost structure. EIP-4844 and blobs result in cheaper posting costs to the L1, which lowers users' average transaction fees. Consequently, the average transaction fee has fallen significantly over the past few quarters, down to $0.01 during Q1 2025.

In Q1 2025, total Polygon transactions rose by 5.6% QoQ to 301.5 million, but the average transaction fee decreased by 40.4%. As a result, total transaction fees decreased by 37.1% QoQ to $1.8 million. The continued decline in average fees has reinforced Polygon’s position as a cost-efficient platform for high-volume use cases, particularly in payments and stablecoin transfers.

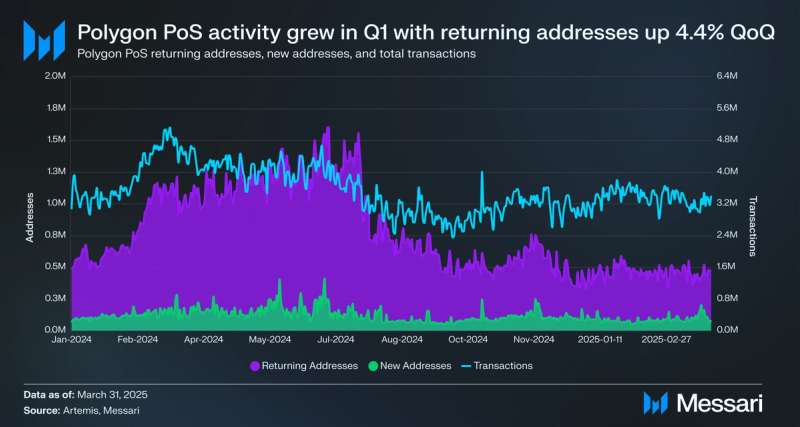

Activity

Polygon PoS saw a slight increase in active addresses during Q1 2025. The average daily active addresses grew to 546,000, a 4.4% increase QoQ. Similarly, average daily transactions increased to 3.4 million, an 8.0% increase QoQ. This increase can partly be attributed to a rise in stablecoin, DeFi, bridges, and NFT activity. Despite the heightened activity, the average daily number of new addresses fell to 88,700, a 16.2% decrease QoQ.

