and the distribution of digital products.

State of Solana Q1 2025

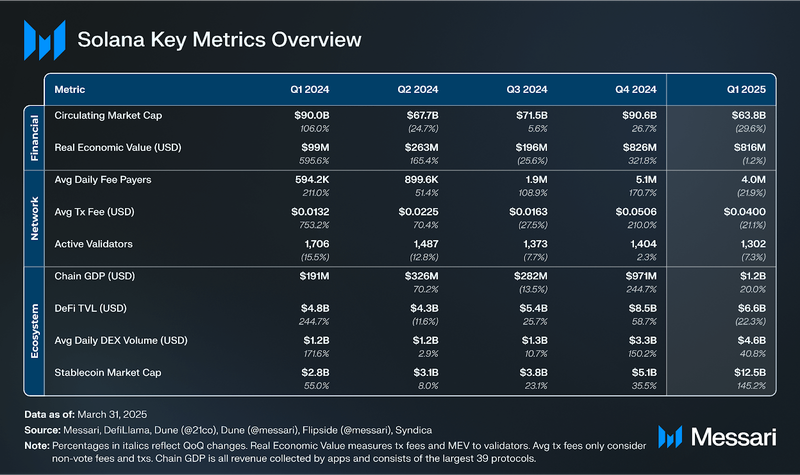

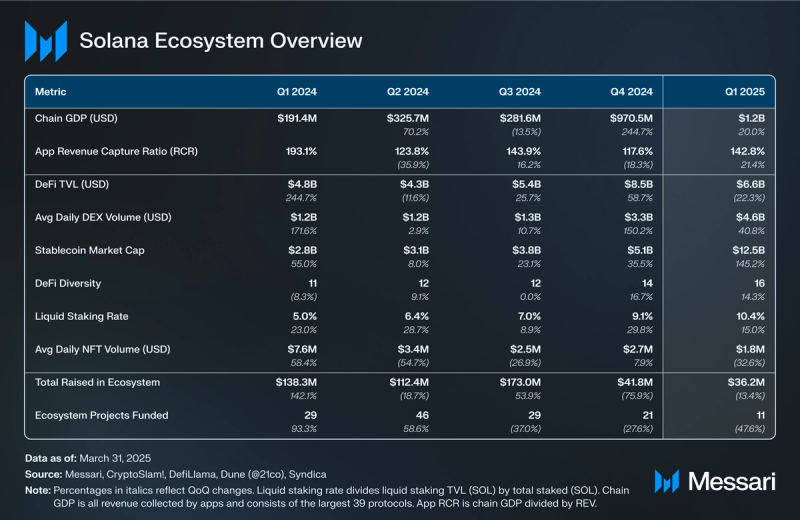

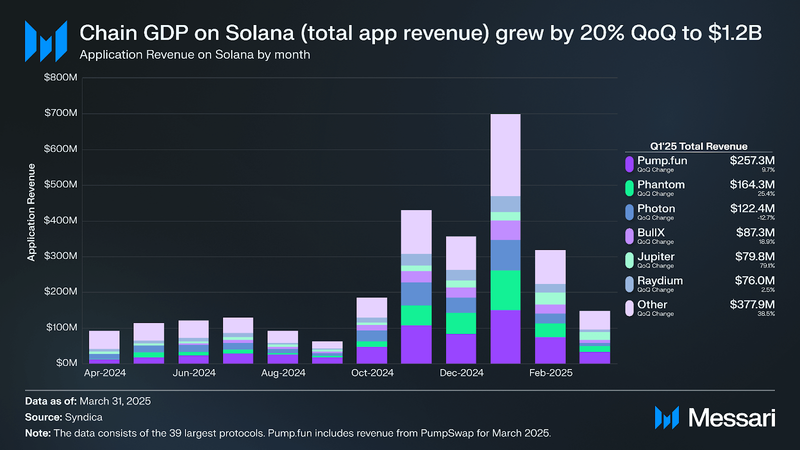

- Chain GDP on Solana (total application revenue) grew by 20% QoQ, rising from $970.5 million to $1.2 billion. January marked the strongest month, generating $698.6 million in revenue.

- The Application Revenue Capture Ratio (Chain GDP divided by Real Economic Value) grew from 117.6% to 142.8%. Real Economic Value (REV) is defined as the sum of base transaction fees, priority fees, and MEV tips paid to validators.

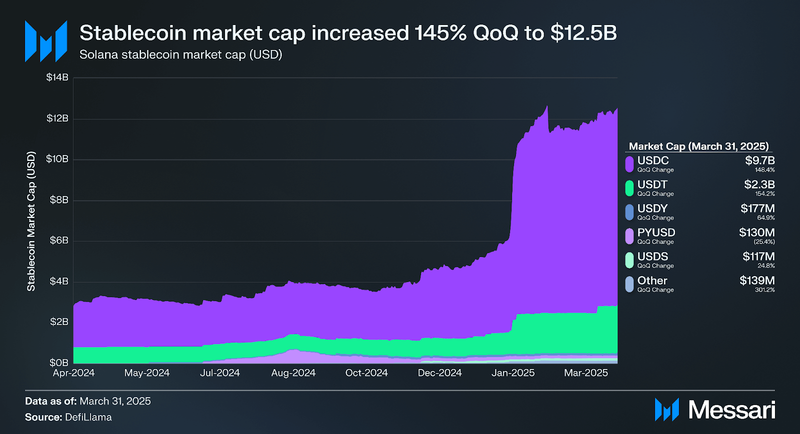

- Stablecoin market cap expanded 145.2% QoQ to $12.5 billion. USDC grew 148.4% to $9.7 billion, and USDT grew 154.2% to $2.3 billion.

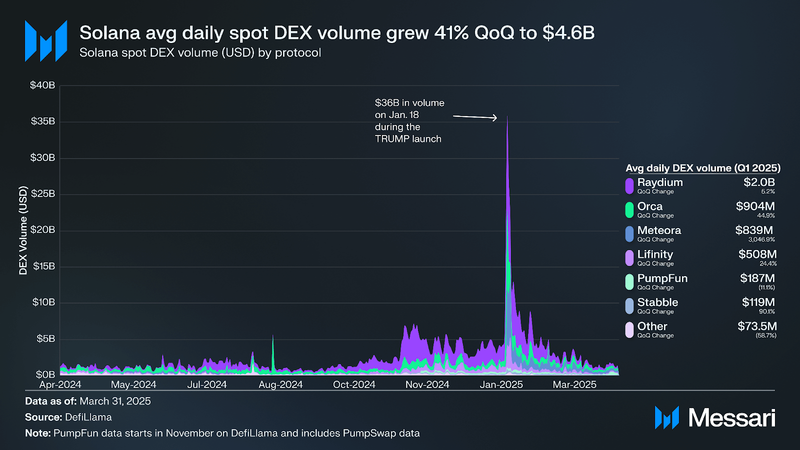

- Average Daily DEX volume grew by 40.8% QoQ to $4.6 billion, fueled by renewed memecoin speculation after the TRUMP token launch.