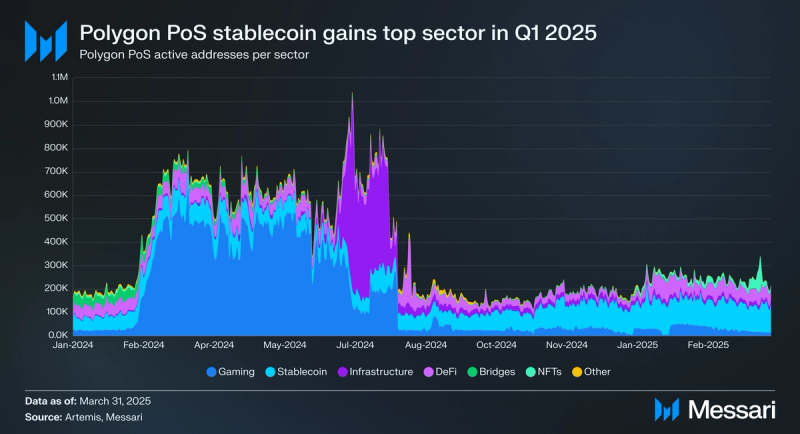

Sectors

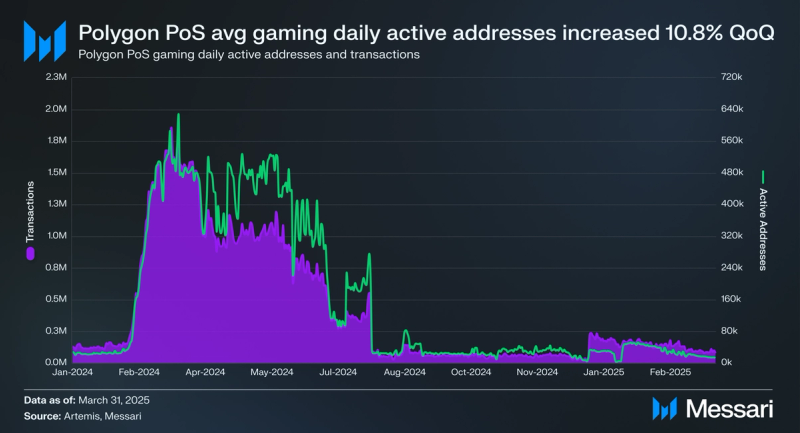

The stablecoin sector emerged as the leading category by active addresses on Polygon PoS in Q1 2025, with the stablecoin supply expanding by 23.3% QoQ. Active addresses within the sector also rose, increasing 29.9% QoQ. DeFi activity rebounded strongly, with active addresses surging 115% QoQ. Bridges and NFTs also posted gains, with active addresses up 14.4% and 105.7%, respectively. In contrast, user engagement in the gaming sector, previously dominant throughout most of 2024, continued its downward trajectory, declining by 23.6% from Q4. The infrastructure sector experienced a similar contraction, with active addresses falling 15.8% QoQ. Other sectors collectively saw a more pronounced drop of 40.6%.

Despite expectations that activity on Polymarket would taper off following its breakout performance in Q4 2024, the platform maintained a strong presence in Q1 2025. Although monthly betting volume declined 55.4% from $1.9 billion in December to $860.8 million in March, Polymarket sustained an average open interest of $110.7 million over the quarter. Significantly, its growth has not solely depended on political markets; sports betting accounted for an average of 25.5% of open interest in Q1, with the Super Bowl alone generating $20.8 million in open interest in February. By the end of Q1, Polymarket reported 360,000 monthly active users (+3.7% QoQ), 3.1 million monthly matched trades (-66.4% QoQ), and 117,000 monthly new accounts (-56.8% QoQ).

The 105.7% QoQ increase in active addresses within the NFT sector was driven in large part by Courtyard, which saw a surge in demand for tokenized collectibles. In particular, Pokémon-themed NFTs gained significant traction, helping boost Courtyard to $107.4 million in sales for the quarter. March alone accounted for $56.5 million of that total, marking a 439.5% increase from December. This activity underscores growing user appetite for digitized real-world assets and highlights Polygon PoS’s suitability for supporting high-throughput NFT platforms.

DevelopmentIn February, Polygon joined the Open Intents Framework, a modular and open-source initiative to standardize and accelerate cross-chain intent infrastructure across the Ethereum ecosystem. By participating, Polygon aims to enhance the interoperability and user experience of its Agglayer network, leveraging shared tooling to support seamless, protocol-agnostic cross-chain transactions.

In March, Kohin SDK went live on Polygon, allowing prediction market developers to integrate onchain insurance and provide 100% coverage on prediction amounts with minimal implementation effort. During the same month, Polygon introduced the Pessimistic Proof Benchmark to establish a standardized, real-world performance test for zkVMs, addressing the need for meaningful evaluation similar to benchmark challenges in AI. Based on a production workload used in Agglayer, the benchmark measures execution and proving efficiency across projects like SP1, Risc0, and Pico in both CPU and GPU environments.

GovernancePolygon Governance 2.0 introduces three main governance pillars for Polygon. Each pillar of governance will have a unique framework, aiming to create scalable and efficient governance mechanisms.

- Protocol Governance: Facilitated by the Polygon Improvement Proposal (PIP) framework, it provides a platform for proposing upgrades to Polygon protocols.

- System Smart Contracts Governance: Addresses upgrades of protocol components implemented as smart contracts. The Protocol Council, governed by the community, will be responsible for these upgrades.

- Community Treasury Governance: Establishes a self-sustainable ecosystem fund, the Community Treasury, to support public goods and ecosystem projects. The governance process involves two phases, starting with an independent Community Treasury Board and evolving into community-driven decision-making.