- Solana Foundation will host the Accelerate conference in May in New York City, featuring two events: Scale or Die, focused on developers, and Ship or Die, focused on product and application teams.

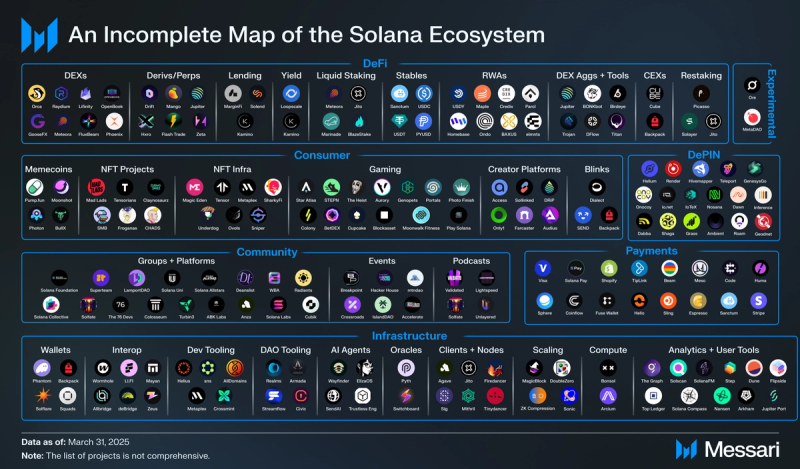

Solana (SOL) is an integrated, open-source Layer-1 network with the goal of synchronizing global information at the speed of light. Solana optimizes for increasing bandwidth and reducing latency. It accomplishes this through features such as its novel timestamp mechanism called Proof-of-History (PoH), a block propagation protocol Turbine, and parallel transaction processing. Since mainnet launch in March 2020, several network upgrades have brought further network performance and resilience, including QUIC, stake-weighted Quality of Service (QoS), and local fee markets.

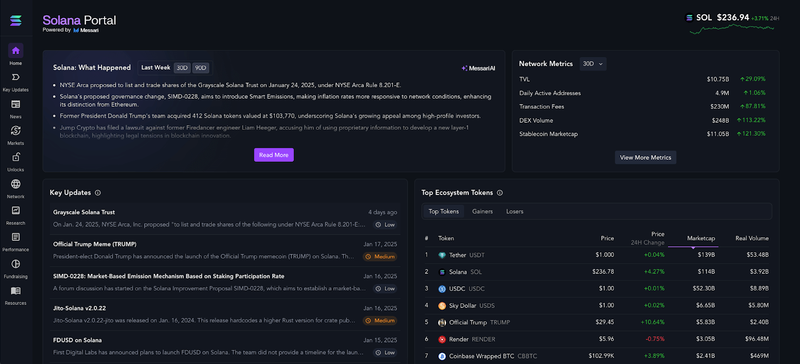

Development and growth of the network and its ecosystem are supported by the non-profit Solana Foundation, for-profit Solana Labs, and various third-party organizations, including Anza, Colosseum, Helius, and Superteam. Solana Labs has raised over $335 million in private and public token sales. Solana features a growing ecosystem of projects across many sectors, including DeFi, consumer, DePIN, and payments. To stay up-to-date with all things Solana, visit the Solana Portal.

Key Metrics Ecosystem Analysis

Ecosystem Analysis

Application Revenue

Application Revenue

Chain GDP is defined as the total application revenue generated on a network. In Q1 2025, Solana’s Chain GDP grew 20% QoQ from $971 million to $1.2 billion. January was the highest-earning month, bringing in $699 million in revenue to applications on the protocol. The leaders by application revenue in Q1’25 were as follows:

- Pump.fun: $257 million (10% QoQ increase)

- Phantom: $164 million (25% QoQ increase)

- Photon: $122 million (13% QoQ decrease)

- BullX: $87 million (19% QoQ increase)

- Jupiter: $80 million (79% QoQ increase)

These applications’ revenue is directly correlated to increases in speculation as they facilitate the trading of assets. This was especially apparent when TRUMP and MELANIA launched. Average daily DEX volume (USD) in January grew to $8.3 billion, a 153.4% increase from the average in Q4’24.

App Revenue Capture Ratio (App RCR)

A network’s App Revenue Capture Ratio (RCR) is the ratio of revenue generated by its apps to its Real Economic Value (REV). REV is defined as the sum of base transaction fees, priority fees, and MEV tips paid to validators. App RCR reflects the efficiency with which applications capitalize on the economic activity taking place on the network. The higher the app RCR, the more effectively apps capture the economic activity being generated on the network, suggesting a mature ecosystem with monetizable applications. A low App RCR may signal untapped potential for app developers or inefficiencies in revenue capture. Alternatively, it may signal a nascent ecosystem not yet ready for monetization.

If App RCR equals 20%, this implies that for every $1 of REV generated by the network, $0.20 is captured as revenue by apps. In Q1 2025, App RCR on Solana was 142.8%, a 21% QoQ increase from 117.6% in Q4’24. This can be interpreted as when $100 is spent in transaction fees (and/or Jito tips) to interact with Solana, applications earn $142.80 in revenue.

A network’s App RCR can be greater than 1 when its applications are successful in monetizing activity, driving revenue streams for project teams and potentially, tokenholders. For example, DEXs charging swap fees or NFT marketplaces imposing marketplace fees in excess of transaction fees paid to Solana.

DeFi

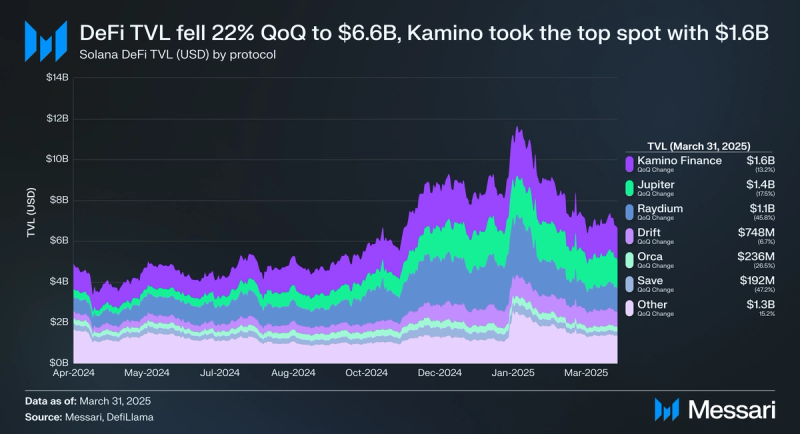

DeFi TVL (USD) on Solana fell 64% QoQ to $6.6 billion. Still, it ranked second among networks after surpassing TRON in November 2024. DeFi TVL (SOL) grew by 18% QoQ to 53 million SOL.

- Kamino: Took the lead in TVL, ending with $1.6 billion and a market share of 24% despite its TVL falling 13% QoQ. On Dec. 5, 2024, Kamino introduced Kamino Swap, an intents-based exchange platform that offers zero slippage, fees, and MEV. The beta version first launched with SOL and USDC as the first available tokens, but has since added support for all SPL tokens.

- Jupiter Perps: Claimed the second spot, though its TVL decreased 18% QoQ, ending with $1.4 billion and a 21% market share.

- Raydium: Fell to the third spot with its TVL decreasing 46% QoQ, ending with $1.1 billion and a 17% market share.

Average daily spot DEX volume (USD) grew 41% QoQ to $4.6 billion in Q1 2025. This growth can be attributed to the memecoin craze being reignited following the November 2024 U.S. presidential election and continuing into the launch of the TRUMP token in January 2025. On Jan. 18, Solana DEXs did $36 billion in volume, which puts it at about 10% of Nasdaq’s daily volume.

Raydium’s average daily volume increased by 5% QoQ to $2.0 billion with a 43% market share. Read more about Raydium’s recent developments in our State of Raydium Q4 2024 report. Orca saw a 45% increase ($904 million) QoQ in average daily volume, with a market share of 20%. Meteora became the DEX with the third-highest quarterly volume after increasing 3047% QoQ to $839 million and a 18% market share. This was mainly led by the TRUMP, MELANIA, and LIBRA tokens, which launched directly on Meteora.

PumpFun dropped to the fifth-largest DEX by quarterly volume on Solana after decreasing by 11% QoQ in Q1 to $187 million. On March 20, 2025, the team launched PumpSwap. PumpSwap replaced Raydium as the sole trading venue of PumpFun tokens that graduate past their bonding curve. In the last week of the quarter, Pump.fun and Pumpswap averaged $279 million in average daily volume, compared to Raydium at $334 million.

The Jupiter team acquired SonarWatch, Moonshot, Ape Pro, and Drip in Q1’25, aiming to become the Solana DeFi super app. However, Jupiter fell to being the secondary trade source by Q1 spot DEX volume on Solana, with 24% of Q1 spot DEX volume being initiated via the protocol. Raydium took over as the primary trade source on Solana, accounting for 31% of Q1 spot DEX volumes. In March, Titan unveiled its Meta DEX Aggregator which claimed their algorithm beats competitors 80% of the time. Titan’s private beta is now live.

Jupiter averaged $1 Billion in daily perp trading volume (USD), a 14% QoQ increase, ending the quarter with a 79.2% market share. Other main perpetual future exchanges include:

- Drift: Drift’s average daily perps volume fell 17.3% QoQ to $138.2 million, resulting in a 10.9% market share.

- In March, the team announced the SWIFT Protocol, which gives users lower-latency and gasless trades.

- GMX: Launching on Solana on Feb. 18, GMX’s average daily perps volume was $58.4 million, resulting in a 4.6% market share.

- Adrena: Adrena’s average daily perps volume fell 20.8% QoQ to $19.8 million, resulting in a 1.6% market share.

- Raydium Perps: Launching on Solana on Jan. 9, 2025, Raydium’s average daily perp volume was $17 million, resulting in a 1.3% market share.

- FlashTrade: FlashTrade’s average daily perps volume grew 4.6% QoQ to $14.1 million, resulting in a 1.1% market share.

- Zeta: Zeta’s average daily perps volume fell 35.4% QoQ to $4.9 million, resulting in a 0.4% market share.

- In March, the team launched their Network Extension, Bullet, on testnet. Bullet is a Layer-2 rollup on Solana that posts ZK proofs to Solana mainnet. The team has claimed that traders will have 2ms of latency when trading on the platform.

Stablecoin market cap on Solana grew by 145% QoQ to $12.5 billion, ranking it 3rd among networks. Much of this growth came after the TRUMP token launched on Jan. 17, which brought an influx of liquidity to Solana and resulted in various high-liquidity pairs using USDC. The sustained increase in stablecoin market cap indicates much of the new capital remained on the network.

USDC ended the quarter with a market cap of $9.7 billion after growing by 148% QoQ with a 77% market share. USDT was the second largest stablecoin on Solana by the end of Q1'25, with $2.3 billion (a 154% QoQ increase) and an 18% market share. Ondo’s USDY claimed the third spot by ending the quarter with $177 million (a 65% QoQ increase). PayPal’s PYUSD was the only top-five stablecoin to fall this quarter, ending with $130 million (a 25% QoQ decrease). USDS, the rebranded stablecoin from Sky Protocol (formerly known as DAI from MakerDAO), launched on Solana in November and ended the quarter with a $117 million market cap.

In February, Paxos’s new USD-backed stablecoin, USDG, went live. Paxos created a Singaporean entity for launching this new stablecoin, which received approval from the Monetary Authority of Singapore (MAS). USDG will power the Global Dollar Network (GDN), a stablecoin consortium cofounded by Paxos, Robinhood, Kraken, Anchorage Digital, Galaxy Digital, Bullish and Nevei. USDG ended Q1 with an $83.9 million market cap.

Liquid Staking

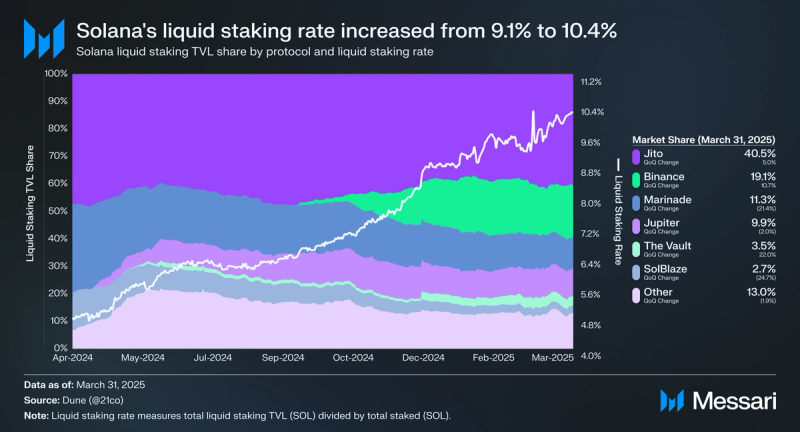

The liquid staking rate on Solana increased 15% QoQ, from 9.1% to 10.4%. With 64% of SOL’s circulating supply staked, a growing liquid staking rate enables a DeFi ecosystem built on yield-bearing SOL.