In Q4 2022, PIP-29 proposed the introduction of the Polygon Protocol Council, which was adopted by the community. The council is responsible for conducting both regular and emergency upgrades to system smart contracts, specifically components of Polygon protocols implemented as smart contracts on Ethereum. The Protocol Council consists of 13 publicly named members.

In Q2 2024, the Governance Hub was announced, enabling community-driven protocol and smart contract upgrades. It is a full-stack governance solution and user interface for the community focusing on two of Polygon Governance’s three pillars: Protocol Governance and System Smart Contracts Governance.

In Q4 2024, Polygon introduced signal voting through the Governance Hub, enabling staked POL tokenholders to engage in community governance for Polygon protocols and shared Agglayer components (once live). This system allows participants to either delegate their votes to technical delegates or vote directly on upcoming proposals. Although there is no onchain mechanism to enforce a veto, the Protocol Council is anticipated to consider community feedback when making decisions.

In Q1 2025, governance activity was limited, with only two proposals executed. The first proposal, published on Jan. 7, introduced a new span message transaction type on the Heimdall layer. The second, published on Jan. 14, implemented a network upgrade, Danelaw hardfork, which resolved issues that had emerged after a previous upgrade. Five additional proposals published during the quarter remained pending without defined end dates.

Ecosystem Overview DeFi

DeFi

Polygon PoS DeFi total value locked (TVL) ended Q1 2025 at $744.8 million, a 14.5% QoQ decrease. Polygon fell from being the twelfth-largest network by TVL to the thirteenth.

Aave remained the top protocol by TVL on Polygon PoS in Q1, despite a 36.1% QoQ decline, ending the quarter with $248.6 million in TVL. Polymarket held its position as the second-largest protocol, with $126.2 million in TVL (+0.9% QoQ). Uniswap dropped to fifth place, with $71.7 million in TVL following a 41.1% QoQ decrease. Spiko and QuickSwap surpassed Uniswap to become the third- and fourth-largest protocols, with TVLs of $116.6 million (+28.9% QoQ) and $105.3 million (+72.5% QoQ), respectively.

Morpho-powered lending vaults launched on Polygon in March 2025, contributing to Morpho’s $41.4 million TVL by quarter-end. Developed in collaboration with Gauntlet and Compound DAO, the new vaults introduce real-time optimization features, such as faster asset listings, adaptive interest rates, and improved liquidation mechanics. A combined $3 million in incentives from Polygon Labs and Compound DAO was deployed to bootstrap adoption, distributed over 120 days.

The following largest protocols by TVL were Tangible at $40.7 million (+2.9% QoQ), BlackRock BUIDL at $33.0 million (+2.0% QoQ), Franklin Templeton at $32.7 million (+1.0% QoQ), and Fluid, which launched on Polygon in March, at $30.3 million. The combined TVL of protocols outside the top ten totaled $257.7 million, marking a 12.0% QoQ decline.

Polygon PoS’s stablecoin supply ended Q1 2025 with a total market capitalization of $2.0 billion, reflecting a 23.3% increase QoQ. Major stablecoins on Polygon expanded in Q1, with USDC supply growing by 30.9% QoQ, USDT by 13.4%, and DAI by 46.9%. As a result, Polygon moved up one position to become the seventh-largest blockchain by stablecoin supply at the end of Q1 2025. It also ranked third in monthly active onchain addresses for USDT and led all blockchains in active addresses for USDC during the same period.

Notably, during Q1, the Wyoming Stable Token Commission launched testnet deployments of its fiat-backed stablecoin, WYST, on Polygon and several other networks. Backed by cash and U.S. Treasuries, WYST is the first state-issued, fully reserved stablecoin in the U.S. The initiative uses LayerZero’s OFT standard for multichain interoperability, with a mainnet launch expected in July 2025.