- Jito’s jitoSOL remained the liquid staking token (LST) leader on Solana. The token’s liquid staking market share grew 5% QoQ, from 38.5% to 40.5%, for a total market cap of $2.1 billion.

- Binance’s bnSOL, which launched in September 2024, grew its market share 11% QoQ from 17.3 to 19.1%, for a total market cap of $1 billion.

- Marinade’s mSOL saw its market share fall 21% QoQ from 14.4% to 11.3%, for a total market cap of $603.3 million.

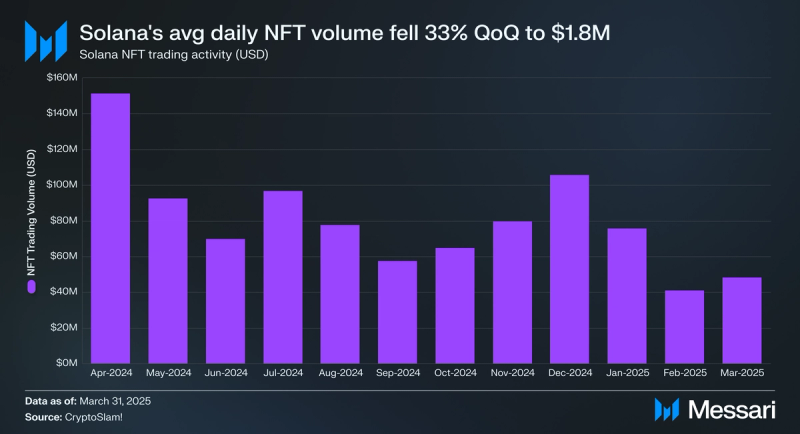

Average daily NFT trading volume (USD) on Solana fell 33% QoQ to $1.8 million in Q1 2025. Magic Eden took the majority share with $62 million, a 27% QoQ decrease. Tensor’s trading volume decreased 77% QoQ to $26 million. While overall volume is down, NFTs on Solana lead on creator royalties.

- In December 2024, Magic Eden launched the ME token. The token initially eclipsed a $1 billion circulating market cap before falling, finishing Q1’25 at $133.1 million with 18% of the supply circulating.

- In April 2024, Tensor launched the TNSR token, airdropping 14.8% of the total supply to early users. TNSR ended Q1’25 with a circulating market cap of $55 million, with 33% of the supply circulating.

- The team behind Star Atlas, ATMTA, announced a strategic investment in Shaga, the decentralized cloud gaming platform. This will allow Star Atlas to expand its reach across lower fidelity devices/phones.

- Shaga launched in March 2025 and shared its first month stats. The platform had over 26,000 streaming hours in over 170 different countries.

- In February 2025, Play Solana, the team behind the PSG1 device, announced its Play Solana Validator, which allowed members of its community to stake SOL to earn XP. By quarter's end, the validator had well over 27,000 SOL staked.

- Lowlife Forms, a dystopian third-person shooter, made its wishlist debut on Epic Games Store, reaching top 3 most wishlisted games on the platform. The project also conducted its $SPICE token launch, helping it enter its next phase of adoption growth.

- At GDC 2025, the Solana Foundation hosted a Developer Summit focused on onboarding Web2 game developers through technical keynotes, live demos, and hands-on workshops - showcasing seamless tooling for integrating on-chain assets, economies, and decentralized platforms into modern game development.

- DeFi Dungeons brought a huge comeback to the idle gaming genre, with its $GOLD token vault reaching $130 million in deposits, significantly exceeding the vault’s $3 million cap, and highlighting massive demand for the new project from the team behind The Heist.

- Colony, the highly anticipated AI game from the Parallel TCG team, powered by Wayfinder, has started its Alpha test phase and is anticipating a Q2’25 Alpha release.

- MixMob: Racer 1 fully launched on iOS and Android as the world’s first card-racing game built on Solana, and has since outperformed midcore benchmarks in virality, monetization, and retention.

- In March 2025, Polymarket announced support to make deposits into Polymarket wallets using Solana.

- In March 2025, Nikita Bier, a social media app founder, announced he would help advise on growing apps within the Solana ecosystem.

- In March 2025, Polymarket announced support to make deposits into your Polymarket wallet using Solana.

- In February 2025, Kalshi announced being able to fund your account with USDC from a Solana wallet.

- In February 2025, the Time.fun team announced they migrated to Solana. Time.fun allows users to buy minutes from anyone on the platform, and either speculate on the price of those minutes or use them to talk to the person whose minutes you are buying. Within its first two weeks, Anatoly’s minutes did over $100 million in volume.

Solana continues to be a hub for DePIN applications, hosting Helium, Hivemapper, GEODNET, Render, Nosana, Jambo, NATIX, and more. Notable Q1’25 events include:

- DePIN projects on Solana distributed over $400m in rewards in 2024.

- Helium Mobile: In Q2’24, Helium Mobile started its Offloading beta program that allows legacy U.S. mobile carriers to offload mobile data to Helium. The program went live in August 2024, allowing hotspots to be paid to offload data.

- At the end of Q1’25, Helium had 534,000 daily users and 193,000 Helium Mobile subscribers. Helium also announced their free phone plan with 3 GB of data. Read more about Helium’s recent developments in our State of Helium Q4 2024 report.

- XNET: XNET migrated to Solana in August 2024. At the end of Q1’25, XNET had offloaded over 101 terabytes of data from over 11 million users.

- Grass: The GRASS token launched in October 2024 at a $200 million circulating market cap. Grass announced the rollout of the Sion upgrade in February 2025, which will allow Grass to scrape over 1 petabyte of data per day.

- Hivemapper: By the end of Q1’25, Hivemapper had mapped about 12 million unique miles, 32% of global coverage, or the surface area of the streets within an urban area.

- Fuse: In March 2025, the Fuse team announced that users in the United Kingdom can install EV home chargers. As of May 2025, Fuse has 40,000 customers in the UK, growing 15% month over month.

- Geodnet: The GEOD token was added to Grayscale’s Research Crypto Sectors Top 20. Geodnet Project Creator Mike Horton testified before the House Agriculture Committee on April 9, 2025 to discuss DePIN’s benefits with Congress.

- Wingbits: In February, Wingbits announced a partnership with Spire Global (NYSE: SPIR) to launch a satellite into orbit on SpaceX’s Transporter 13 mission, in order to better validate their terrestrially gathered flight tracking data.

With low transaction costs, sub-second finality, and a network of several thousand nodes, Solana aims to power mainstream payment flows. Notable events from Solana-native payments infrastructure companies and applications this quarter include:

- Stripe: launched Stablecoin Financial Accounts, powered by Bridge, where users can store stablecoins (on Solana) for easy dollar access and send/receive funds in stablecoins and in USD and Euros

- Sphere: Sphere announced their partnership with Perena to support USD*, with the goal of making Solana the home of payments.

- Fuse: Virtual bank accounts are now live on Fuse, allowing users to convert USD payments directly to USDC. In Fuse’s first four months, the product facilitated over $10 million in transactions.

- SolCard and Kast: Digital Cards that are live in an Apple Wallet capacity. Kast offers three versions of their card with varying rewards.

- Helio: In early Q1, MoonPay acquired Helio in a strategic acquisition. MoonPay also acquired the stablecoin infrastructure platform Iron for $175 million.

- Shift4: Back in October 2024, a global leader announced that users will allow businesses to accept cryptocurrencies for ecommerce and POS merchants. Users will be able to accept BTC, ETH, SOL, USDC, and “other major stablecoins”. In March 2025, the platform went live. Shift4 processes payments for 1 in 3 restaurants and 40% of hotels across the US.

DeSci (Decentralized Science) is an emerging movement to reimagine how scientific research is funded, published, reviewed, and accessed - using web3 models for financing and monetization. Notable events from the Solana DeSci space include:

- Curetopia became the first bioDAO to launch on Solana, leveraging Bio Protocol’s DeSci launchpad. Focused on addressing rare diseases, Curetopia raised $1.77m via auctions across 1,000+ participants. Already, using an AI-driven yeast-based drug screening, Curetopia identified multiple lead drug candidates for AARS2 deficiency, a rare disease condition that is on its way to having a DeSci-native cure.

- Bio Protocol kicked off a two-month-long hackathon focused on the intersection of scientific research and AI agents. Solana Foundation was a proud sponsor of this effort, helping fund a $125k prize pool to discover new ways to conduct scientific research at a fraction of traditional costs and timelines.

- Genpulse revolutionizes derma-care with AI agents, smart wearables, on-chain security, and data rewards. Announcing its launch on Solana in March, the team’s first flagship product is an AI-powered scalp/hair analyzer that checks hair health across 14+ parameters (e.g., follicle density, hair thickness, oil levels, etc.).

- Starpower is a decentralized energy network that connects over 1 million energy devices and 1 million application users across approximately 792 cities worldwide. In March 2025, Nature Nanotechnology accepted a paper co-authored by the Starpower team, highlighting its DeSci-driven battery research and work on next-generation storage for AI and compute (full Messari report here).

Notable infrastructure-related events from Q1 2025 include:

- In December 2024, former Head of Strategy at Solana Foundation, Austin Federa, announced his departure to cofound the DoubleZero protocol. The protocol is a decentralized framework for creating and managing high-performance, permissionless networks. The ambition is to create a next-generation public network where blockchains can thrive and not be throttled by the current limitations of the public internet. According to Austin, this can be achieved with an already-laid fiber network that is currently unused. The team is targeting a mainnet launch in Q3 2025.

- In October 2024, Metaplex released a website for anyone to use the Token Metadata optimization they released. This optimization reduces the size of all previous and future NFTs created using the Metaplex standard. Previous NFTs can be resized for the next six months, and holders can claim the excess SOL. After the six-month window, any remaining accounts will be resized, and the excess SOL will be contributed to the Metaplex DAO. In February, Messari released a report on Metaplex. In March, Metaplex created 3x more tokens than Ethereum and all L2s combined.

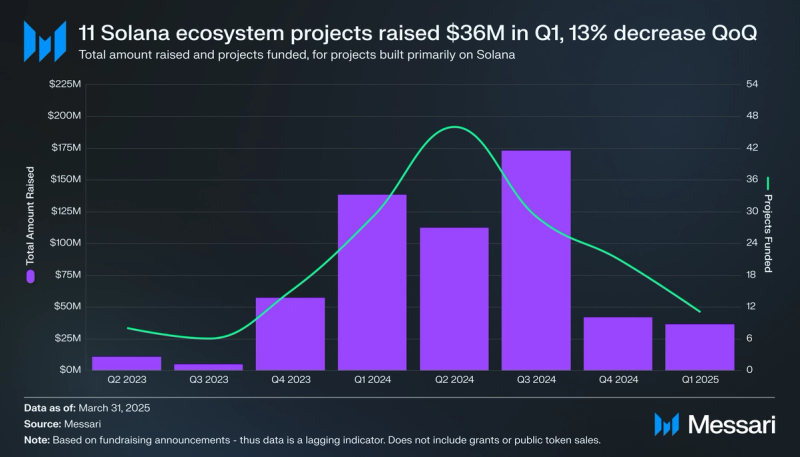

In Q1 2025, 11 projects announced funding rounds, a 48% QoQ decrease. These projects raised a combined $36 million, a 13% QoQ increase.

- In March 2025, DoubleZero raised $28 million led by Multicoin Capital and DragonFly.

- In January 2025, Starpower raised $2.5 million in funding led by Framework Ventures, with support from Solana Ventures and Bitscale Capital, bringing total funding to $4 million. Starpower utilizes Internet of Things (IoT), blockchain, and artificial intelligence to connect and aggregate energy devices like air conditioners, water heaters, and energy storage batteries. To learn more about Starpower, read our research report here.

In November 2024, Messari launched the Solana Portal. Users can use this to keep up to date on all things qualitative and quantitative within the ecosystem. Notable recent events include:

- In April, the Step Finance and SolanaFloor team hosted Solana Crossroads in Istanbul, where many projects, founders, and community members congregated. To see all talks and product announcements, head to SolanaFloor’s X and Youtube accounts.

- In May, the foundation will host the Accelerate conference in NYC. The conference will have two separate events. The first, Scale or Die, is focused on builders and is only for accepted developers. The second, Ship or Die, is focused on products and apps.

Notable Q1’25 institutional events:

- Solana eclipsed $303.2 million in RWAs in Q1’25, with 57% of that coming from USDY.