NFTs

Polygon PoS experienced an increase in NFT activity during Q1 2025. Average daily NFT trading volume grew to $1.4 million, representing a 68.2% QoQ increase. Similarly, average daily NFT sales rose to 24,900, marking an 18.8% QoQ increase. NFT activity during the quarter was primarily driven by three collections: Courtyard, which recorded $107.4 million in sales; LEDNFT, with $5.8 million; and Infinitex, with $1.1 million in sales. Polygon experienced a quarterly peak in daily NFT trading volume of $4.4 million on March 20, 2025, primarily fueled by demand for Pokémon NFTs on Courtyard.

Courtyard's growth highlights both the product-market fit of digitized assets and Polygon PoS’s capability to support such applications. In March 2025, Courtyard recorded $56.5 million in sales, up 439.5% from $10.5 million in December 2024. Pokémon NFTs comprised a significant portion of this activity, accounting for $28.9 million (51.2% of March sales). By the end of Q1 2025, Courtyard had issued 701,000 tokenized Pokémon cards to 13,000 unique holders.

Beyond collectibles, tokenized real-world assets (RWAs) are also gaining traction. The Indian Railways issued NFT-based train tickets to passengers attending Maha Kumbh Mela, a major Hindu festival held once every 144 years. These NFTs were minted on Polygon and distributed through NFTtrace, a platform specializing in RWAs and traceability. With millions of travelers using the Indian Railway Catering and Tourism Corporation platform daily, the initiative highlights how blockchain technology can scale to support large-scale, real-world applications.

Gaming

Polygon’s gaming sector, which had a strong start in the first half of 2024 before slowing later in the year, rebounded in Q1 2025. Average daily gaming active addresses increased to 29,800, representing a 10.8% increase QoQ, while average daily gaming transactions rose to 146,900, marking a 171% increase QoQ.

PaymentsPolygon has established itself as a natural home for payment solutions, offering low fees, fast settlement, and an accessible development environment. In Q1 2025, the network saw strong global adoption in remittances, cross-border payments, and merchant services. Payment transactions highlight one of the clearest examples of large-scale real-world crypto adoption. Developments in the payments ecosystem include:

- Stripe’s integration with Polygon PoS enables over three million merchants across more than 150 countries to accept USDC payments with a reduced transaction fee of 1.5%, compared to the traditional 2.9% card rate. Polygon is one of three blockchains supported by Stripe, alongside Ethereum and Solana, highlighting its role as core infrastructure for onchain payments.

- Transak launched Transak Stream on Polygon PoS, enabling users to off-ramp from crypto to cash with one click directly from decentralized applications. The service streamlines cashing out from stablecoins into local currencies, further expanding Polygon’s real-world usability.

- Stablecoin-linked crypto cards processed $140.7 million in combined Mastercard and Visa volume on Polygon PoS in Q1 2025, across nine different card programs. Mastercard accounted for $130.3 million and Visa for $10.4 million, reflecting continued traction in bridging digital assets with traditional payment rails.

- Payments-focused applications on Polygon PoS facilitated $245.3 million in transfer volume across more than 15 platforms, up 5.8% QoQ. Nexo led with $130.3 million in volume, followed by Bitso at $45.8 million and Robinhood at $18.6 million, illustrating Polygon’s growing footprint across crypto-native and fintech-integrated services.

Real-world assets (RWAs) continued to gain momentum on Polygon in Q1 2025, reinforcing the network’s role as a core infrastructure layer for asset tokenization. Growing demand from traditional financial institutions and proven product-market fit for digitized collectibles, such as Pokémon cards on Courtyard, helped drive a notable increase in onchain RWA allocations. By the end of the quarter, Polygon ranked seventh by total RWA value, reaching $271.8 million. Key RWA developments this quarter include:

- Fasanara, a London-based investment manager with over $4 billion in AUM, launched FAST, a tokenized money market fund on Polygon PoS. Developed in collaboration with Apex Group, Tokeny, Chainlink, Fireblocks, and XBTO, FAST streamlines subscriptions, redemptions, and fund management through real-time settlement and onchain operations.