- In March 2025, The CME Group launched SOL futures. Participants have the choice to trade a 25 SOL contract or a 500 SOL contract.

- In March 2025, Securitize announced that the BlackRock USD Insitituional Digital Liquidity Fund (BUIDL) will support the Solana Network. At the end of Q1, BUIDL finished with $1.9 billion in market cap, with $20 million of that sitting on Solana.

- In February 2025, Franklin Templeton’s Benji fund (BENJI) went live on Solana.

- In January 2025, former SEC and CFTC economists released a paper examining Solana and the SOL market.

- In January 2025, Securitize announced the partnership with Apollo to tokenize the Apollow Diversified Credit Fund to create the Apollo Diversified Credit Securitize Fund (ACRED). The launch was immediately available to accredited investors on Solana. ACRED ended Q1 with a $60.5 million market cap, with $25.1 million of that sitting on Solana.

- In March 2025, the Solana Policy Institute (SPI) was announced to focus on educating policymakers on how decentralized networks like Solana are the future infrastructure of the digital economy. Miller Whitehouse-Levine was named CEO of SPI, and Kristin Smith (former CEO of the Blockchain Association) will join in May 2025 as President.

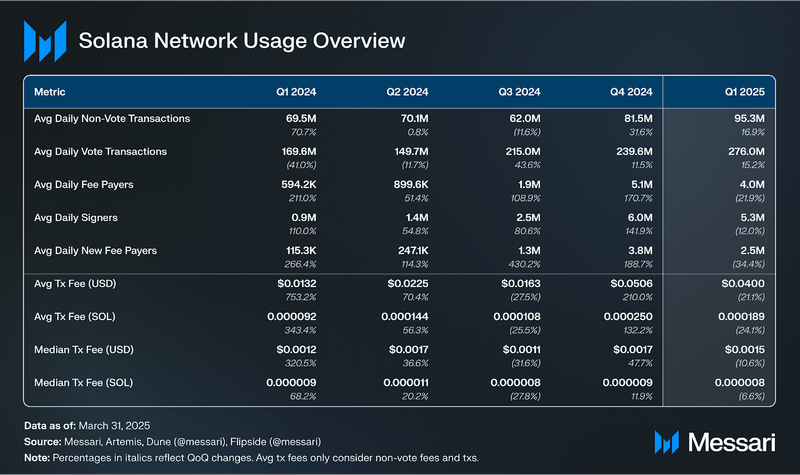

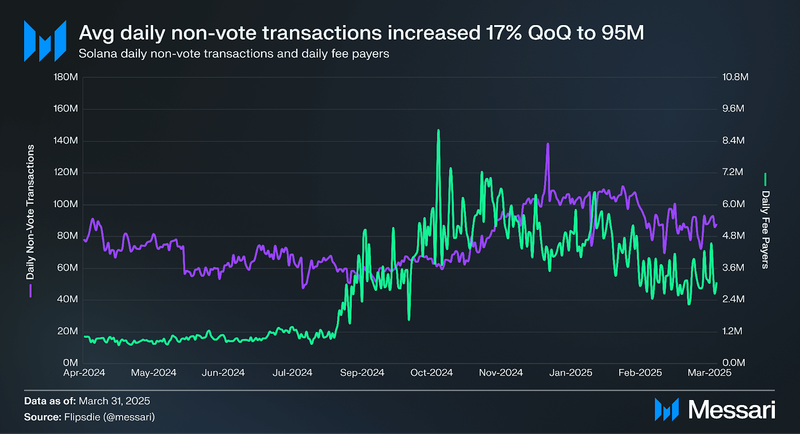

Network activity, measured by non-vote transactions and fee payers, saw relatively flat metrics in Q1 2025. Average daily fee payers decreased 22% QoQ to 4.0 million, and average daily new fee payers fell 34% QoQ to 2.5 million. Average daily non-vote transactions increased 17% to 95.3 million.

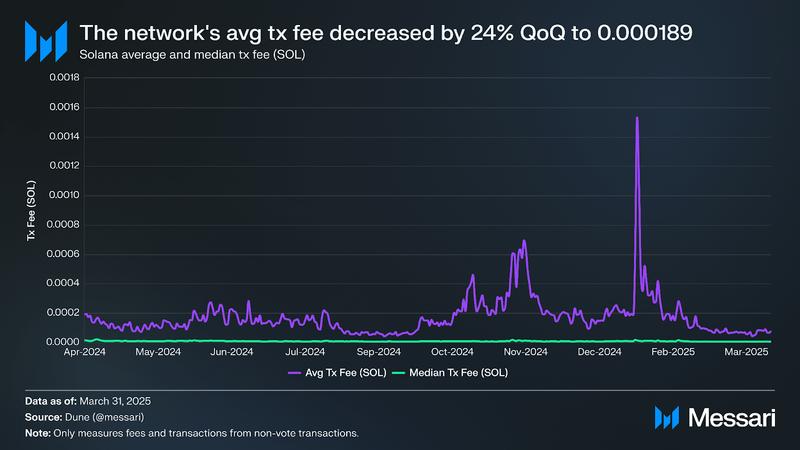

The average transaction fee decreased by 24% QoQ to 0.000189 SOL ($0.04), and the median transaction fee decreased by 7% QoQ to 0.000008 SOL ($0.0015). There was a spike in average transaction fees in January when the TRUMP token launched before President Trump took office. On Jan. 19th, the average fee paid was $0.41, however, the median fee paid was $0.003, highlighting the power of local fee markets. Helius was able to consistently land 100% of transactions during this period with fees as low as $0.001.

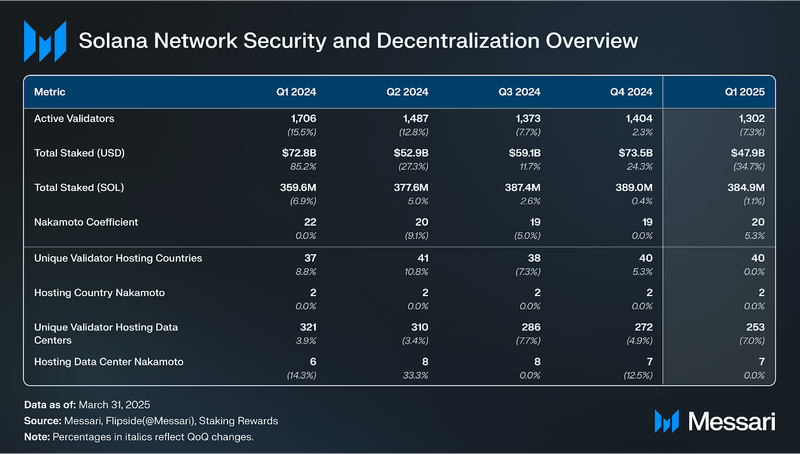

Security and Decentralization

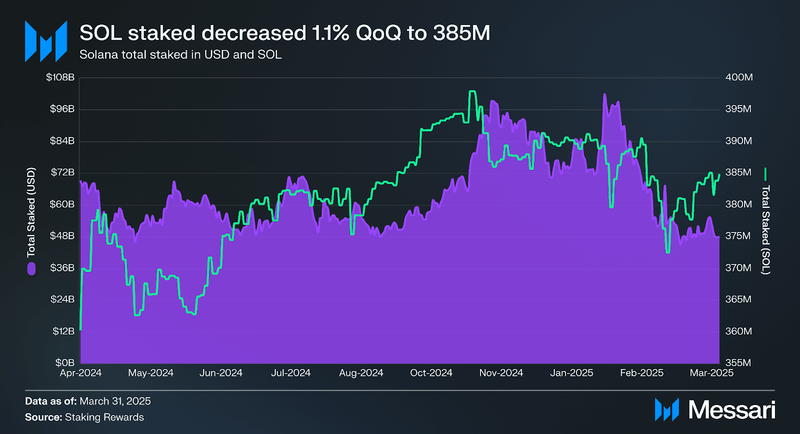

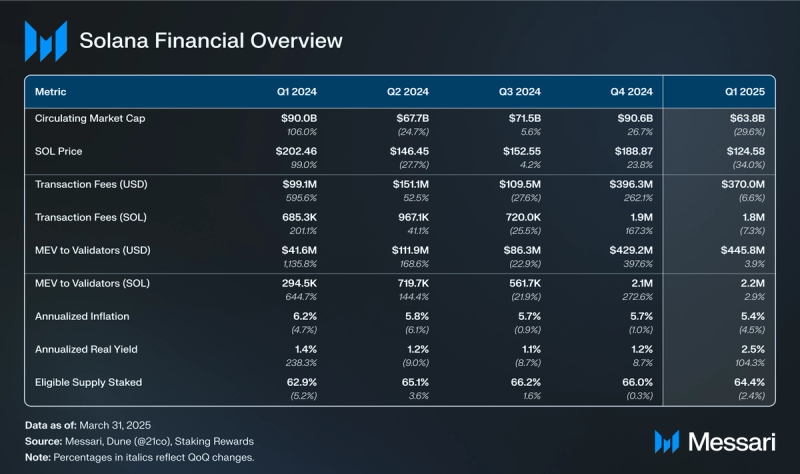

Total stake (USD) hit an all time high of $102 billion on Jan. 18th when SOL hit all-time highs around $295. Staked SOL (USD) decreased 35% QoQ to $48 billion in Q1’25, down from $74 billion at the end of Q4’24. Total stake (SOL) fell 1% QoQ, from 389 million to 385 million.

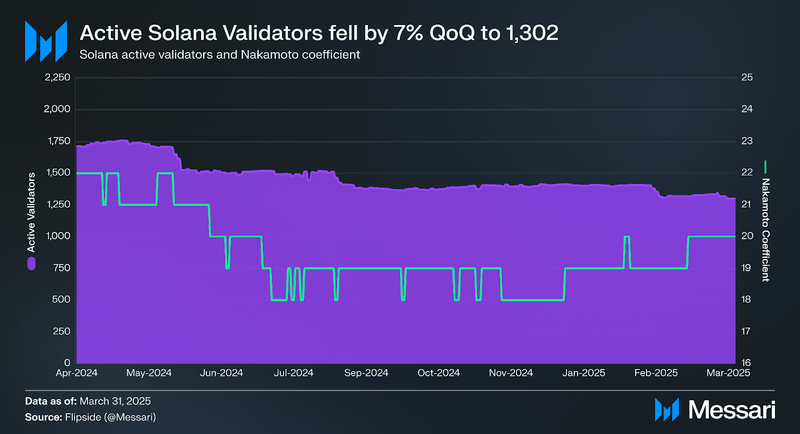

The Nakamoto coefficient is the minimum number of nodes needed to break liveness. The metric can also be measured across other dimensions important to the resilience of a validator network, including distribution of stake by location, hosting provider, and clients.

In H2’24, the Nakamoto coefficient on Solana fell to 18, an all-time low since 2021. However, Solana’s Nakamoto coefficient ended Q1’25 at 20, which is above the median of other networks. Solana’s 1,302 active validators (down 7% QoQ) are hosted in 40 countries. Solana validators are hosted in 253 unique data centers, down 7% QoQ, and its hosting data center Nakamoto coefficient stayed flat at 7.

Performance, Upgrades, and RoadmapAgave UpdatesIn Sept. 2024, the Anza team announced at Breakpoint that Agave V2.0 is live on Solana Testnet and Devnet. Over October 2024, validators started to upgrade to V2.0 on mainnet. This new client version completes the transition from the Solana Labs repository, which has been archived and can no longer be used. Currently, most of the changes involve removing and renaming RPC endpoints, SDK calls, crates, and validator arguments. At the time of writing, over 90% of validators are running a V2.0 or later version, with 75% of validators running the most recent release of 2.1.21. Technically, most of the network stake is running the Jito-Solana client, an Agave fork optimized for MEV.

Firedancer/Frankendancer UpdatesBeyond improvements to the Agave client, the network is set to benefit from upcoming clients being created from scratch. Notably, Jump Crypto is developing Firedancer in C. At Breakpoint 2024 in September 2024, Jump provided an update on the client's development.

Frankendancer, a version of Firedancer that includes parts of Agave code, has been live on Solana mainnet since September 2024. Additionally, Firedancer is fully live on testnet, and live on mainnet in a non-voting mode. This means the client can listen to the network and replay blocks in real-time. There were 33 validators running Frankendancer in April 2025, with a full launch expected at the end of Q2’25.

SIMDs

- SIMD-0096: Reward Full Priority Fee to Validator was activated, updating the distribution of priority fees. Before this SIMD, 50% of fees were burned and 50% were shared with validators. Now, 100% of priority fees are shared with validators.

- SIMD-0228: Market-Based Emission Mechanism was hotly debated throughout the quarter. This SIMD was proposed by Multicoin Capital and Anza. Solana’s current inflation rate follows a fixed model that began at 8% annually, decreasing by 15% each year until it reaches 1.5%. The change would have adjusted inflation dynamically based on the staking rate. The primary goal was to minimize token issuance and sell pressure by reducing inflation when staking is high, and increasing it when staking is low.