- Securitize integrated Wormhole as its primary interoperability solution, enabling secure, native transfers of tokenized funds like BlackRock’s BUIDL across Ethereum, Arbitrum, Avalanche, Optimism, and Polygon. The deployment enhances cross-chain liquidity, accessibility, and scalability for institutional-grade tokenized assets.

- eNor launched its investment app on Polygon, offering global access to tokenized stocks, commodities, real estate, debt, and crypto assets. The platform enables users to invest in regulated RWAs and tokenize assets through a full-service suite.

- Brickken went live on Polygon PoS, expanding its multichain tokenization platform to increase accessibility and scalability for real-world assets. The integration aims to bring hundreds of millions in tokenized assets to Polygon and broaden investor reach within the ecosystem.

- Mercado Bitcoin, the third-largest private credit tokenization platform, partnered with Polygon to tokenize over $200 million in real-world assets in 2025. Mercado Bitcoin will leverage Polygon’s infrastructure to improve transaction costs and settlement times. The initiative builds on Mercado Bitcoin’s existing platform, which has issued over 340 tokenized products totaling $180 million.

- RealEstate.Exchange (REX), built by DigiShares, launched on Polygon PoS to enable the regulated trading of tokenized real estate assets with fractional ownership. Licensed in the U.S. through Texture Capital, REX offers a compliant, blockchain-based secondary market for residential, commercial, and luxury properties.

Additional developments related to the broader Polygon ecosystem in Q1 2025 include:

- Jio Platforms Ltd. partnered with Polygon to integrate Web3 capabilities across applications and services for over 450 million users. The first integration launched on JioSphere, featuring a native wallet integration powered by Polygon PoS, and quickly reached the #1 ranking in India’s App Store and Play Store for browsers.

- Privado ID launched Billions, a global human and AI network that leverages mobile-first, privacy-preserving verification without biometrics. The network uses decentralized proof of personhood and ZK technology to enable trusted interactions between humans and AI agents.

- Polygon Labs launched the Community Grants Program Season 2 with 35 million POL in grants, expanding support for builders across AI, DePIN, and memecoin sectors. Independent Grant Allocators such as Eliza Labs, Crossmint, IoTeX, Thrive, and Gitcoin will distribute up to 15 million POL, while the Direct Track offers 20 million POL for projects outside predefined themes. Season 2 builds on the momentum of Season 1, which awarded 17.5 million POL to over 120 projects.

Polygon concluded Q1 2025 with advancements across its ecosystem, anchored by the activation of pessimistic proofs on the Agglayer mainnet. This milestone established a foundational security mechanism for cross-chain interoperability, enabling integrations with Tria, SOCKET Protocol, Karate Combat, and Rome Protocol. Agglayer’s roadmap remains active, with multistack support and fast finality features slated for later in the year, positioning it as a key enabler of secure, low-latency blockchain interoperability.

On the network side, Polygon PoS experienced moderate growth in activity, with daily active addresses rising 4.4% QoQ and daily transactions increasing 8.0% QoQ. The stablecoin sector emerged as the leading category by active addresses on Polygon PoS, growing its supply by 23.3% QoQ to $2.0 billion, while DeFi and NFT activity also rebounded. Notable developments included a 68.2% QoQ increase in daily NFT trading volume, primarily driven by the surge in tokenized assets like Pokémon NFTs through Courtyard. Meanwhile, real-world asset tokenization initiatives accelerated, solidifying Polygon’s role as a scalable infrastructure layer for institutional adoption.

Looking ahead, Polygon’s focus remains on expanding its network through the Agglayer while solidifying Polygon PoS as a leading platform for payments and RWA use cases. With upgrades to protocol security, enhanced cross-chain coordination capabilities, and growing real-world utility across payments, DeFi, NFTs, and RWAs, Polygon is well-positioned to continue fostering developer growth, institutional engagement, and Web3 adoption throughout 2025.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.