- Although the SIMD failed to pass, the governance process led to the biggest crypto governance vote ever as over 74% of stake voted. 43.6% of stake voted yes and 27.4% voted no, resulting in only 61% of votes being in favor, falling short of the required 66% needed to pass. The proposers of the SIMD have said they will listen and incorporate all feedback they heard during the process.

- SIMD-0123: Block Revenue Distribution was voted on at the same time as SIMD-0228. SIMD-0123 automates the onchain distribution of Solana validator rewards (base fees, priority fees, and Jito MEV tips) to stakers. This SIMD passed with 73% of votes in favor of the change, and is awaiting implementation.

- SIMD-0207: Raise Block Limits to 50M aimed to change the block size from 48 million compute units (CUs) to 50 million CUs, with the goal to add more later. This SIMD has been accepted and is awaiting implementation.

- Since SIMD-0207 was accepted, SIMD-0250: Raise Block Limits to 60M was proposed. This SIMD is still in its discussion and review stage.

SOL’s circulating market cap fell 30% QoQ to $64 billion. Although the circulating market cap fell throughout the quarter, the token price hit an all-time high on Jan. 19 with a price of $295 and a circulating market cap of $128 billion, making it the 5th most valuable cryptocurrency. However, at the end of Q1 2025, SOL fell to 6th among all cryptocurrencies by circulating market cap, behind BTC, ETH, USDT, XRP, and BNB.

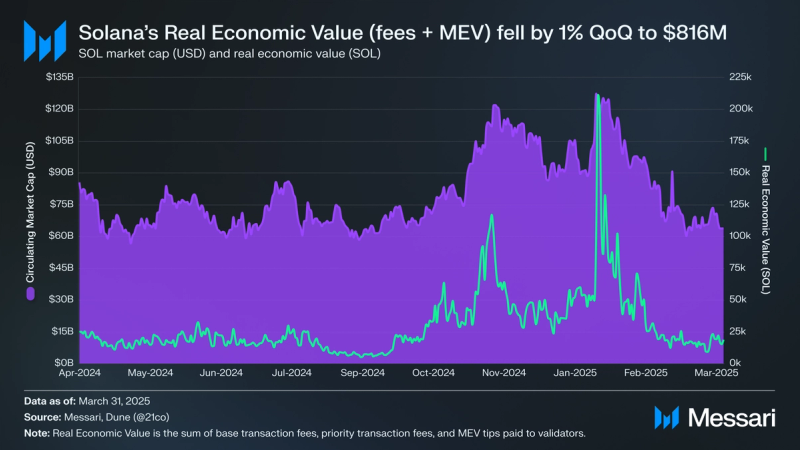

Real Economic Value (REV), which is the sum of base transaction fees, priority transaction fees, and MEV tips paid to validators, decreased 1% QoQ in SOL terms to 4 million ($816 million). Of this, 45% came from transaction fees, with the rest coming from MEV tips.

FTX EstateIn Q2’24, the FTX Estate auctioned off the remaining tokens acquired from the Solana Foundation and Solana Labs. In April 2024, it was reported that the Estate sold 30 million SOL at $64 per token, with a later sale of 1.8 million SOL at prices between $95 and $110 also reported. In May 2025, it was reported that the Estate had sold the last of its tokens, with one purchaser reportedly paying $102 per token. Reported buyers among the sales have included Pantera Capital, Figure Markets, Galaxy Trading, and Neptune Digital. The tokens sold are subject to the same unlock schedules as the original purchases by Alameda and FTX. The average unlock date of the tokens is in Q4’25, with March 2025 featuring the most unlocks of any month (11.2 million tokens, around $1.6 billion). The next-largest unlock is in May 2025 (74,000 tokens, around $11 million). Upcoming unlocks can be viewed on Messari’s Solana Portal.

SOL ETFAll SOL ETFs that applied before the election were denied. However, with a crypto-friendly administration, the likelihood of a SOL ETF being approved has drastically increased. Per Polymarket, the odds of an ETF being approved before July 31, 2025, ended Q1’25 at 32%. Meanwhile, the odds of an ETF being approved in 2025 ended Q1’25 at 82%. On Feb. 11, 2025 ,the SEC officially acknowledged four spot ETFs from Canary, Vaneck, Bitwise, and 21Shares. In April 2025, the SEC also acknowledged Fidelity’s spot SOL ETF. The SEC has also acknowledged Grayscale’s application to convert its Solana Trust into a spot ETF. Most of these applications have an approval decision expected to be announced by October 2025.

SOL StrategiesOn Sept. 12, 2024, the Canadian-traded company Cypherpunk Holdings rebranded to SOL Strategies, representing its bet on the Solana ecosystem. SOL Strategies' strategy is similar to Microstrategy’s; however, it is going a step further by staking its SOL tokens, of which it holds over 267,000, and investing in projects in the ecosystem. This strategy has gained momentum as multiple other firms have followed suit with many announcements in April 2025, including DeFi Development Company (previously Janover), Upexi, GSR, and Galaxy Digital).

Closing SummaryIn Q1 2025, DeFi TVL decreased 64% QoQ to $6.6 billion, though TVL (SOL) rose 18%, maintaining Solana’s rank as the second-largest network by DeFi TVL. Chain GDP increased 20% QoQ as applications earned $1.2 billion, driven largely by speculative activity in January during the TRUMP token craze. DeFi saw an extremely active quarter as average daily DEX volume (USD) increased 40.8% QoQ to $4.6 billion, and the stablecoin market cap increased 145.2% to $12.5 billion. Network usage saw mixed results as average daily non-vote transactions grew 17% QoQ, while average daily fee payers declined 22%. The liquid staking rate increased from 9.1% to 10.4%, led by continued growth in Jito’s jitoSOL product.

Infrastructure developments included the widespread adoption of the Agave V2.0 client and early mainnet deployment of Firedancer components. Governance votes on reward distribution and inflation mechanisms reflected increased stakeholder participation. Financially, SOL’s market cap fell 30% QoQ to $64 billion. External factors such as the FTX estate token sales and emerging interest in SOL-based ETFs influenced market dynamics. Overall, Solana’s ecosystem showed resilience in core metrics while facing a decline in some financial indicators during the quarter. To stay up-to-date with all things Solana, visit Messari's Solana Portal.

- Home

- About Us

- Write For Us / Submit Content

- Advertising And Affiliates

- Feeds And Syndication

- Contact Us

- Login

- Privacy

All Rights Reserved. Copyright , Central Coast Communications, Inc.